Published on: 10/28/2022 • 4 min read

Is Inflation Starting to Show Signs of Easing?

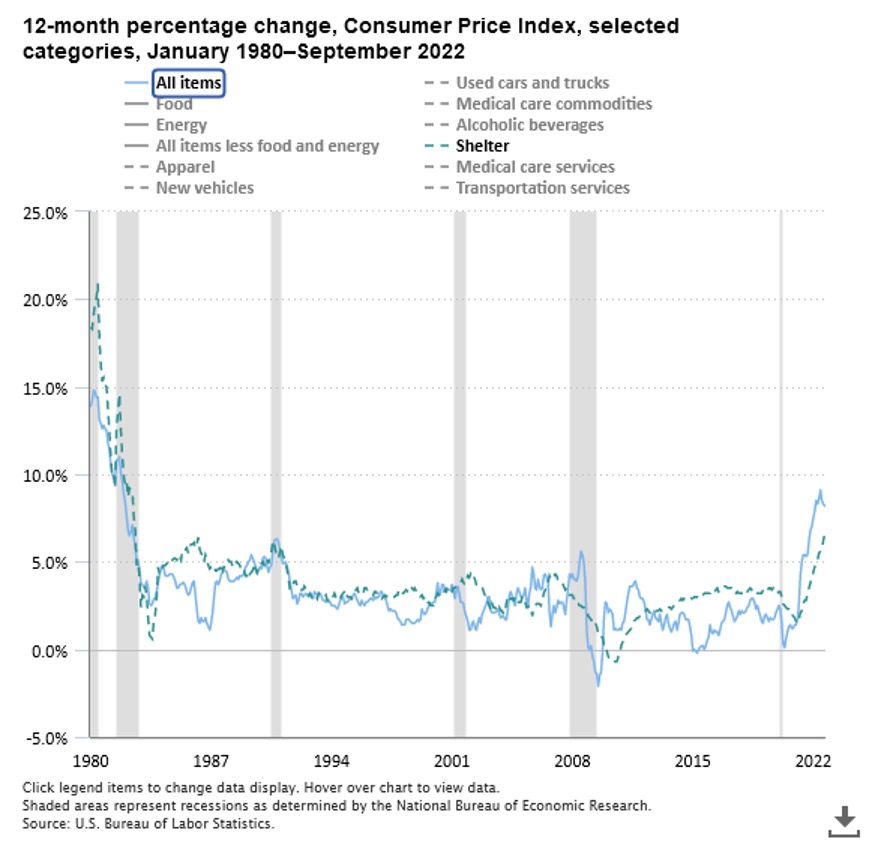

The Consumer Price Index for All Urban Consumers increased in September and had investors thinking the Federal Reserve would remain hawkish.

However, more recently there has been some talk of the Fed slowing down and potentially taking a pause to see how higher interest rates are impacting the economy.

After all, rate hike effects are often seen well after the fact, unlike the financial markets which react immediately after a policy decision is made public.

For now, we are beginning to think the Fed may in fact be getting closer to a pause. There are several reasons we think this.

First, They have remained steadfast in their quest to tighten financial conditions meaningfully this year which has caused a painful drawdown across asset classes.

Second, there are some signs that inflation may be set to roll over.

In this week’s report, we will review a handful of economic data points that appear to support this thesis.

Semiconductors

Let’s start with the semiconductor sector.

As many investors are aware, the period between 2020 and the middle of this year saw semiconductor supply chains impacted by COVID, which led to significantly higher lead times for semiconductor contracting.

With supply chains bottlenecked, it led to inflationary pressure built up in the sector. However, as the chart here shows, those lead times now appear to be slowly easing which could relieve the pricing pressure.

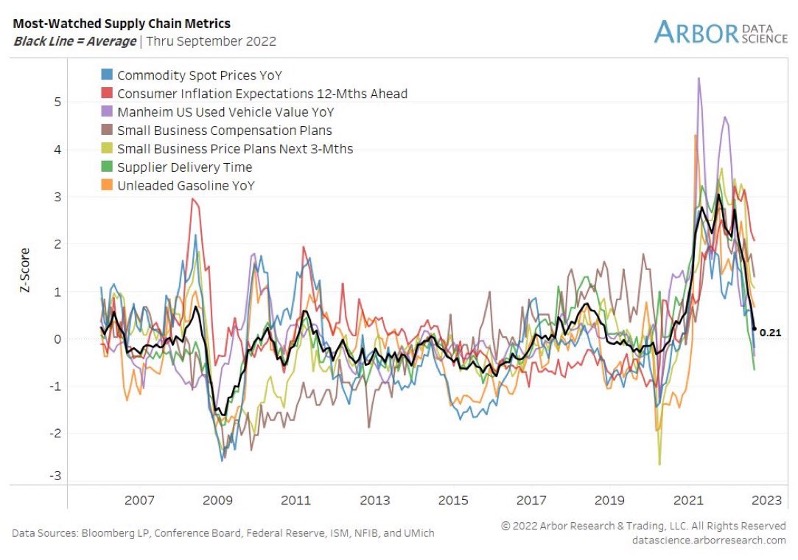

Supply Chains

Speaking of supply chains, the chart here follows and covers multiple supply chain related metrics.

