Published on: 01/11/2020 • 8 min read

Avidian Report – As Markets Rise, Don’t Forget About Risk

INSIDE THIS EDITION:

As Markets Rise, Don’t Forget About Risk

Weekly Snapshot of Global Asset Class Performance

Financial Planning Goals for 2020

401k Plan Manager

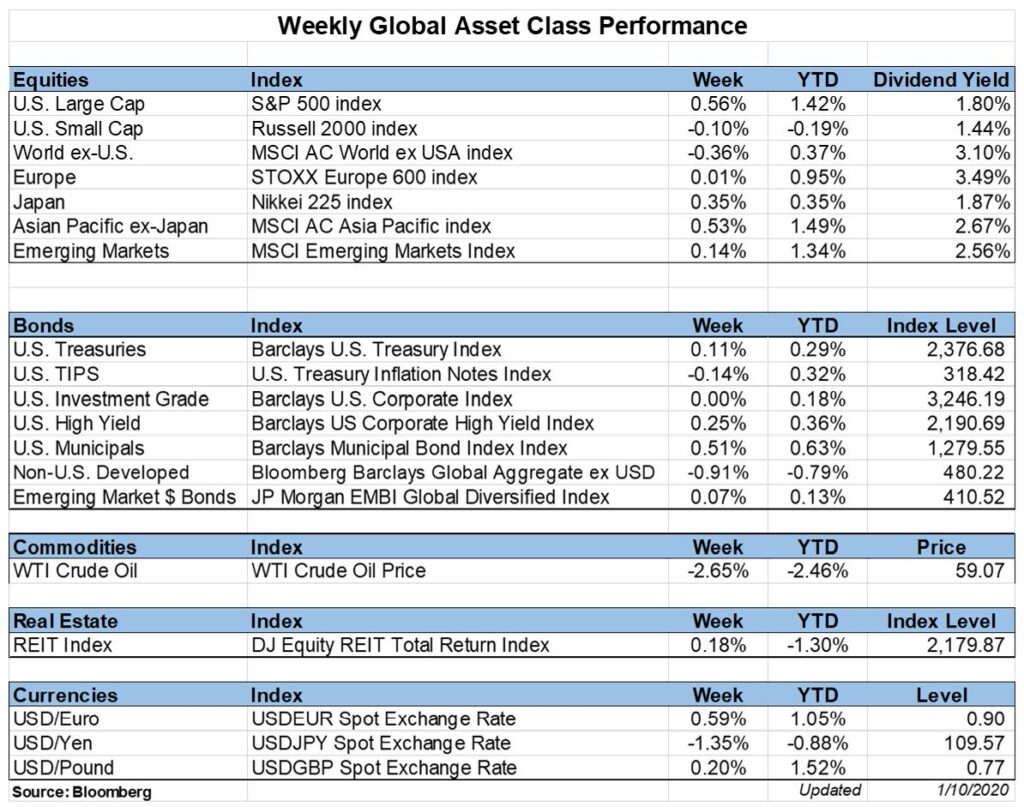

Equity markets around the world continue to trend higher. The S&P 500 to start the year has added another 1.59% total return to a very impressive 2019 total return of 31.48%.

[toggle title=’Read More’]

Similarly, developed international markets as measured by the MSCI All Country World Index have followed up a 27.3% total return in 2019 by tacking on an additional 1% total return this year. All of this despite increasing tensions in the middle east.

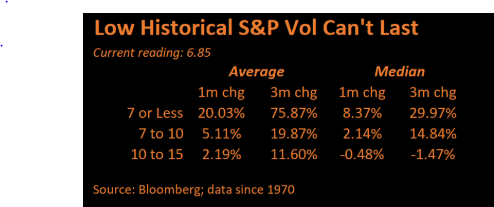

What is perhaps most surprising is not the returns, but rather the lack of volatility we have seen. Take, for example, the volatility for the S&P 500. Currently, the S&P has 60-day volatility of 6.85, which is close to 50-year lows.

