Published on: 05/31/2019 • 7 min read

1033 Exchanges: Tax Relief for Involuntary Conversions due to Fire, Theft, Natural Disaster, Eminent Domain, Seizure and Condemnation

Authored By: Scott Bishop, CPA/PFS, CFP® and Michael Churchill, MSPA, CPA

Understanding the tax benefits of using Code Section 1033 of the Internal Revenue Code can help a taxpayer to defer what otherwise would have been a recognized gain due to an involuntary conversion of their property. A commonly used “cousin” to the 1033 exchange is a 1031 exchange, which also provides tax benefits for deferring the recognition of gain for the sale or property. The important difference between the two is that a 1033 event is unplanned or unexpected and the 1031 event is the opposite, hence the phrase “involuntary conversion.” Because of the planned nature of 1031 Like-Kind exchanges, there’s more structure to the process, limitations on what constitutes a Like-Kind exchange, and more stringent time frames to follow. Conversely, the 1033 exchange is much more flexible with far fewer restrictions and “red tape.”

In my experience, the 1033 exchange is an under-utilized benefit that is often overlooked by taxpayers. It’s important to consult a professional when an unexpected event occurs. When events happen like natural disasters, fire, and theft taxpayers experience property losses. When insurance proceeds are received to compensate the insured for their loss, and the amount received is greater than the original cost of the property when it was purchased, the taxpayer has realized a taxable gain. A 1033 election allows the taxpayer to defer their taxable gain by replacing the lost property with Like-Kind new property using the proceeds received. In the case of Federally Declared Disaster Areas where property is lost, and insurance proceeds are received, the entire gain does not need to be recognized.

Compensation received from the government for seizure or condemnation of property creates a realized gain. Again, a 1033 election allows the taxpayer to defer their taxable gain by replacing the lost property with new property using the proceeds received.

Whether the property was used in a trade or business, personally owned or held for investment, the 1033 exchange rules apply. Depending on the property that was lost or involuntarily converted, the amount of time given to the taxpayer to find replacement property is either 2 or 3 years. The 3-year period is available to real property that is seized or condemned, and all other property is allowed two years. The time frame may be granted an extension depending on certain circumstances.

The following are examples of what would constitute as a qualifying event for the 1033 exchange:

• Real property seizure or condemnation for which the owner is compensated such as:

– along highways that the government uses eminent domain to seize land for expansion of public roadways

– for expansion of public land easements

– for pipeline development

– for public transportation expansion like high speed railway development

– for establishing dams and land is lost along water ways

• Livestock lost due to disease that is either reimbursed through insurance or a government covered program

• Personal residence or vacation home lost in a fire

• Personal residence or property lost due to a natural disaster such as a flood

• Personal assets of high value stolen such as rare art, expensive vehicles, or any insured asset lost to due to theft when the current value is much higher than the original purchase amount

Electing to utilize the 1033 exchange does not require any official notice to the IRS (FSA 200147053 IRS Field Service Advice September 2001). By simply omitting the gain from the return in the year that the gain occurred constitutes a deemed election. You may indicate with a notation on the return that the election is being made with the return. However, the return is deemed incomplete in the year of election until the replacement property is acquired. Therefore, the normal 3-year statute of limitations for the IRS to audit the tax year will remain open until the replacement property is acquired and reported in the tax year it is replaced.

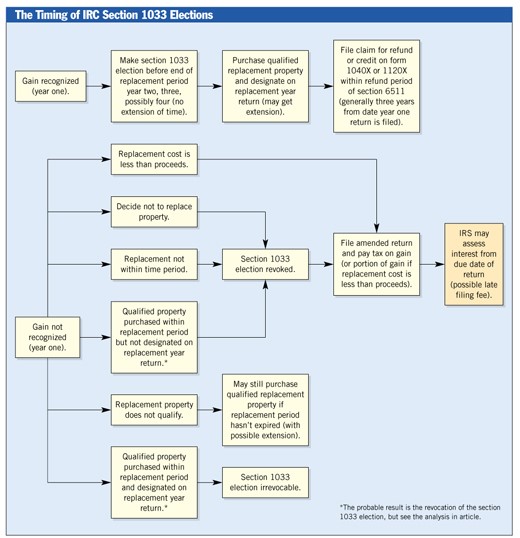

If, however, the replacement property is not acquired

timely, the taxpayer will have to amend the prior tax return filed in the year

the conversion occurred, report the gain, and pay taxes plus interest and

penalties. Another option is the report

the gain in the year of conversion and then later amend that tax return for a

refund if the 3-year amending period is still open. I think this option puts

the taxpayer at greater risk of losing the benefit, so the earlier versus the

latter option may be the best approach when making the election. It’s better to keep your options open. Below you can see a flow chart of timing

related to making a 1033 election:

