Published on: 08/22/2019 • 12 min read

Using Options to Hedge or Enhance Your Stock Portfolio

Many of us have individual stocks in our portfolios. If you are true to yourself, you have a lot of biases such as familiarity bias (I like the company/products), loss aversion, confirmation bias (inaccurate validation of our ideas), or recency bias (waiting to sell a stock currently at a loss until it gets back to a recent high, etc.). Many times, investors fall in love with stocks and decide they will “hold it forever” …however, those feelings change when there are events like:

- Significant market volatility,

- Bad company news (especially unexpected), or

- Fear of loss (loss aversion > greed), etc.

At Avidian Wealth, we really believe that you must have an investment discipline that is integrated with your financial plan. If you hold individual stocks that you are familiar with, it is even more important to have a strong buy and sell discipline. It is really important to have that in place BEFORE you start worrying or see a lot of volatility (similar to what we discuss when we talk about “Stress Testing” your portfolio). This is even more true when you have a concentrated stock position that you have to manage or a large position that would incur a large taxable gain if sold.

With these issues in mind, Avidian Wealth has introduced Lavaca Capital to some of our clients to create options strategies to help manage, enhance or hedge these large stock positions.

Options Strategies to Consider:

Bottom line, there are many ways that options can be used to enhance, or hedge, an equity portfolio. This article will examine four of these strategies that can be employed using options to either increase returns or reduce risk in a portfolio. The first two strategies discussed are tactical in nature and have the goal of increasing returns. The final two strategies are more strategic and have the goal of reducing risk and protecting from downside in markets. The strategies are:

- Entering Equity Positions by Selling Put Options

- Exiting Equity Positions by Selling Call Options

- Hedging Downside Portfolio Risk by Buying Put Options

- Hedging Downside Portfolio Risk with a Costless Collar

Strategy 1: Entering Equity Positions with Put Options

A put option gives its owner the right, but not the obligation, to sell their stock at a specific price by a certain date. In exchange for this right, the person buying the put option pays an up-front premium to the person selling the put option.

If someone wants to buy stock for their portfolio, they will typically go to the market and purchase shares of the stock directly. An alternative to outright buying the stock would be to sell a put option at the strike price they wish to buy the stock at and receive a premium for the option. The result of this transaction is the person selling the put option reduces their net basis in the stock position equivalent to the amount of premium received.

Here’s an example that may help highlight the benefits of this approach:

Example – AAPL Stock Purchase

Investor A wants to purchase Apple stock for their portfolio. AAPL is trading at $200 which is a price level they think is attractive based on the company financials.

Alternative 1: Investor A can purchase the stock directly at the market price of $200.

Alternative 2: Investor A could sell a put option with a strike price of $200 expiring in 30 days and receive $7.00 for the option. In this scenario, Investor A collects $7.00 for giving someone the right to sell them the stock at the price they want to buy it at anyway. This improves their cost basis by 3.5% vs. just buying it directly from the market.

If the stock price stays the same or falls after 30 days, Investor A will receive the stock at an effective price of $193 ($200 – $7.00 premium). If the price rises, then the option will not be exercised, and Investor A keeps the $7 premium and can either buy the stock directly from the market or sell another put option to collect more premium.

Selling put options to enter stock positions can be an effective method of improving the purchase price. Simply stated, it is getting paid for giving someone the right to sell you something you have planned to buy anyway for the price you plan to buy it.

Strategy 2: Exiting Equity Positions with Call Options

A call option gives a person the right, but not the obligation, to buy stock at a specific price by a certain date. In exchange for this right, the person buying the call option pays an up-front premium to the person selling the call option.

If someone wants to sell stock for their portfolio, they will typically go to the market and sell their shares directly. An alternative to outright selling the stock would be to sell a call option at the strike price they wish to sell the stock at and receive a premium for the option. The result of this transaction is the person selling the call option increases their net proceeds in the stock position equivalent to the amount of premium received.

Here’s an example that may help highlight the benefits of this approach:

Example – Disney Stock Sale

Investor B wants to sell Disney stock from their portfolio. Disney is trading at $150 which is a price level they think may be overvalued based on the company financials.

Alternative 1: Investor B can sell the stock directly at the market price of $150.

Alternative 2: Investor B could sell a call option with a strike price of $150 expiring in 30 days and receive $4.50 for the option. In this scenario, Investor B collects $4.50 for giving someone the right to buy the stock at the price they want to sell it at anyway. This improves their cost basis by 3% vs. just selling the stock directly to the market.

If the stock price stays the same or increases after 30 days, Investor B will sell their stock at an effective price of $154.50 ($150 + $4.50 premium). If the price falls, then the option will not be exercised, and Investor B keeps the $4.50 premium and can either sell the stock directly to the market or sell another call option to collect more premium.

Selling call options to exit stock positions can be an effective method for improving the sale price. Simply stated, it is getting paid for giving someone the right to buy the stock you have planned to sell anyway at the price you desire to receive for it.

