Published on: 10/08/2021 • 6 min read

Avidian Report – An Updated Market Outlook

INSIDE THIS EDITION:

This week’s report will focus on a brief market update and some of our thoughts on how investors might want to think about portfolio positioning moving ahead. With the US economy possibly transitioning to a later stage, a review of macroeconomic factors, corporate fundamentals, and valuations that help drive asset classes’ future performance is appropriate.

Macroeconomic Review

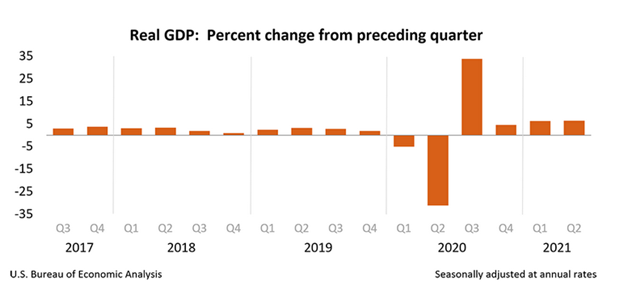

We have seen strong US growth. However, we believe that peak growth is firmly behind us. Recent shifts in economic growth can be attributed to data showing the impact of the delta variant and the fading impact of fiscal stimulus and ongoing supply chain issues that have had the largest effect on emerging Asia. However, although we see a gradual slowing of growth from peak levels, the absolute level of growth remains robust. It remains above trend, at more than 2% in the US.

While the US has transitioned into the mid-cycle, outside of the US, excluding China, it remains a little earlier in the cycle. This tells us that there is likely still ample room for the global economy to grow before recessionary risks emerge. So what do we see as it relates to economic growth moving forward?

We expect growth to continue through the end of 2022. While it is unlikely, we will see double-digit growth like we have seen in the last few quarters as the economy bounced back from depressed levels, we do see an economy that can grow at a low single-digit rate of around 3 or 4 percent. This view is supported by a strong household balance sheet that gives consumers room to spend more and a powerful CAPEX cycle as corporations boost capacity to meet consumer demand. In addition, we also see baseline government deficit spending continuing, especially in the US and in Western Europe. Lastly, the gradual cooling of economic activity is not necessarily a bad thing. It may be very positive as it could help avoid overheating and drive a longer economic expansion.

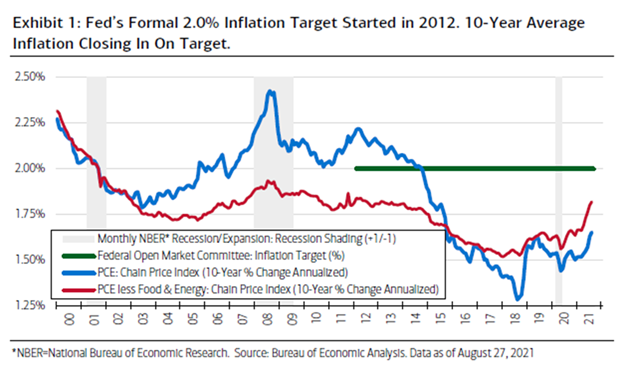

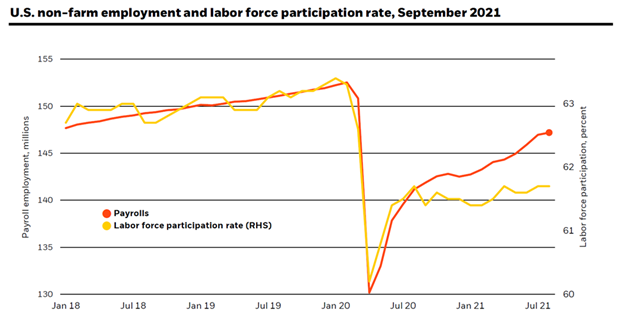

Inflation

Inflation readings surprised us to the upside over the last several months, relative to Fed forecasts and market consensus. Not only have inflation readings surprised investors, but so has the durability of inflationary pressures. The significant drivers of inflationary pressures have been led by base effects and the temporary reopening dynamics, which have driven CPI higher over the last two quarters. Although we continue to believe inflationary pressure may turn out to be transitory in nature, there are some components in the CPI readings that might prove to be stickier going forward. Namely, we have some wage pressures from labor shortages, booming housing prices after a decade of undersupply, and continuing supply chain disruptions. That said, we are not concerned with hyperinflation because the longer-term inflation expectations remain well-anchored between 2% and 2.5%, a condition that we see into 2022.

