Published on: 07/30/2021 • 5 min read

Avidian Report – China crackdown: What happened and what we think investors should do?

INSIDE THIS EDITION:

At the beginning of this week, investors were greeted with surprising and unexpected action by the Chinese government to crack down on their education sector. The shock reverberated throughout the Chinese equity market across sectors. Even in the domestic equity markets where many exchange-traded funds have meaningful exposure to Chinese stocks, a sell-off ensued on Monday morning as investors moved to reduce exposure to Chinese equities.

This week’s market report is designed to shed some light on what happened to cause the sell-off and, more importantly, provide our thoughts about how this is likely to play out and what we believe investors should be doing as a result.

What led to the sell-off?

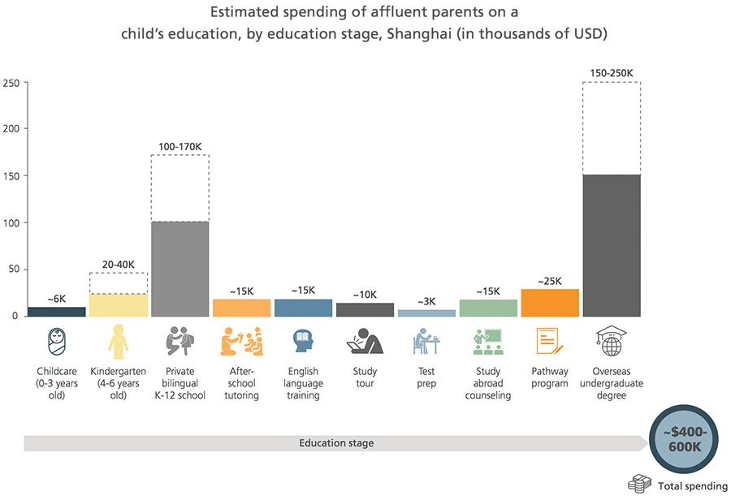

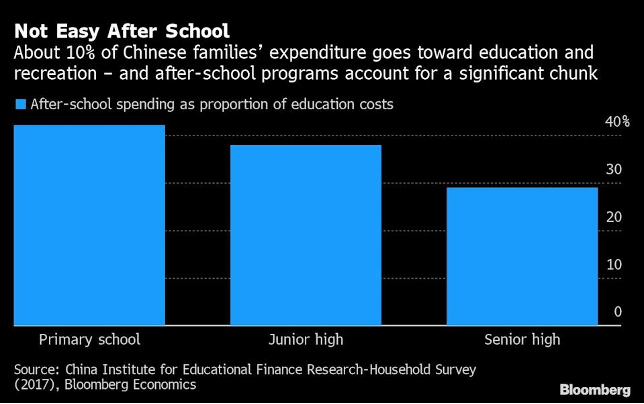

What started the sell-off was a set of unexpected Chinese government regulations on the education sector designed to lessen the need for after-school tutoring for K-12 students. This sector has historically presented a tremendous burden on Chinese families in terms of time commitment and costs. We believe that at the heart of the government’s actions this week is a strong attempt to level the playing field related to access to education.

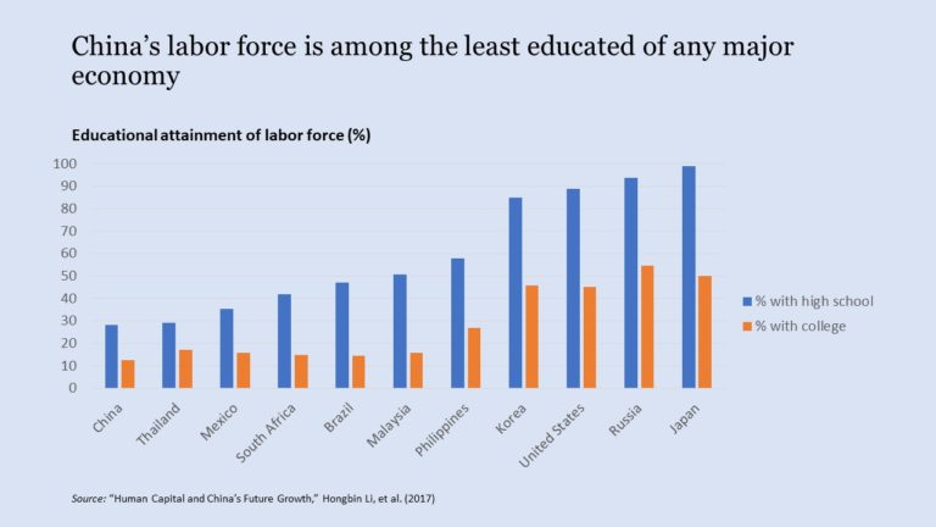

Source: Consultancy.Asia

However, the action was also nuanced as the Chinese education sector is divided in two. First, there are vocational education companies that focus on the training and operation of higher education institutions. These companies, of course, fall outside the umbrella of K-12 educational institutions and have been unregulated. These companies were encouraged to operate by the Chinese government to provide higher education programs to Chinese citizens and supply private industry with qualified employees. The two-segment education sector in China is important to note because, to date, there have been few signs that the Chinese government has any intention of discouraging privately-owned companies addressing the needs beyond 12th grade education from engaging in providing education services. After all, these are essential institutions for maintaining and advancing China’s economic growth and supporting the supply of skilled labor.

Regulatory actions this week in the educational sector have not been accompanied by any guidance from the government. But at the heart of the issue appears to be that the government is trying desperately to address growing inequality. This falls in line with some of the recent actions taken against select technology and financial companies in China, with one distinction. Namely, the actions against the likes of Didi Global and Ant Financial were company-specific actions in response to those firms ignoring government calls for reforms.

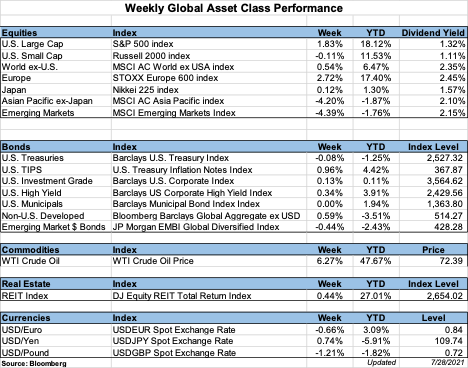

Nonetheless, investors lumped both regulatory moves together and sold equities indiscriminately across sectors for fear that similar regulatory action would take place in other industries. However, as we have gotten more clarity in the last day or two, it appears that the Chinese government, in response to rising equity market volatility, has taken intentional steps to calm investor fears by publishing articles highlighting that they believe the sell-off has been overdone. Additionally, some believe that the government stepped in to intervene and stave off a steeper drop.

As a result, we continue to believe that the recent market activity is likely a blip on the screen rather than a drastic policy shift that investors should be concerned about. We received several questions from clients over the last week about whether investments with ties to China should be sold or avoided. We don’t believe so. The actions taken by the Chinese government late this week provide some encouraging signs that they will step in to support Chinese equity markets and keep investors calm. That means that the risk of contagion seems very small. This view appears to be gathering support with market prices recovering, especially in sectors like technology which were big targets of the sell-off due to their increasing power in the Chinese economy.

Heng Seng Index Performance to Start Trading on 7/29/2021

Source: Bloomberg

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*