Published on: 09/11/2020 • 7 min read

Avidian Report – Commodity Markets Could Be Stirring – copy

INSIDE THIS EDITION:

Commodity Markets Could Be Stirring

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

We have focused many of our weekly market updates on the broad general economy, COVID-19, and how investors should think about portfolio construction over the last 6 months. However, as investment managers, we also spend a great deal of time looking for opportunities in sectors and asset classes in the process of inflecting.

[toggle title=’Read More’]

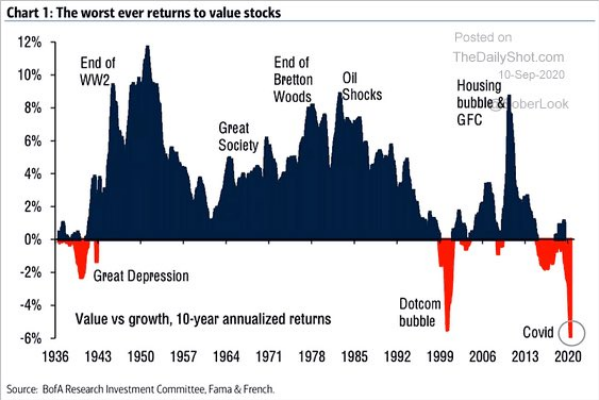

Oftentimes, the positions that are incorporated into our managed portfolio models have been watched for a long time, where we have studied trends, and observe possible inflection points. As an example, we have been closely monitoring the underperformance of value stocks relative to growth stocks for a long time as the divergence has widened. As the chart below shows, value stocks have massively underperformed this year. In fact, value stocks have now experienced their worst performance on a 10-year annualized return basis relative to Growth in history. When we see this type of underperformance, we naturally get interested and try to understand what might need to change to get an inflection to materialize.

As the chart above implies, COVID-19 has widened the performance gap between value and growth, as investors have piled into sectors and companies that are expected to perform well in a social distancing environment. This naturally includes growth-oriented technology stocks. So, it is certainly possible that a performance reversal in these factors hinges on moving beyond COVID-19 and if history is any guide, potentially a weaker dollar.

While it is unclear whether the trend will reverse, we are certainly paying attention.

Of course, inflections are not limited to value or growth stocks. They can also be seen in sectors and/or asset classes like commodities. This week’s commentary will focus on commodities and what we think may be set ups for future inflections. Of course, timing remains uncertain, but we are seeing some weakening of the US dollar and supply/demand changes that could make commodities a prime hunting ground for opportunity ahead.

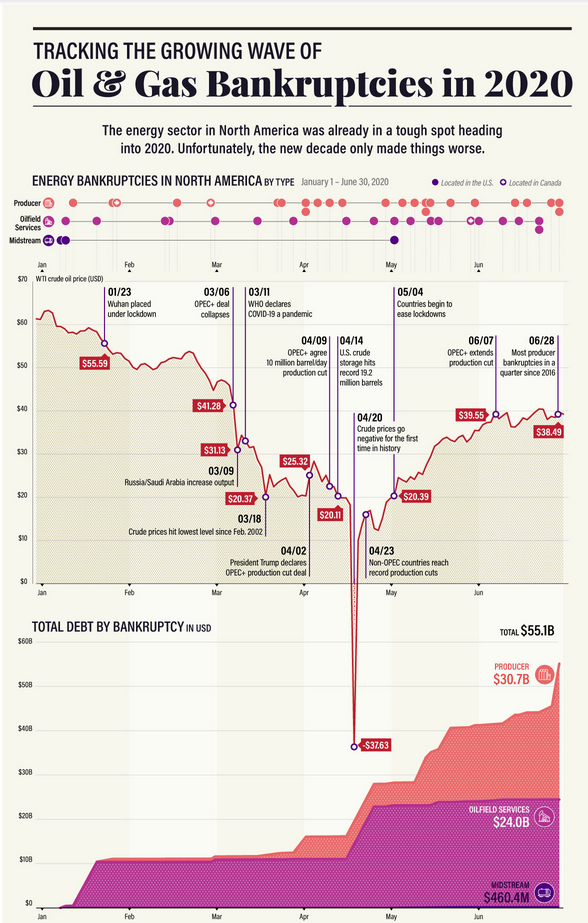

Energy stocks have been very difficult to invest in for about 5 years now. However, 2020 has been exceptionally difficult for oil & gas companies. Oil demand started to take a hit when Wuhan China was placed on lockdown and only declined further as more of the world shut down due to COVID-19. Adding insult to injury, the OPEC+ deal collapsed in March and sent crude prices tumbling before hitting a low point in April when crude prices went negative in the futures market.

