Published on: 05/13/2021 • 5 min read

Avidian Report – Alternative Investments and an Introduction to the J-curve

INSIDE THIS EDITION:

Alternative Investments and an Introduction to the J-curve

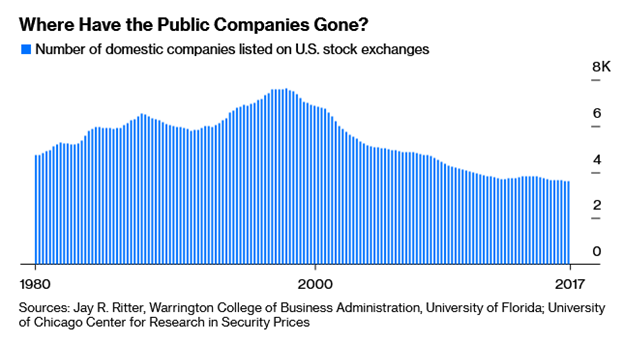

As the investment landscape has evolved, we have seen several significant developments: the involvement of central banks worldwide in supporting asset prices, artificially low interest rates, and a challenging environment for generating portfolio yield. Further, we have seen a reduction in the number of publicly traded firms going back to 2000, as the chart below shows.

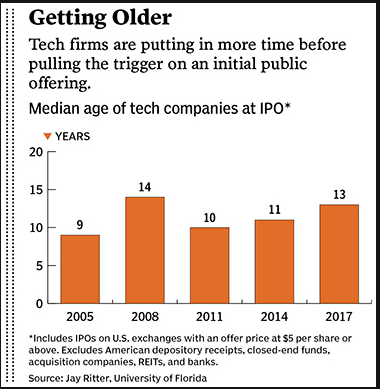

This has caused a reduced opportunity set for outsized returns in publicly traded companies because they are now remaining private longer, getting bigger while private, and squeezing the majority of their value from their growth well before hitting the public markets via initial public offerings. Although the chart below is a bit dated, the trend has been for firms to stay private longer.

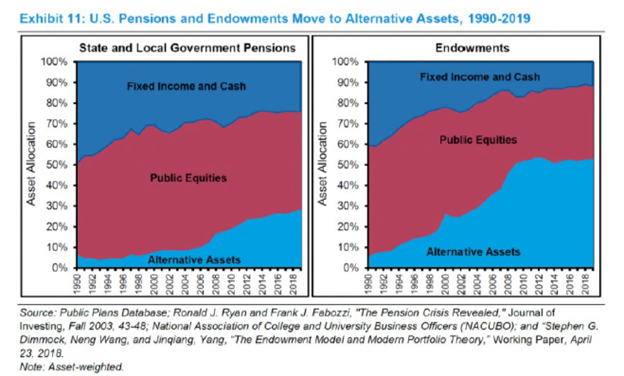

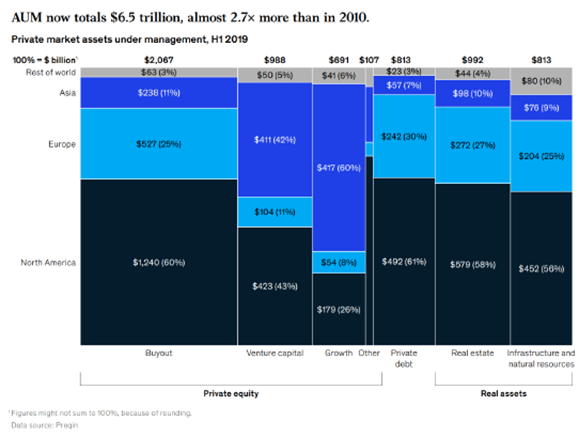

Consequently, US pensions and endowments have moved into private markets (also referred to as alternatives) at scale going back to 1990.

As the chart below shows, growth in allocation to alternatives for pensions and endowments has rocketed higher in the last 20 years, which, in some ways, paved the way for many private markets to go more mainstream.

