Published on: 09/23/2014 • 4 min read

Tax Efficient Charitable Planning

Recently we have had a lot of requests for ideas and guidance on better ways to give money to charity. In Houston, our economy has been doing great, so many people are trying to find ways to effectively give back to the community and charities of their choice.

For those that are charitably inclined and have appreciated stock that it is worth much more than what they paid for it, there is a great opportunity to give to charity, still have some of the income or benefit of the asset for themselves or for their family and avoid paying much of the capital gains taxes and even the 3.8% ObamaCare Taxes (of which I wrote an Avidian Wealth website article about a few months ago). To minimize taxes, I would have you consider using a Charitable Remainder Trust.

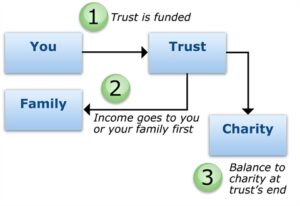

Please click this hyperlink if you would like to see a brief piece on the details on Charitable Remainder Trust. Charitable remainder trusts (CRT) can be created with the help of a good estate planning attorney. In essence, a charitable remainder trust (CRT) is an irrevocable trust used to enable donors (called grantors) to give money or property to charities, while continuing to receive income (fixed or variable) from the property for life or for a period of time up to 20 years. The grantor, and/or other beneficiaries (the income beneficiaries) receive distributions from the trust annually, and the charities (the remainder beneficiaries) receive the assets remaining in the trust when the trust ends. The grantor gets an immediate income tax deduction for the remainder interest (subject to the usual limitations), defers or avoids capital gains tax on the donated assets (like appreciated stock), and gets gift or estate tax deductions for the remainder interest.

Charitable Remainder Trust Illustration:

If you have concentrated stock positions, there are several options that I have outlined in Concentrated Stock Positions: Considerations and Strategies, but if you are charitably inclined a CRTs is a great way to go. However, some of you may be hesitant, as you want to keep the hard earned wealth “in the family”. With that in mind, the September 2014 Washington Report from the Association for Advanced Life Underwriting (AALU) outlined a great strategy to use the income tax deduction you receive from the CRT charitable gift to fund a “Wealth Replacement Trust”. Bottom line, you could use the income tax deduction you receive for making the charitable gift to fund an estate planning life insurance policy that if well structured can replace the assets, can be creditor protected and can be both income tax and estate tax free.

So before you make a large donation to a charity, if may be prudent to take a look at some of these more sophisticated strategies. Although it may sound difficult, taking the time to learn more may be well worth the effort!

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor.

STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*