While we have seen some recovery in crude oil prices since then, it has done little to stem the growing number of bankruptcies in the Oil & Gas sector. In fact, by the end of June, we had the most oil producer bankruptcies in a quarter since 2016.

The good news for investors potentially interested in oil & gas related investments is that the process we are going through at present may be setting the stage for better days ahead, eventually. Especially as we see an increasing number of producer bankruptcies and curtailment of production. But we still think investors should be patient as an improvement will also require a better demand picture which has been wrecked by COVID-19.

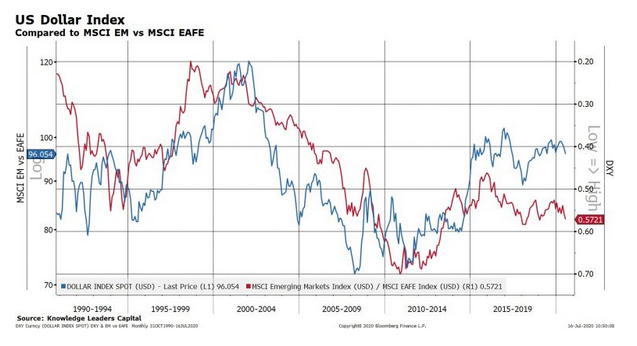

As the chart below shows since May, a weaker dollar historically has supported oil prices and could be another key ingredient for an oil sector recovery. However, in the COVID-19 environment, it is difficult to confirm whether the weakening dollar trend shown in the chart below will continue.

For now, we think investors should remain patient but continue monitoring developments in this sector and in the currency market to catch opportunities as they emerge.

A weaker dollar may in fact be a key for identifying inflections in many commodity-related industries and even emerging markets. Take copper for example which has recently seen a rising spot price on the back of the weaker dollar and improving copper demand from China.

If we look at copper through time, it generally has an inverse relationship to the US dollar index. More interesting, however, is that Copper has historically outperformed gold in a weak dollar environment. We think this may be due to its solid performance in inflationary periods as well as in environments that experience real growth.

In our view, copper markets may be an interesting place to look for opportunities especially because this commodity is likely to enjoy strengthening demand for quite some time as emerging technologies like electric vehicles require it for production. At the same time, constrained supply should make spot prices less sensitive to changes in demand.

Lastly, we think it is worth noting that commodities are an important component of emerging economies. That is why if the US dollar continues to weaken as it has for the last 6 months, and commodities perform well, we might also see a boost to emerging market stocks. This is especially true for countries that tend to have higher inflation and run a balance of payment deficits. In fact, in a scenario where the dollar weakens and commodities are buoyant, history has shown us that emerging markets tend to outperform not only US stocks but also stocks in developed international markets.

While we are not necessarily saying the moment to deploy capital into these commodity-related markets is now, it may be possible that we could be setting up with an opportunity to do so.

As investors, if you are not thinking a few steps ahead, these are the types of opportunities that may simply pass you by. It is why we strongly advocate for selecting an advisor that thinks not only about the current environment but also about the one that lies ahead.

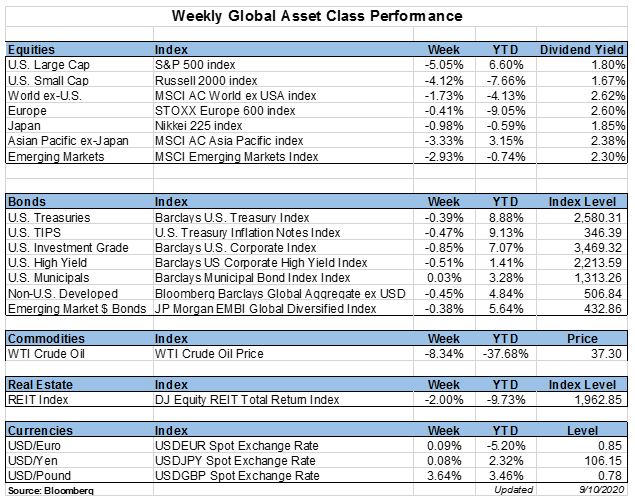

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*