Published on: 12/10/2021 • 9 min read

Avidian Report – 2021 in Review and Our Inflation Outlook

INSIDE THIS EDITION:

This week’s market report will cover a couple of topics that are especially timely as we head into the last few weeks of the year and into next year. First, we will go over a 2021 market review, where we will discuss overall asset class performance to date to serve as a bit of a recap. Then we will close with a discussion about inflation. As many of our longtime readers know, we have been watching inflation data very closely and simply want to provide an update on our outlook for inflation moving forward, as it could have meaningful implications for the broader economy and for investments across asset classes.

2021 Performance Review

The truth is that 2021 has been friendly to equity investors overall. So much so that it has been difficult for investors to locate areas to tax loss harvest from. In the paragraphs that follow we will provide some high-level performance commentary by market segment as we begin to reflect on the last 11 and a half months and start to look ahead to next year.

Small Caps

S&P SmallCap 600 Value Index (YTD Returns %)

Source: Avidian Wealth Solutions/Bloomberg

The S&P 600 Small Cap Value Index greatly benefited as the economy continued to recover post-COVID. The index got an extra boost from its value focus, which was more tied to the cyclical recovery and helped it perform better than more defensive equities so far this year. It should be noted that small caps have generally been strong performers this year but still not as strong as Large Cap domestic equities.

Large Cap Domestic Equities

S&P 500 Index (YTD Returns %)

Source: Avidian Wealth Solutions/Bloomberg

In the Large-Cap Universe, we have seen the S&P 500 Index perform exceptionally well despite some concerns in the 3Q about possible margin compression. However, the broad index has proven resilient as strength in some of the largest market cap constituents have saved the day as their technology focus uniquely positioned them to weather ups and downs during the year.

International and Emerging Market Equities

MSCI EAFE Index (YTD Returns %)

Source: Avidian Wealth Solutions/Bloomberg

MSCI Emerging Market Index (YTD Returns %)

International equities and emerging market equities have generally struggled to keep pace with domestic equities this year. The reason is that vaccine distribution has been slower, and those economies have been considerably slower to return to normal following COVID compared to the US. However, we do continue to believe that the valuations on international equities and emerging market equities pose a compelling value in today’s market with upside potential should we move beyond COVID impacts in those economies and if we see the US dollar weaken. Perhaps the upshot for many investors is that international and emerging market exposure tends to be lower relative to domestic equity exposure in portfolios which has helped limit the performance drag from exposure to these areas of the market during 2021.

However, we believe in globally diversified diversification over a full market cycle can help from a return perspective as we usually see changes in leadership between geographies. The Callan chart below which shows how these geographies shift between leader to laggard over time.

Fixed Income

The one segment of the market that has not performed as well this year has, perhaps unsurprisingly, been fixed income. While we believe that fixed income securities still play an important role in portfolios for diversification, concerns over rising interest rates have posed some challenges as bond prices generally decline as rates rise. Further, because bond yields are depressed, we have seen investors move to riskier corners of the market as they stretch to make up for the shortfall that the prevailing interest rate environment has created in many cases.

Inflation Outlook

As many of you may know, inflation has been in the headlines a lot over the last 6 months. With that, many clients have asked us questions about our outlook moving forward so here we want to spend some time discussing that. First, we will touch on our thoughts regarding near-term inflation and then we will move on to some thoughts regarding longer-term secular inflation.

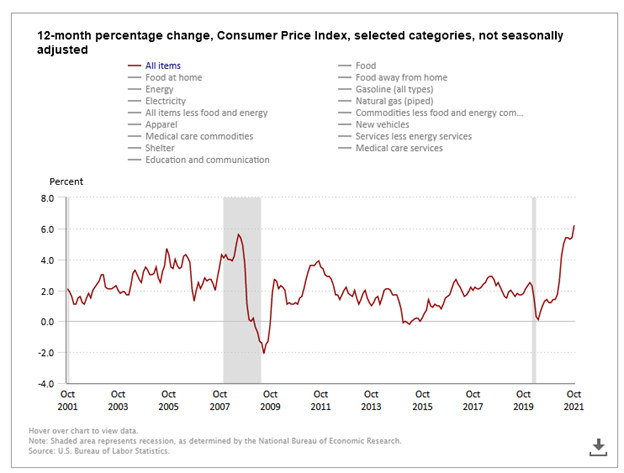

Let’s start with some numbers. The US Consumer Price Index jumped more than expected in October, bringing the annual inflation rate to 6.2%.