“The Timing of Section 1033 Elections” By Larry Maples and Melanie Earles

Source: Journal of Accountancy

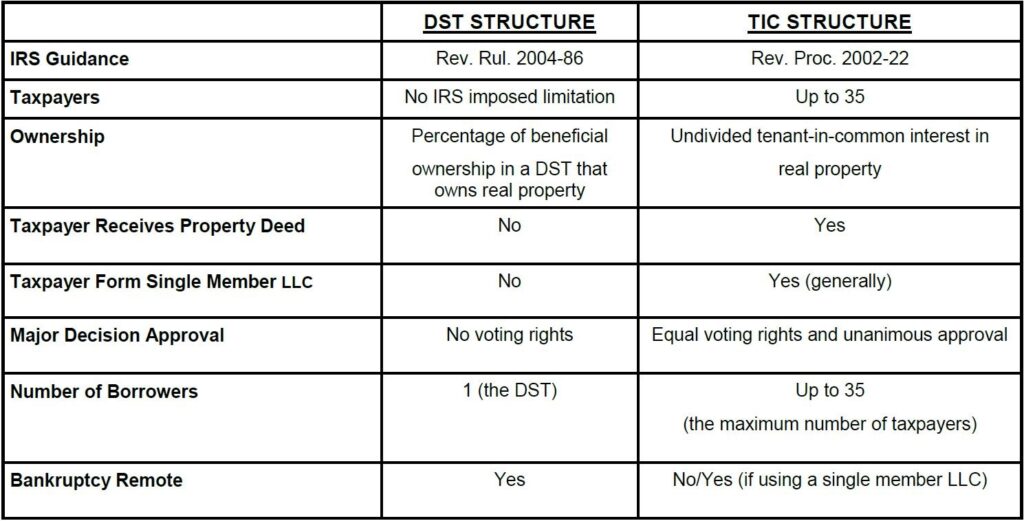

When an involuntary conversion involves real estate, it may

be difficult to find a replacement because the Like-Kind asset must be directly

owned as it was before. There are,

however, two other potential strategies that exist that may be options for a

1031/1033 exchange. Delaware Statutory

Trusts (DST) and Tenancy in Common (TIC) ownership strategies would qualify for

the exchange. Both have their pros and

cons and you should work with your investment advisor when choosing to enter

into these arrangements to ensure they are suited for your situation. Both will have other investors alongside your

investment. DSTs come with further

restrictions once the fund closes and TICs are limited to the number of

owners. See the chart below for a

summary of structure for DSTs versus TICs:

Samples of Fractional Ownership for Tax-Free Exchanges:

Sometimes it helps to visualize an example. Take a moment to review the examples below:

Mr. Ranch Owner owns thousands of acres of land in the southern part of Texas used in his ranching business. A major pipeline wants to build across his land, however, Mr. Ranch Owner isn’t willing to sell. The government deems the pipeline expansion as a public use project and acquires the land through a forced sale by eminent domain seizure. Mr. Ranch Owner is compensated $5,000,000 for the land he lost that he originally paid $500,000 for years ago. By using the 1033 exchange election, Mr. Ranch Owner decided two years later to reinvest the proceeds by purchasing a strip center in his local town. By using the 1033 election, Mr. Ranch Owner was able forego recognizing the $4,500,000 gain on his land and not pay any taxes and his original basis was rolled into the new property.

Mr. Property Owner owns several lots of land held for investment along a designated path for development of high-speed rail. Mr. Property Owner does not want to sell, so the government deems the high-speed rail project as important for public transportation expansion and seizes the necessary easement and right-of-way by used of condemnation eminent domain so the project can be built as planned. Mr. Property Owner is compensated for his lost land in the amount of $4,000,000 that he originally paid $2,000,000 for several years ago. Mr. Property Owner couldn’t make up his mind on how to reinvest the proceeds and missed his required window to reinvest the proceeds and therefore had to amend his prior tax return to pay taxes on the $2,000,000 gain plus interest and penalties. If a proper 1033 exchange had been accomplished, he would have been able to roll the gain into his new property and saved thousands on tax and penalties.

IMPORTANT DISCLOSURES:

Financial Planning and Investment Advice offered through Avidian Wealth Management, a registered investment advisor. Avidian does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*