If anything, this suggests that stocks may be primed for an increase in volatility. While the seemingly short-lived Iran confrontation did little to move volatility higher, we ponder whether the looming earnings season could be the catalyst for volatility levels above 7. What we do know is that when volatility levels get this low, the following three months see a sharp rise in volatility (chart above). So historically certainly favors a pick-up in volatility.

The one confounding factor is that investors are seemingly unphased by anything lately. They have remained relatedly calm in the face of tenuous trade negotiations, the imposition of tariffs, the uncertainty of an impeachment, BREXIT, and a variety of other potentially market-moving events. So even earnings season is not guaranteed to make volatility rise meaningfully.

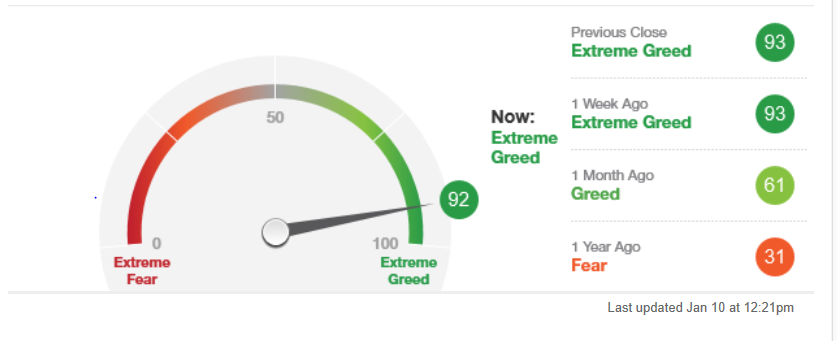

However, what we do posit is that when volatility does rise, it is likely to do so sharply. Not only are we at these very low levels, but investor sentiment is firmly showing increased greed in the market.

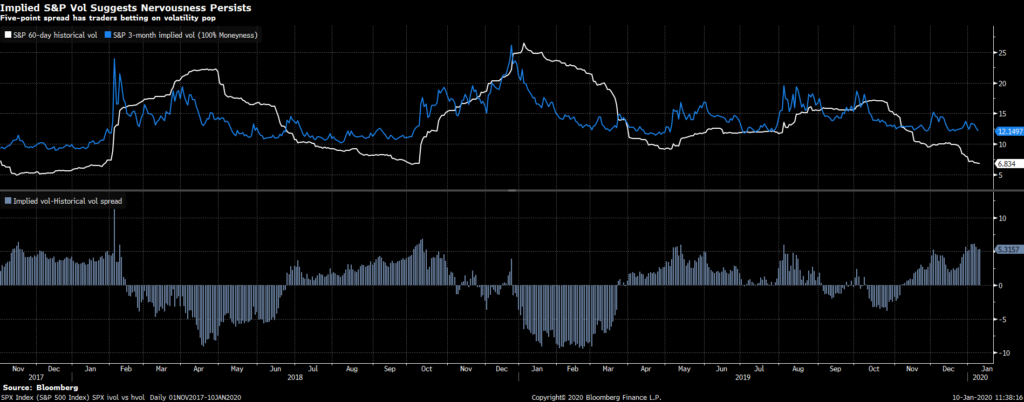

Additionally, we see implied S&P volatility spreads showing traders betting on pop in volatility, which could be a sign that some caution is warranted at this juncture.

In also means that now is likely an apropos time to be thinking about risk.

Defining Risk

How an investor defines risk is supremely important to how it is managed. Some investors focus on volatility while others look at risk through the lens of permanent loss of capital. At Avidian Wealth, we take a more holistic approach and assess risk along four dimensions – principal risk, volatility risk, purchasing power risk (also known as inflation risk), and longevity risk.

The principal risk is best defined as the risk of losing the amount that has been invested. This is what happens when an investment loses value over a holding period – a permanent loss of capital. As an example, let’s say an investor buys security ABC for $10 per share. If that security drops in price to $8 and never recovers, then the investor has lost $2 per share of principal. This is principal risk and it can have huge implications for investors looking to meet their goals and objectives.

