Published on: 11/09/2022 • 5 min read

Midterm Elections and How They Affect Markets

For the next few days, the main topic of conversation in the news will likely be the midterm elections.

Midterm elections are important because they give voters the ability to elect new representatives that can influence policy at the local, state, and national levels.

This is especially important today as polarization has increased, and we find ourselves in a new economic regime marked by higher inflation than we have seen in the recent past and rising concerns over a possible recession. It should be no surprise that in a recent survey of registered voters, the economy was the top issue for voters as they headed to the polls to cast their ballots.

Of course, as investors, we want to put the politics aside and instead focus on what midterm elections have historically meant for financial markets.

Luckily there is quite a bit of historical data that can provide some context.

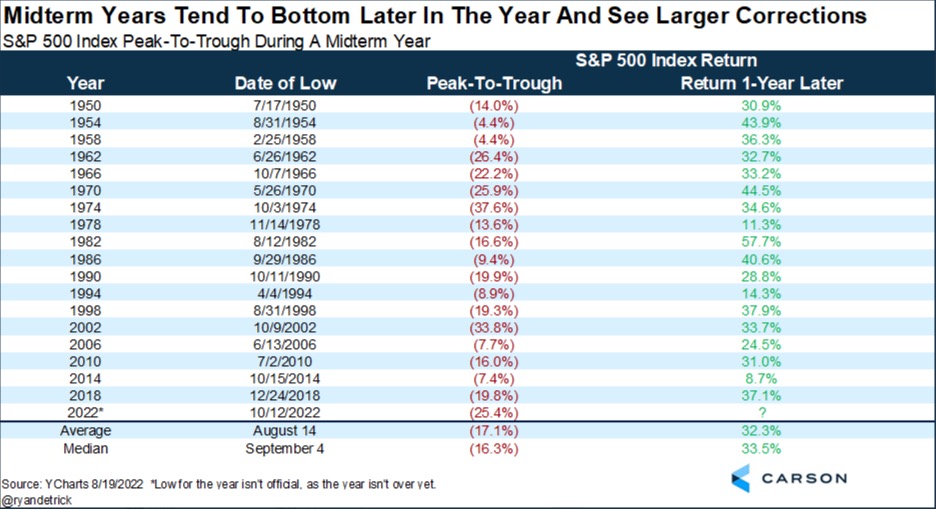

Take for example the table below. It shows that going back to 1950, midterm years tend to be challenging for equity investors, with the average peak-to-trough performance of the S&P 500 at -17.1%.

Further, the low has tended to occur in August or September. This year, we have exceeded both the average and median drawdowns for stocks, and it remains to be seen whether the low has been put in yet. We will have to wait to answer that question definitively. However, there is still good news in the historical record, particularly for the patient long-term investor. More specifically, after a midterm year, the S&P 500 returns tend to be strong over the subsequent year or two. In fact, going back to 1950, the average 1-year return after a midterm year is over 32%.

A repeat of strong equity performance for equities would certainly be welcome by investors as we move into the next year. However, it remains to be seen whether that will materialize.

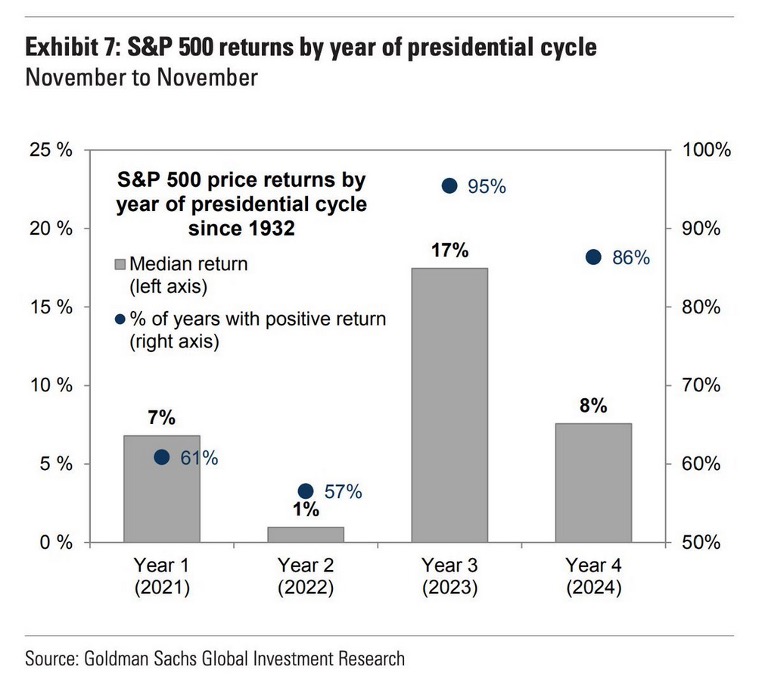

What we do know is that historically, the years following a midterm election year are not only the strongest from a return perspective, but also have exhibited a high probability of turning in positive returns.

In fact, the year after the midterms have seen positive equity market performance 95% of the time going back to 1932. And the year after that tends to be strong as well with equities turning in positive performance 86% of the time.

We also know that this year isn’t like the rest. It is extremely challenging to determine all the possible economic and market scenarios that could play out over the coming months and quarters as a more inflationary regime has forced the Federal Reserve to raise interest rates aggressively. Further, we have geopolitical instability in certain parts of the world that further muddy the water for investors.