Everything from commodity spot prices to consumer inflation expectations, wages, and unleaded gas prices are all showing a disinflationary turn as of late.

While inflation can ease and then accelerate, this could be very encouraging for the Fed as inflation has been enemy number one for the duration of this year.

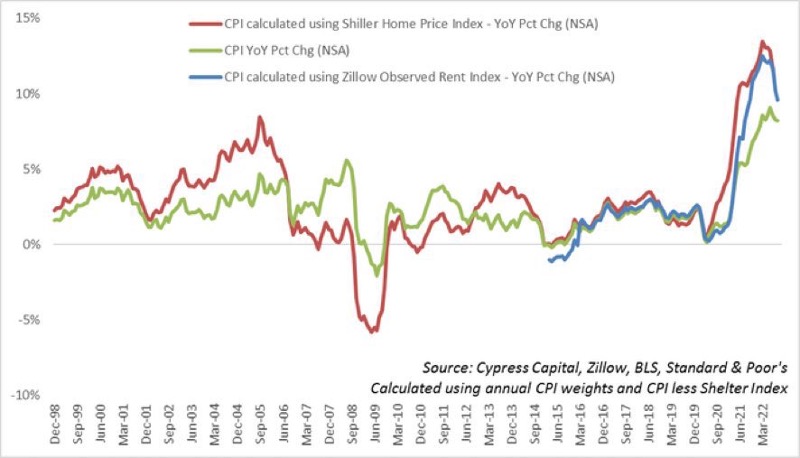

The Housing Market

Now, we come to the housing market which for the duration of 2020 and 2021 showed demand well ahead of supply.

However, as interest rates have risen this year, we are seeing both the Schiller Home Price Index and the Zillow Observed Rent Index pointing to an easing of housing inflation thanks to supply and demand slowly heading toward equilibrium.

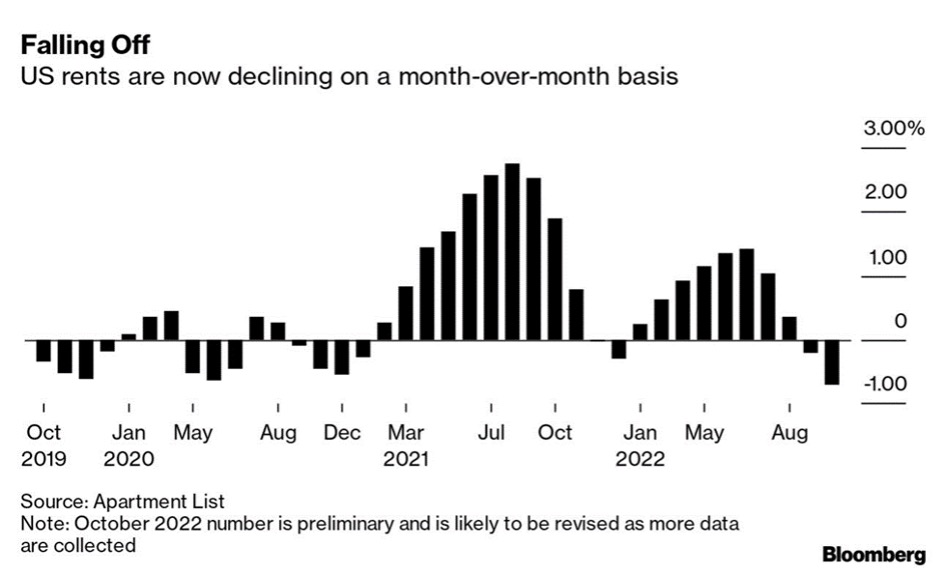

US Rent Prices

Especially encouraging is that US rents have now declined on a month-over-month basis twice.

Although there remains work to be done on housing inflation, the disinflationary impact from these last couple of months could be very meaningful to the headline numbers.