Volatility risk is the second risk we focus on and in many cases the one that all investors focus on the most. This makes a lot of sense because it is also the one that is easiest to quantify through quantitative measures like standard deviation. In short, volatility risk is associated with frequent and severe fluctuations in the market price of an investment or portfolio that can lead to issues if the need for liquidity rises. Take for example what happened to investors that were getting ready to retire just as the great financial crisis began. Portfolio values dropped and suddenly these investors had to either sell portfolio positions as an inopportune time or had to potentially even postpone retirement.

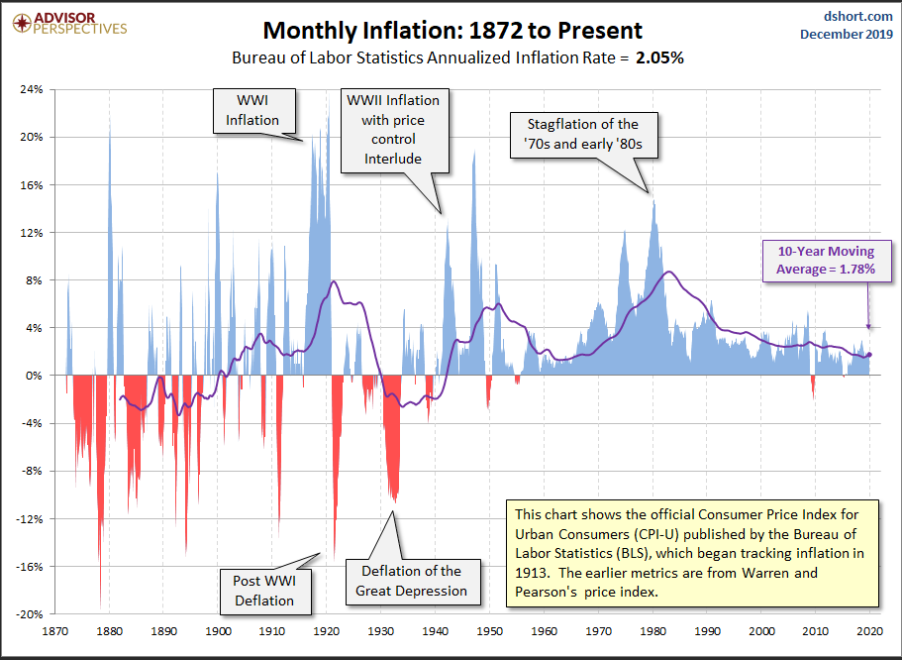

The third risk that we pay close attention to is called purchasing power risk (also known as inflation risk). Inflation risk describes the chance that the value of assets or income decreases due to inflation. Inflation as many knows is a rise in prices that has the impact of reducing the purchasing power of a dollar. Although inflation has remained relatively tame for years, as the chart below shows there have been periods of time when investors have faced high inflation scenarios that have resulted in reduced purchasing power.