However, this area of the investment universe is fragmented, requires a well-designed due diligence process, and can, in many cases, require more specialized knowledge of the asset class. Unfortunately, not every investment advisory firm or advisor is well versed in alternative investments. Avidian has designed an alternative investment platform that provides qualified investors access to an array of alternatives that have been fully vetted, and we believe it is important for those investors to get educated on concepts like the J-curve.

What is the J-curve?

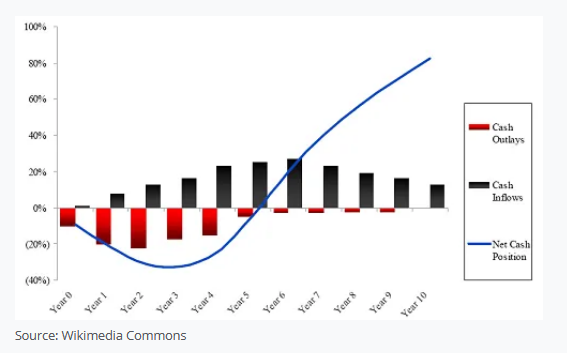

When we talk about the J-curve, we are referring to a chart that shows a period of cash outflows and then a period where those outflows gradually decline and then eventually turn into inflows. This is very common in private equity investments as private equity often operates under the premise that rates of return are negative as investments are made, then stabilize, and then enter a period of profitability. The chart below is how the J-curve typically looks in private equity investments, though the size of outlays, time to overcome the initial J-curve dip, and the trajectory of profitability may differ.

For investors in private equity, negative returns that appear at the beginning of the investment period are usually attributed to investment costs, management fees, and a portfolio of investments that have not reached maturity.

During this period, it is not uncommon for the private equity fund to generate small or, in some cases, no cash flow for investors. But, if a private equity fund is run by experienced managers, which can be discovered through a thorough due diligence process, it will likely improve cash flows used in many cases to pay down debt until such time that excess cash can be paid to investors. How long this takes is determined by how quickly the returns are generated, with a steeper J-curve indicating higher returns in a shorter time and a well-run private equity fund. On the other hand, a flatter J-curve tends to indicate a lower return stream and potentially a poorly managed private equity investment.

For investors new to the private equity space, it is crucial to understand this typical return stream as explained by the J-curve, as it can help set correct expectations and ensure that exposure to private equity is appropriate for the investor’s liquidity needs and investment objectives.

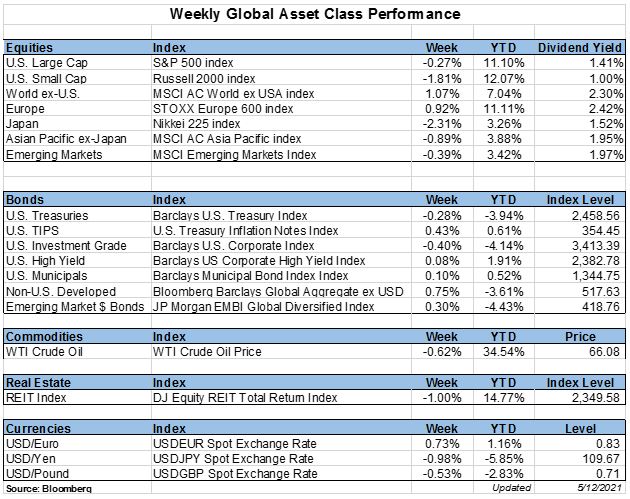

Weekly Global Asset Class Performance

10 Most Asked Tax Questions so Far in 2021

Written by Scott Bishop, MBA, CPA/PFS, CFP®

At Avidian Wealth, we hear from our clients frequently about pending tax law changes. If you have followed my articles over the years, you know that I often write about taxes and their impact on your estate, retirement and overall financial planning; several of these articles are referenced at the end of this piece.

With all the tax law changes we are considering as “pay for’s,” and in terms of having Americans “Pay their Fair Share,” we receive many calls from clients asking, “What should we do?” At this point, there is no immutable law and no solid guidance as to what will pass and when any changes will be effective, but we believe it is helpful to share some of our recommendations based on the ten most asked questions that we hear. But of course, before taking any action, please check with your tax and financial planning team!

Click Here to Read the Entire Article

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*