Published on: 03/27/2020 • 6 min read

5 Things Small Businesses Should Know About COVID-19 Disaster Loan Relief

Small businesses across the nation continue to be significantly impacted by the Coronavirus (COVID-19) outbreak, leaving them in need of financial assistance to stay afloat. As part of its Economic Injury Disaster Loan Program, the U.S. Small Business Administration (SBA) is providing low-interest working capital loans to small business owners affected by COVID-19. If you are interested in pursuing an SBA loan, here are five things you need to know:

- Eligibility. To be eligible, the applicant must meet the following requirements:

- Be a small business (500 employees or fewer).

- Be physically located in a U.S. state or territory.

- Businesses must be directly affected by COVID-19 or offer services directly to businesses impacted by the outbreak.

Non-qualifying applicants may include, but is not limited to,

businesses with activity such as gambling, passive investments, multi-level

sales distributions, non-profit organizations recognized as private

non-profits, consumer and marketing cooperatives, religious affiliations,

lobbying, real estate development, life insurance services, government-related

entities, agricultural enterprises, feedlot operations, post-pandemic

establishment or recent changes in ownership, among others.

- Borrowing amount and terms. SBA can offer up to $2 million in loan assistance, with an interest rate of up to 3.75% for small businesses and 2.75% for non-profit organizations. Loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid due to disaster impact, and are not intended to replace lost sales or profits or pay down existing long-term debt. Additionally, SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay. There are two types of primary loans (also see attachments) – you can start the application process online, but you will need to talk to your banker to see if they can offer these SBA loans to you:

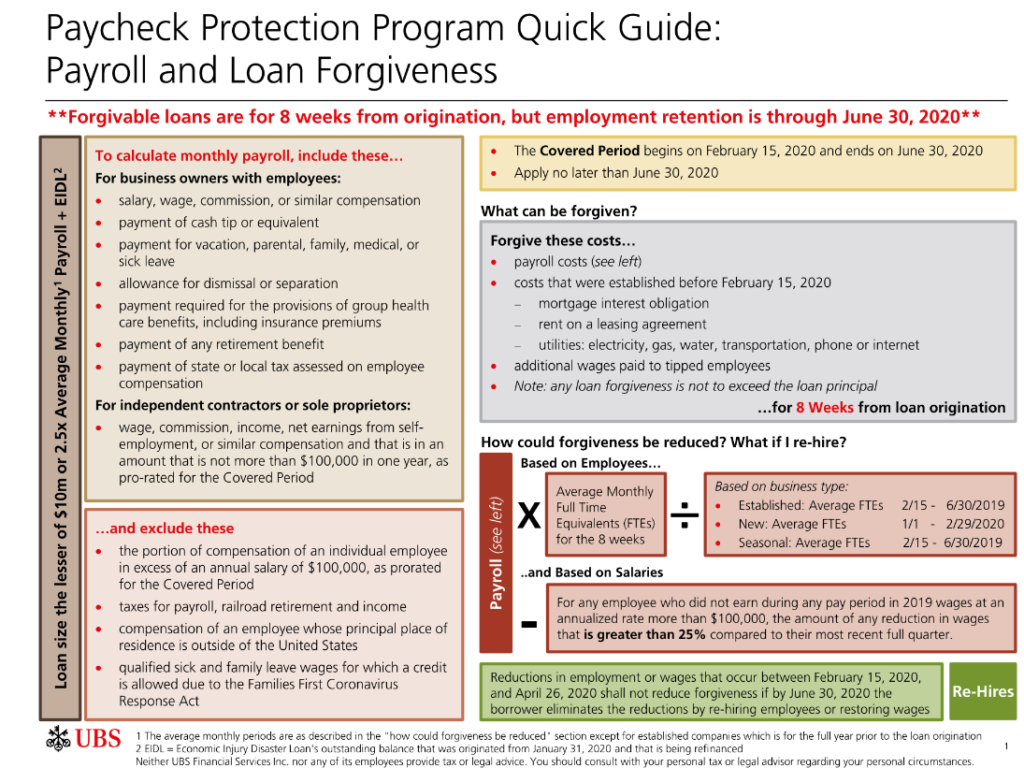

- Payment Protection Program (PPP): A low-interest loan program for those with payroll. Loan terms are two years and can be partially forgivable if you keep most of your employees (see image below). The loan amount is based on payroll (capped at $100,000 annually per employee) and other allowable expenses for a 2 ½ month period (so eligible expenses x 250%). These loans will also NOT need a personal guarantee. Since the passage of the CARES Act, the SBA has been updating its rules and has created this linked PPP FAQ – please review this before filing for your SBA loan.

- Economic Injury Disaster Loan (EIDL) Program: These are more similar to traditional SBA loans, but are still lower interest with longer amortization schedules (up to 30 years). These loans can be up to $2 million.

- EIDL Advance Disaster Grants: If you apply online, all businesses that apply, that were in business before this crisis, can get a $10,000 forgivable loan that may be paid to you in as quickly as 10 business days.

- Application process. Applicants should have the following information ready for submission:

- These forms are available through the SBA website:

- Tax information authorization for the applicant, principals, and affiliates.

- Schedule of liabilities.

- Personal financial statement.

- Full copies of their most recent federal income tax return.

- Income, balance sheet, and cash flow statements.

- Any other information that may be requested, such as a year-end profit-and-loss statement and balance sheet (if a most recent federal income tax return has not been filed).

- These forms are available through the SBA website:

To avoid processing delays, consider these application tips:

- Include the specific disaster in your application (specifically reference COVID-19).

- Save your work at every prompt.

- Check and recheck the filing requirements to ensure that all the needed information is submitted. The biggest reason for delays in processing is due to missing information.

- Be sure to use the same contact information (business name and the name of all owners) that you use on your federal tax returns.

- If your tax returns reference other businesses that you own, you must also submit those tax returns.

If the loan request is denied, applicants have up to six months to provide new information and submit a written request for reconsideration.

- Loan criteria. The applicant must have an acceptable credit history and demonstrate their ability to repay the SBA loan. The loan amount will be based on the company’s size, type of business and its financial resources. If you receive more or less than the funds that are needed, applicants may request an increase by submitting supporting documents or request a loan reduction, respectively.

- Distribution of Funds. Organizations could receive their loan money within three weeks of their application submission. Keep in mind that incomplete information and verification of collateral will delay the approval process.

If you are considering applying for other financial aid options offered by the federal government, please remember federal funds come with restrictions, so accepting funding or receiving approval from one program may cause you to become fully or partially ineligible for other options. There are some additional provisions in the CARES Act bill that has not been passed that would significantly expand the scope of these loans. Stay tuned for more information.

Stay Tuned

Congress is already far along in considering a fourth stimulus plan, so stay tuned. Doeren Mayhew and Avidian Wealth will continue to keep you up-to-date as things progress amongst the COVID-19 outbreak via Doeren Mayhew’s Coronavirus Resource Center. If you have any questions regarding this new law’s impact on your business, please feel free to contact your financial advisor at Avidian Wealth or a member of the CPA and advisory team at Doeren Mayhew.

Forgiveness on PPP Program Illustration:

Disclosure:

This is for informational purposes. The information was prepared by Avidian Wealth Management and Doeren Mayhew CPA’s and Advisors this information has not been independently verified by a third party. STA Wealth Management LLC is not an affiliate of Doeren Mayhew CPAs and Advisors, their offerings, nor their management team.

Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security or product. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Management, LLC), or any non-investment related content, made reference to directly or indirectly during this event will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Moreover, you should not assume that any discussion or information presented serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. To the extent that any recipient has any questions regarding the applicability of any specific issue discussed, he/she is encouraged to consult with the professional advisor or CPA of his/her choosing.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*