Published on: 05/01/2017 • 4 min read

Trump Tax Reform

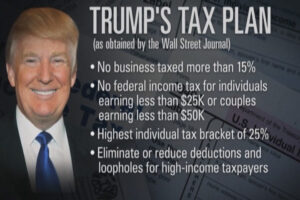

On Wednesday April 26, 2017, President Trump outlined his goals and priorities for major tax reform that could have a significant effect on all businesses and individuals. This one-page summary highlights the key features of the proposed tax reform which the administration is labeling, “The Biggest Individual and Business Tax Cut in American History.”

If you want to hear some detail on who will be the “Winners and Losers” if this proposal becomes law, we discussed it on on April 28, 2017The STA Money Hour.

Below are highlights of the proposal which could have the greatest impact on you!

Individual Tax Reform Proposals:

Lower Individual Rates.

The current seven individual income tax brackets are collapsed – 35%, 25% and 10%. While it is not clear what income levels will be associated with these brackets, the brackets will likely result in a tax cut for most Americans. The top bracket is reduced from the current 39.6% to 35%.

Changes to Individual Deductions.

The two most significant proposals would be a doubling of the Standard Deduction and the revocation of state & local tax deduction. All individual deductions except for the deduction for mortgage interest and charitable contributions would be eliminated.

Estate Tax, Alternative Minimum Tax, and “ObamaCare Surcharge” Repeal.

The plan eliminates the Estate Tax, the Alternative Minimum Tax, and the 3.8% additional Medicare tax added under the Affordable Care Act, aka the “Obamacare Surcharge.”

Business Tax Reform Proposals:

15% Corporate Rate; Also Applied to “Pass Through” Income.

The corporate income tax rate would be lowered from 35% to 15%. The 15% rate would also be made available to “pass-through” income; i.e. income from S-corporations and partnerships that is paid to the shareholders/partners.

“Territorial” International Tax System.

The US would no longer tax income on a world-wide basis, instead shifting to a “territorial” system (like most of our major trading partners). There would, however, be a one-time tax on all “offshore” income which has not been repatriated.

Disclaimer:

The information herein has been obtained from sources believed to be reliable, but we do not guarantee its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, made reference to directly or indirectly in this presentation will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of this article should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees is available for review upon request. ALL INFORMATION PROVIDED HEREIN IS FOR EDUCATIONAL PURPOSES ONLY – USE ONLY AT YOUR OWN RISK AND PERIL.

IRS CIRCULAR 230 NOTICE: To the extent that this message or any attachment concerns tax matters, it is not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*