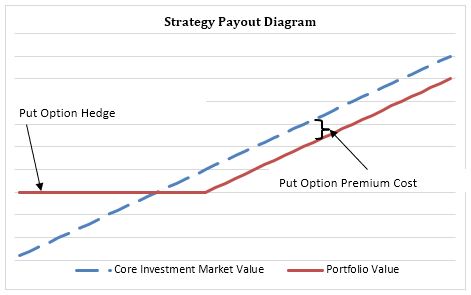

Strategy 3: Hedging Downside Risk by Buying Protective Put Options

This is a strategy we use most often for those with concentrated large positions and/or positions that would incur a large tax “hit” if sold. In these situations, the investor may want to hold the positions for the long term, but they are concerned about a sudden price decline and would like to hedge them in the event of an unexpected loss.

If someone is concerned about a large market decline and wants to protect their portfolio, one method they can employ is to purchase put options. Owning a put option gives the holder the right to sell their stock at a defined price by a defined date. Owning a put option effectively puts a floor on the price of an investor’s stock over a defined time period, acting as a form of price insurance.

In addition to setting a floor on the price of the stock, the value of the put option will typically move in the opposite direction of the stock price, increasing when the stock price decreases and decreasing when the stock price increases which results in lowering the portfolio’s volatility.

Here’s an example that may help highlight the benefits of this approach:

Example – SPY Put Option Hedge

Investor C owns SPY as a major holding of his portfolio, which is trading at $300. He is concerned that over the next 6 months the stock market could fall significantly from current levels based on a deteriorating macro-economic landscape.

To hedge against a large decline, Investor C buys a put option with a strike price of $270 expiring in 6 months for a premium of $5.50. So, Investor C pays $5.50 for price insurance that will put a floor on his SPY position 10% below the current market price over the next 6 months

If in 6 months the SPY price is $250, Investor C can exercise his right to sell his stock at $270. If in 6 months the SPY price is $280, the put option will expire worthless and Investor C will forfeit the $5.50 paid for the put option

Buying put options is very similar to buying price insurance for a portfolio. The put option sets a floor on the price of the stock being hedged over the time period. However, just like any insurance, there is a premium that is paid to receive that benefit.

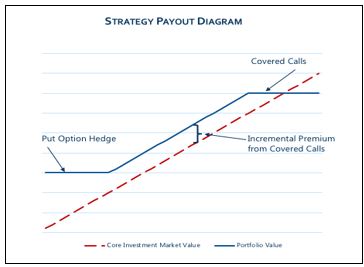

Strategy 4: Hedging Downside Risk with a Costless Collar

The goal of the costless collar is to provide downside protection from stock price declines while also generating at least enough income to pay for the protection. The strategy is executed in two parts:

- Protective Puts – The manager purchases protective put options to hedge the risk of a down move in the stock price. These protective put positions are rolled periodically so that there is always a downside hedge in place on the stock.

- Covered Call Sale Strategy – To fund the cost of the put option hedges, the manager sells a covered call option. The revenue from the call option funds the protective puts.

Here’s an example that may help highlight the benefits of this approach:

Example – AMZN Costless Collar Hedge

Investor D owns AMZN as a major holding of her portfolio, which is trading at $1800. She is concerned about a potential fall in the stock price.

To hedge against a large decline, Investor D buys a put option with a strike price of $1500 expiring in 6 months for a premium of $45 and sells a covered call option with a strike price of $2000 for a premium of $50.

If in 6 months the AMZN price is:

- Above $2000 – Investor D’s AMZN stock will be called away

at a price of $2000

- Below $1500 – Investor D will have the right to sell her stock for $1500

- Between $1500 and $2000 – Both options will expire worthless and Investor D keeps her stock and the $5.00 net difference between the option premiums

Utilizing a costless collar is very similar to buying price insurance for a portfolio. The put option sets a floor on the price of the stock being hedged over the time period. However, instead of paying for the premium out of cash, the investor sells a covered call option to fund the protective put option purchase, effectively giving up upside participation in price moves above the covered call strike price level.

In summary, these four option strategies have the potential to enhance returns and lower volatility in a portfolio. The mechanics of using options in a portfolio can be complex, however, and thus it is extremely important that anyone considering utilizing an options strategy work with a Financial Advisor experienced in the asset class who can develop a plan that fits within their overall investment objectives.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions (“STA”), Lavaca Capital, LLC (“Lavaca”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from STA or Lavaca. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Neither STA or Lavaca are a law firm or a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the STA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a STA client, please remember to contact STA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

This presentation includes forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. There are frequently substantial differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

Please keep in mind that options are a specialized form of investment and are not suitable for all persons or for use in all portfolios. If you buy an option, you could lose all of your investment and if you sell one, you could expose yourself to nearly unlimited risk of loss. Still, if you understand the risks and benefits of options you may find them to be a useful part of your investment strategy. Remember more advanced strategies (such as spreads, collars and volatility trades) will likely require you to conduct additional research to determine whether their complexity and risk is right for you. This article is for educational purposes only and is designed to help you make intelligent and informed choices regarding options. Before acting on information in this content, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial, investment and/or tax advisor. For additional information on options or investments, please consult with your investment advisor and review the brochure entitled Characteristics and Risks of Standardized Options.

Please Also Note: If an Avidian Wealth client wishes to participate in any of these option strategies, they would be subject to an additional layer of fees. Both STA and Lavaca Capital charge a management fee for these strategies. Participation requires an executed agreement which clearly defines the fee arrangement prior to implementation. No STA client is under any obligation to participate.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*