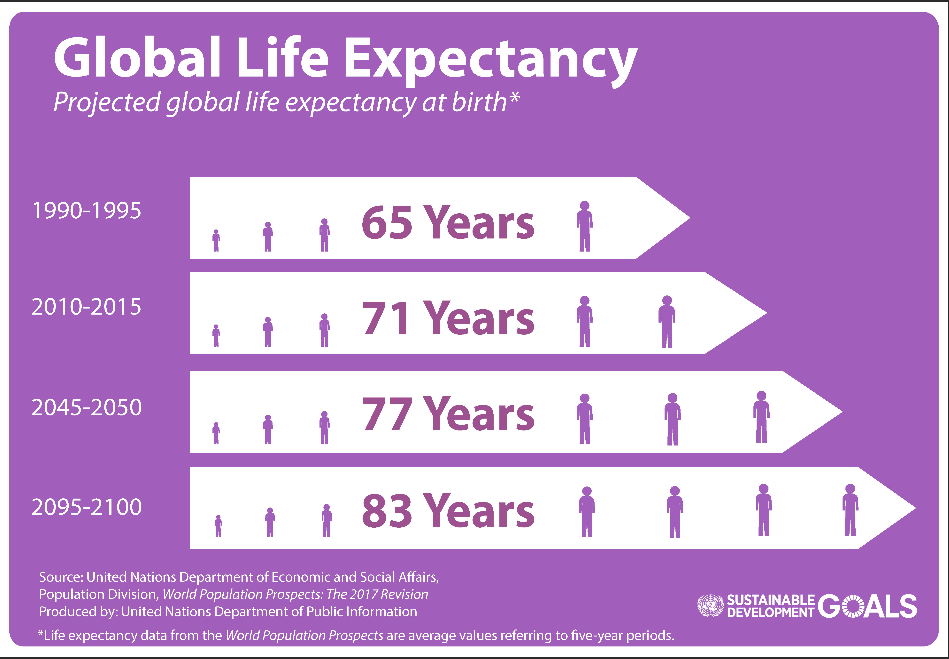

Longevity risk is the fourth risk investors should keep in mind as they draw up financial plans and make investments. Quite simply, longevity risk is the potential that an investor outlives their assets. This has become a very real risk for a lot of investors as medicine improves and life expectancy increases.

Managing Risk

With a hodgepodge of risks facing investors, the question becomes how best to address them to reduce the likelihood that they impact their financial future. First, it is important for investors to focus on what they can control. This includes using a reliable, time-test investment strategy that is well designed to improve the probability of success. As it comes to the four risks discussed above, there are some simple things investors can focus on and refine to help minimize that any of these risks come back to hurt them.

For principal risk, the best antidote is to get the asset allocation right. This means working with an experienced advisor to help determine the right asset allocation that factors in important criteria like time horizon, risk tolerance, and liquidity needs. As an academic study by Brinson called “Determinants of Portfolio Performance” found, there is evidence that asset allocation accounts for 93.6% of total return variation. This means that getting asset allocation right could indeed be the single most important investment decision one can make. To do it, make sure your advisor uses a robust analysis using realistic assumptions and then runs a scenario analysis to make sure the split between stocks and bonds is the correct one.

When it comes to volatility risk, investors would be wise to diversify their portfolios across sub-asset classes as characteristics and drivers of the performance vary across investments. A well-diversified portfolio usually will include a mix of asset classes, across different geographies that exhibit different correlations to each other. This will naturally mean that at any given time some positions will be up while others are down, a feature that disciplined rebalancing can take advantage of.

Inflation risk may be one that investors today are less concerned about. However, we feel that it is short-sighted to ignore the potential for inflation as most have discounted the likelihood it makes a comeback following a period of Fed Balance Sheet expansion and low-interest rates. That said, we advocate having exposure to real estate, infrastructure, or inflation-protected treasuries (TIPS) that will generate a return in a benign inflation scenario but really shine in a portfolio when inflation runs hot. These real assets as they are often called may be able to capture rising prices and help protect purchasing power.

Finally, longevity risk is mostly a financial planning concern but one that investors should nonetheless keep in mind.

With people expected to live longer than they have at any other time, one of the best ways to protect against this risk is to utilize a financial planning process that is integrated into your investments. This can ensure that asset allocation decisions are being expressed in portfolios correctly. Additionally, using conservative life expectancy assumptions in the process can provide a buffer in the event a longer life expectancy comes to pass.

Weekly Global Asset Class Performance

[/toggle]

Financial Planning Goals for 2020

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Carter Blackburn

The beginning of each year presents a unique opportunity to self-reflect about whether your Financial Plan is on track. Many of us set “New Years Resolutions” with no true actionable goal or follow-through. Remember a goal without a plan is just a wish!

With that in mind, especially given recent tax law changes and the passage of the retirement SECURE Act, now is an excellent time to review your plan to see if you are on track to meet your short and long-term goals. Below are some important areas which you should contemplate and plan before we get too far into the year.

Read Full Article Here

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*