Published on: 04/14/2022 • 6 min read

Avidian Report – Could Uranium Be Among The Best-Performing Assets Of The Year?

INSIDE THIS EDITION

Could Uranium Be Among The Best-Performing Assets Of The Year?

Special Notice:

The Avidian Report will now be delivered every other week directly to your email inbox. The Avidian Report will continue to include timely financial commentary to keep you informed. Thank you for taking the time to read the Avidian Report!

As the Department of Energy describes it, uranium is a silvery-white metallic chemical element that few outside of energy and perhaps defense circles know much about. However, there appears to be growing interest in uranium from investors and media alike. And it doesn’t surprise us because it has been a sector that has started to perform.

Source: CNBC, Barron’s

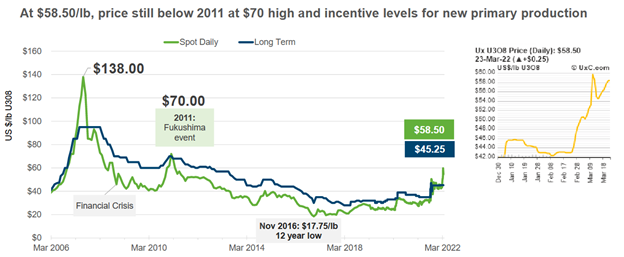

Despite solid performance as of late, it could be a commodity that continues catching a bid as several things in place would support a bullish thesis.

Source: Uranium Energy Corp., TradeTech, Numerco, UxC, LLC

During this week’s report, we will touch on why so many investors appear to be getting interested and, more importantly, why they might be right.

Supply and Demand

As with any commodity, supply and demand are key drivers of price and performance. As demand rises above supply, prices rise, and if supply supersedes demand, price declines. However, an essential thing to note is that if spot prices decline, those prices cannot stay lower than the cost of production forever. Eventually, they must rise to a point where producers have an incentive to enter the market. After years of spot prices being depressed, the tides appear to have shifted.

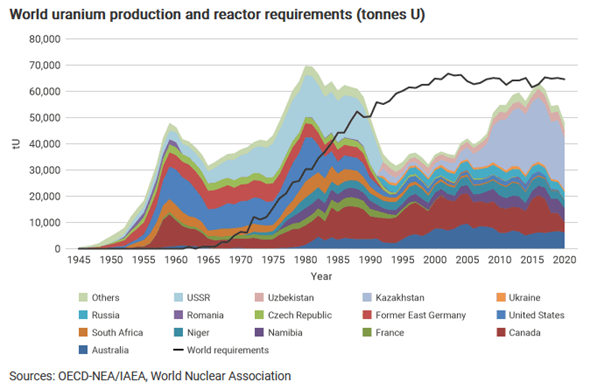

Currently, there are 440 reactors in operation worldwide that require an estimated 74,000 tons of uranium oxide concentrate each year. That contains requires approximately 62,500 tons of uranium from either mines or stockpiles. And although the last 20 years have seen a slowdown in demand, we are witnessing a point of inflection where the trend likely will reverse. The World Nuclear Association published a report that shows increased uranium demand to the tune of 27% from 2021 to 2030. That’s a significant increase, especially when we consider that at the end of 2020, the production of uranium from mines only covered 74% of the world’s demand.

That’s certainly bullish as we see it.

Financial Buyers

Another piece of the demand puzzle that is sometimes missed is the role financial buyers play in pushing spot prices higher. In August 2021, the Sprott Physical Uranium Trust, which substantially invests all its physical uranium assets, launched an “At-the-market” equity program. Issuing more trust units to investors in Canada created a financial buyer of uranium in the spot market. The initial “ATM” was for $300M of units and then increased to more than $1B. Sprott goes into the spot market with each unit sold to secure physical uranium for the trust and creates a bit of a flywheel effect with a positive feedback loop. As spot prices rise, investor interest rises, and Sprott goes into the spot market to stack uranium. And because the entity is structured as a passive perpetual vehicle, the fund won’t sell its stockpiles to other entities and virtually ensures that whatever uranium is purchased never comes back to the market.

Increasing calls for Sanctions on Russian Uranium Exports

Thus far, we have covered two drivers for a bullish sentiment on uranium, but there’s more that supports bullish takes on the commodity. For example, the impact that the Russia/Ukraine conflict is having on the market.

Since the start of the conflict, most of the news flow has centered around oil and gas. However, the truth is that Russia is a big player in the global supply chain for uranium too. Especially since the world’s largest producer, Kazakhstan, sends most of its milled Uranium through Russia before it gets sent worldwide. With rising sanctions against Russian businesses, there is a possibility that uranium exports will hit a snag and further constrain global supplies.

Some countries are already making a move away from Russian-sourced uranium. For example, the Czech Republic’s prime minister said they are officially switching away from Russia’s uranium instead of sourcing it from the US and France.

In the US, there have been several bills introduced in Congress to outright ban uranium imports from Russia. These have gotten bipartisan support, and while nothing has been passed just yet, the chorus is growing louder. This is a big deal because not only is Kazakhstan sending uranium for processing in Russia, but between 16%-20% of the US uranium supply is sourced from Russia. If that were to disappear from the US’s supply side of the equation, it could be a significant tailwind as utilities could be forced to enter the market for their long-term needs.

Although not necessarily a requirement to see good performance for uranium going forward, a move from Congress that constrains supply would be wildly bullish for uranium spot prices.

As a result, we think investors are likely to hear more and more about the sector as things continue to evolve. However, as with any commodity, we expect any bullish moves in uranium to be accompanied by tremendous volatility.

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. The information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, and formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*