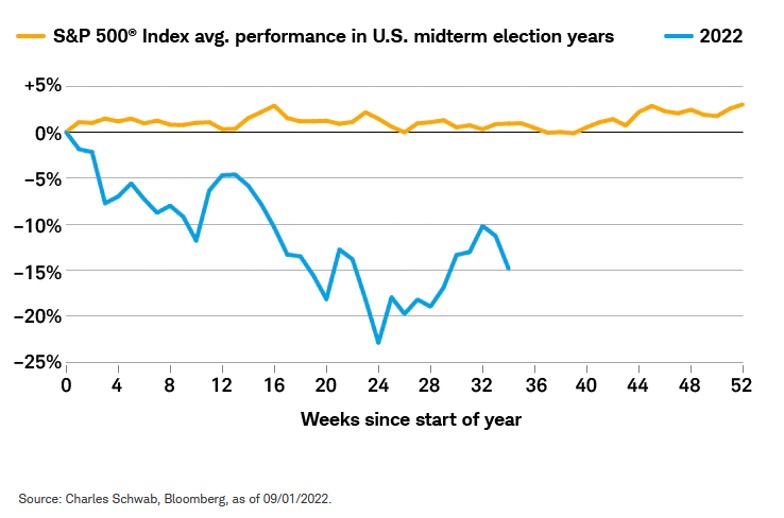

It is these hard-to-predict scenarios that have led to atypical equity market performance this midterm election year. As the chart below nicely illustrates, the performance of the S&P 500 this year has been well below average.

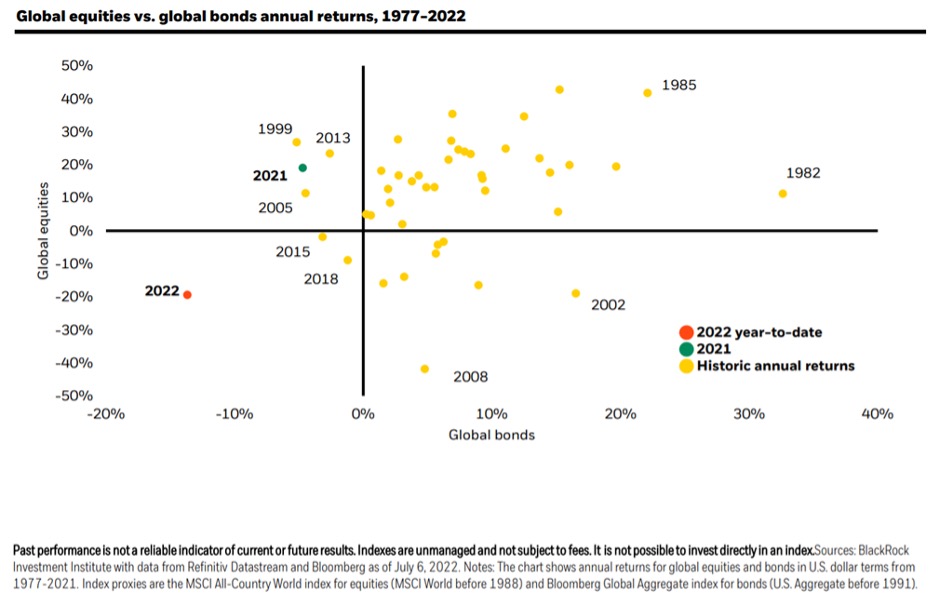

And unfortunately for bond investors, they have not been insulated from the drawdowns like one would expect in a more typical market environment where bonds zig while stocks zag. Instead, even bonds have produced negative returns year-to-date as bond yields soar.

It is no wonder why investors holding a balanced portfolio have started to question whether diversification between stocks and bonds works.

Despite the year-to-date performance of stocks and bonds, we argue that it still works. However, to see that we need some perspective.

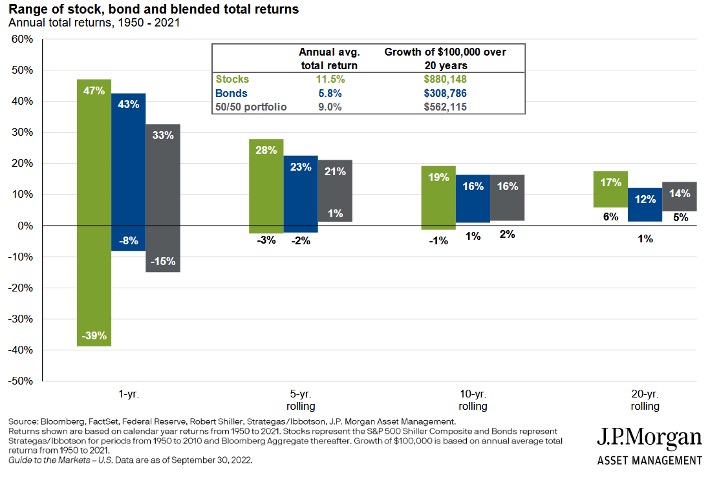

The truth is that in a short period of time like weeks, months or even a year or two, stocks and bonds may see their correlation rise. In fact, stocks and bonds have produced negative returns in a calendar year a couple of times (2015, 2018) before going back to 1977.

However, over long periods of time, the benefits of diversification across these two asset classes become apparent. Not only that, but the dispersion of returns narrows as the holding periods lengthen.

This is all to say that even during an unusual midterm election year like this one where it seems like little is working, investors should stick with their plan and remain disciplined as they wait for markets to turn.

And, if recent market volatility has left you feeling like you need help crafting a plan, or you need to revisit your current plan, reach out to us.

At Avidian Wealth Solutions, we can help make sure you meet your short- and long-term investment goals. Our approach to total wealth management is driven by time-tested fundamentals and a disciplined, conservative process. Avidian’s fiduciary investment advisors are dedicated to working with you to create a comprehensive financial plan that meets your needs.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*