Some investors have raised the question about stagflation, and we should all be paying attention, especially with growth slowing somewhat, inflationary pressures showing up in some of the data, and supply chain issues and labor shortages similarly cropping up. Should this continue, the risk of stagflation could increase meaningfully.

Therefore, we advocate including some inflation resilient assets within portfolios to help hedge inflationary pressures and the increased sensitivity that financial assets may have to interest rate changes. However, we do not think the overweight to inflation hedged assets needs to be extreme at this stage. A moderate allocation should be enough for the moment.

Fed Policy

In September, the Federal Reserve signaled a slight policy pivot in what was a significant meeting. More specifically, they set the stage to move away from emergency action that was highly accommodative in favor of less accommodation. This looks like tapering of quantitative easing that is likely to start sooner rather than later. While consensus now is that this will begin in November or December, we think the bar for aggressive tapering may be a bit higher than meets the eye. Combined with the announcement of two hawkish Fed board members’ resignations, the Fed may take a bit longer. After all, at the current pace of bond purchases being made by the Fed ($120 billion) and a target of concluding tapering by mid-2022 would require a reduction in bond purchases by $15B per month. This caused the yield on 10-year US treasuries to jump from 1.3% to 1.54% in a week, after bottoming at 1.18% in early August. With higher bond yields, we saw a moderate sell-off in the stock market with rising volatility.

Despite that, we do not expect a repeat of the 2013 taper tantrum because the timing of QE tapering has been telegraphed by the Fed and is largely anticipated by the market. Also, even if the Fed starts tapering bond purchases, their policy remains substantially accommodative, as tail risks remain. As a result, we expect the stock market to stabilize as current interest rates remain at negative real yields, which should support risk assets.

Of course, the situation will remain fluid, and the Fed may be determined to stay on the dovish side if it can as long as inflation doesn’t become dangerous. This is positive for equity markets but could increase the risk of asset bubbles in the intermediate term, so encourage investors to remain vigilant.

Corporate Earnings

Over the past year, corporate earnings have beat analyst estimates for four consecutive quarters, as analysts continue underestimating the resilience of corporate results to the pandemic. As of today, earnings are on track to meet the estimates forecasted in 2019 and 2020. In other words, it is almost as though the earnings impact on corporate earnings has been zero despite a global pandemic.

The S&P 500 has rallied more than 40% from trough to peak from a price-performance standpoint. That represents strong performance which we believe has been driven by two factors: first, the strong earnings fundamentals mentioned above, and second, the ample liquidity, which has supported higher equity multiples that today stand elevated at a P/E of 20x.

As we move ahead, however, the pace of earnings growth will slow, and margin pressure may emerge, especially given the increases to both input prices and labor costs from supply chain issues and potentially rising interest rates and corporate tax rates.

Combined, this should translate to more moderate returns for stocks. But we are by no means bearish on equities. Instead, equities may consolidate with periodic pullbacks or corrections but remain in a modestly bullish uptrend with higher levels of volatility.

Altogether, this leads us to think investors should begin to play a bit less offense and instead add some layers of defensiveness to overall allocations while being sure not to overdo it.

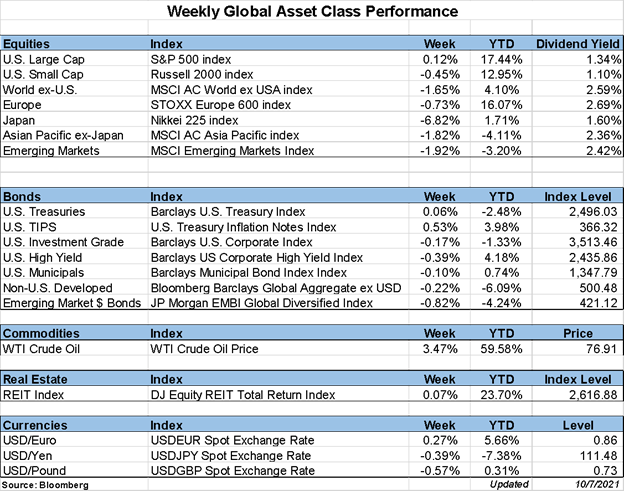

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*