Published on: 08/20/2021 • 5 min read

Avidian Report – Could Now Be The Time For Liquid Alternatives?

INSIDE THIS EDITION:

Liquid alternatives can be considered more liquid versions of illiquid investment strategies like those implemented by hedge funds. Although these investments have attracted significant investment dollars from retail investors over the last decade, their performance has not always been stellar. This is especially true after factoring in fees, opacity, and a robust equity market. Despite periods of lackluster returns for liquid alternatives over the last ten years, they have a place in a portfolio as a portfolio diversifier. This is especially true as we face heightened uncertainty on interest rates, inflation, monetary and fiscal policy, and geopolitics, leading to increased volatility in traditional asset classes.

Of course, it would not surprise us to see a fair share of doubters after reaching this conclusion. After all, as Morningstar found recently, a U.S.-biased portfolio allocated 60% to equities and 40% to bonds over the last ten years would have outperformed nearly all other strategies and asset classes on a risk-adjusted basis. Not only that, but they also found that because stocks and bonds were to a great degree uncorrelated during this period, the correlation benefit of liquid alternatives sometimes went undetected.

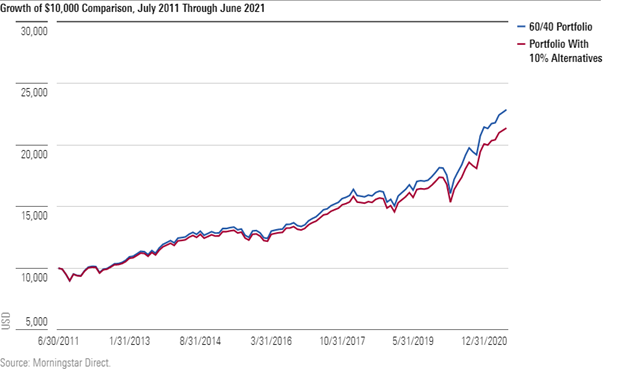

The study invested $10,000 in a 60/40 ratio split between the Vanguard Global Equity Fund and the Vanguard Total Bond Market Index, respectively. As the chart below shows, the 60/40 portfolio of these two investments outperformed a portfolio when it carved out 10% of the allocation to invest in liquid alternative investments.

Not only that, but that plain vanilla 60/40 portfolio also produced better risk-adjusted returns as measured by the Sharpe ratio than the portfolio that included a 10% allocation to liquid alternatives.

So what led to this result?

It is likely a combination of factors. First is a market environment with sustained low interest rates, shown to be a headwind to liquid alternatives strategies. Second, liquid alternatives have inherent complexity that has led to more stringent regulations on their managers. While regulations on liquid alternative strategies have been passed as protections for investors, these have made it more challenging for investment managers to implement their strategies as designed. Third is the issue with fund flows. While fully illiquid strategies have semi-permanent capital, the more liquid nature of liquid alternative investments can lead to more rapid entry and exit as investors chase performance. This naturally leads to a performance headwind for liquid alternatives.

However, going forward, these headwinds may be far less impactful on performance, especially as interest rates potentially begin to rise and volatility increases. Therefore, liquid alternatives may be poised to perform quite well moving forward.

As interest rates rise, many liquid alternative strategies can capitalize and deliver much better performance than they can in ultra-low interest rate environments. For example, an event-driven strategy like merger arbitrage is often found in liquid alternative portfolios. When interest rates are low, merger spreads are typically narrow, so the prospect of strong returns is somewhat diminished. When interest rates rise, merger spreads widen, making the merger arbitrage strategy’s potential returns significantly stronger. This is just one example of the impact of interest rates on strategies found in a liquid alternatives portfolio.

Also, consider what might happen if stock and bond correlations rise. In this scenario, investors look to diversify to less correlated asset classes. If stock and bond correlations look similar, it is unlikely for investors to reduce equity exposure in favor of bonds; there isn’t the correlation benefit to justify the move. However, investors might instead allocate to liquid alternatives that could shine as their diversification benefits rise above bonds. A bit of icing on the cake is that in these environments, liquid alternative investments could also allow investors to derive positive returns still while mitigating traditional market risk.

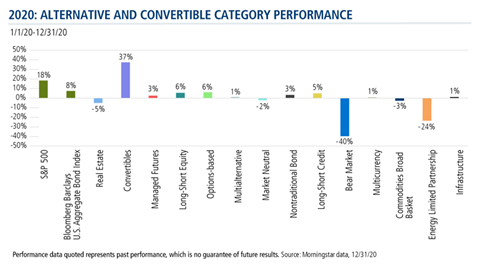

Investors got a preview last year of how this works when equities sell off. As the chart below illustrates, alternative asset classes provided quite a bit of downside protection relative to the drawdown of almost 40% that we saw at the height of the start of the pandemic.

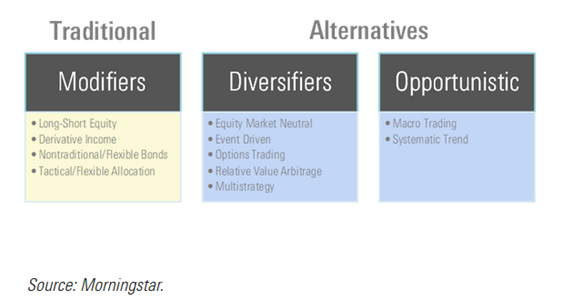

However, it must be noted that the results investors get in liquid alternative strategies will be highly variable and depend a great deal on manager and strategy selection. At Avidian, we look at liquid alternative strategies based on objectives, similar to the table shown below.

Also, we like to think about liquid alternative strategies through the lens of a target volatility profile or correlation profile. Take, for example, the 52-week correlations to Morningstar Global Markets Index compared to the VIX shown below.

These particular strategies can help a portfolio over the long term from a return perspective and help them maintain a lower sensitivity to stock volatility. And after a period of relative underperformance vs. equities, now may be the time to consider adding an exposure if you don’t already have one.

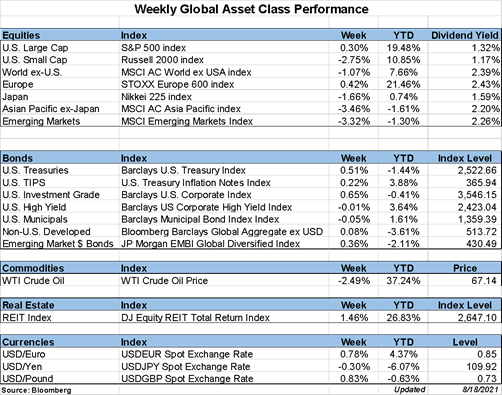

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*