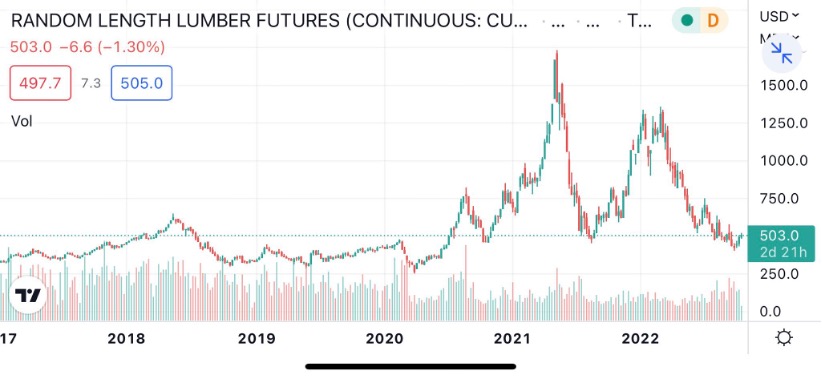

Lumber Futures

Of course, then we have lumber futures which are also tied to construction and housing. Here we have seen a sharp decline in the price of the lumber futures contract.

In fact, it has been a spectacular fall from the highs lumber futures traded at during 2021.

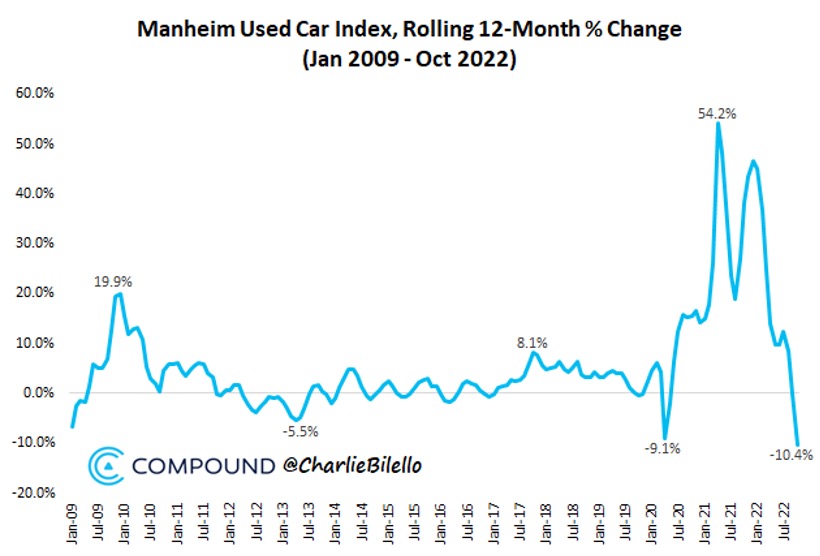

Automobiles

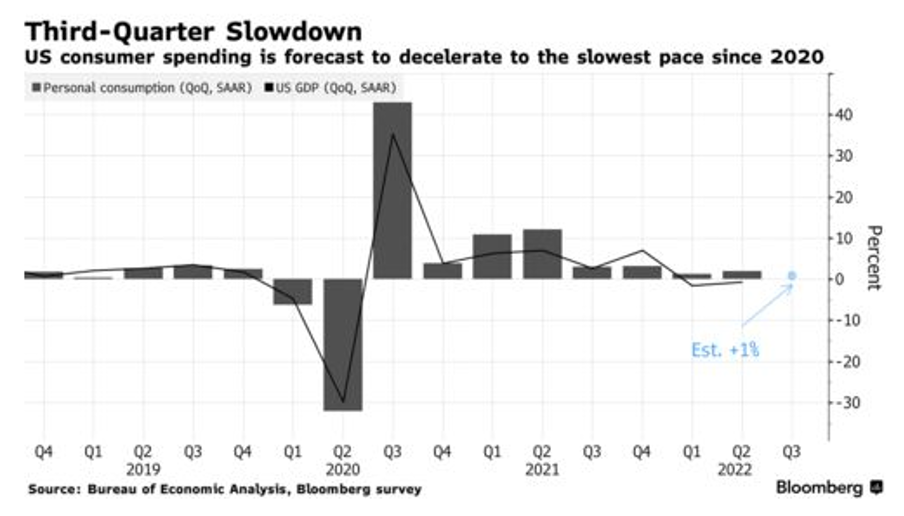

Lastly, the Manheim Used Car Index has also declined in spectacular fashion. This as consumers slow their spending to levels not seen since 2020.

Our Conclusion

Taking all these data points into account certainly leads to optimism that inflation may be easing.

However, before the Fed claims victory over inflation, these disinflationary forces will need to continue. If they do, we think a Fed pause is not far behind and could set the stage for a more positive market environment.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*