This is the highest level in three decades in the US. Headline CPI also has remained above 5% for five consecutive months. So rising inflation concerns during this year have turned out to be well-founded. However, there is still no consensus as to whether this will prove to be longer-lasting.

Why does it matter so much?

One key element is that if inflation does turn out to be transitory, the Fed can remain patient on monetary policy normalization, which would support both bond prices and equity valuations. If instead higher inflation proves to be more structural in nature, then the Fed may be pushed to tighten policy more aggressively and prove to be a headwind for both stocks and bonds.

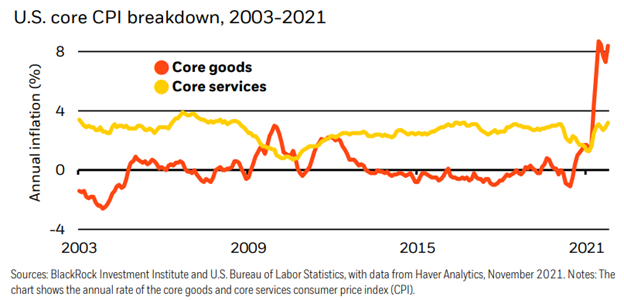

As a reminder, the fundamental catalyst for the current inflationary impulse is the surge in spending on goods relative to services in both the US and Europe. This is an abnormal pandemic-related change in consumption patterns that supply chains were not ready for. Perhaps the best way to explain it is by looking at the share of goods spending as a percentage of total personal consumption. On a percentage basis, we are at the highest level in the last 15 years.

This after the price of goods excluding food and energy has been in a deflationary trend for most of the past decade. On the other hand, inflation on core services has remained relatively stable. This means that as the economy continues to reopen, and consumption patterns return to normal we think it will provide a key driver that moderates inflation over time. However, in the short run, we do expect inflation pressures to remain as the mismatch between strong demand, particularly for consumable goods, and supply constraints in energy, semiconductors, and labor continue. We currently expect this imbalance to gradually resolve in 2022 as exceptionally strong demand for goods moderates as the effect of stimulus fades and spending on goods switches back to services and COVID restrictions in Asia abate.

We also don’t foresee a stagflation scenario playing out. Stagflation, where you see high levels of inflation combined with slower growth, high unemployment rate, and sluggish productivity produces an unstable equilibrium that is unlikely to stick around for two main reasons. First, it is highly unusual to see high inflation combined with a high unemployment rate, because those two forces counteract each other to some degree. And secondly, we are currently seeing growth slow from the peak, but it continues to look robust with a continuing recovery in the labor market and increased productivity thanks to the wide adoption of technology during the pandemic. As a result, we hold our view that current inflation pressures are largely transitory and cyclical in nature, with a small possibility that it lasts a bit longer than economists were anticipating before.

We do think it is worth noting that we are seeing the possibility that labor shortages and wage pressures could become an enduring feature of the post-COVID economic environment. Should it last, it could put pressure on the Fed to accelerate its monetary policy normalization.

Lastly, we want to briefly address our longer-term inflation outlook. Based on the data we are seeing; we don’t currently believe a secular hyperinflation scenario is likely to play out. However, there is a chance that the potentially sticky labor and wage pressure dynamics lead to a slightly higher inflation regime versus years prior for a period of years. That might lead to inflation rates slightly ahead of the 2% historical average but should nonetheless remain benign.

The reason for this view is that we simply believe secular trends that started to emerge over the last two decades are likely to continue. Especially as it relates to aging demographics, technology development and adoption, globalization, and income inequality which each provide a disinflationary force to the economy. Of course, we encourage investors to closely monitor these factors and rethink the traditional 60/40 portfolio, which has performed exceptionally well over the last 30 years as interest rates fell and bond ownership was an inexpensive insurance policy against equity volatility. Our sense is that we are entering a period where a marginally more inflationary environment supports the inclusion of real assets like commodities, real estate, and infrastructure in portfolios as they could provide an alternative source of income and better diversification in the long run. Of course, investors should not think on binary terms. They should position for a range of scenarios and that is why we think core bonds should continue to be part of the portfolio mix as they could be a diversifier and source of liquidity should alternate scenarios play out. Then for some investors, it also makes sense to consider alternative investments as an extra boost to potential return, diversified return streams, and a yield booster

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*