Published on: 05/07/2021 • 5 min read

Avidian Report – COVID Update, Four Phases of Economic Recovery

INSIDE THIS EDITION:

COVID Update, Four Phases of Economic Recovery and What It Means for Portfolios

This week we start the commentary with a pandemic update because, as we have said previously, we believe this will be a key driver to both an economic recovery and what financial markets do moving forward.

The good news is that the US appears to be approaching herd immunity quickly. We estimate that 75% of the US population will have either acquired immunity through the vaccination process or by prior COVID-19 infections by the end of May. We think by the end of June, this percentage may be as much as 85%, especially with the vaccine now widely available across the country. With this progress, we believe the pace of returning to normalcy will be fast as long as most of the population embraces the vaccine from here on out. Though we acknowledge that this has been complicated by the blood clot issues caused by certain vaccines, we think this is unlikely to derail the progress made in getting the majority of the US population safeguarded against COVID.

Currently, the US is third globally, with 30% of the population fully vaccinated and more than 40% having at least one dose of the vaccine, so we note considerable progress there.

However, it is important to note that there are some risks on the vaccine front. First is continued hesitancy by large portions of the general population about getting the vaccine, which could delay a total return to normalcy. Second is the possibility that virus variants from places like India get here, and the vaccines do little to stop their spread.

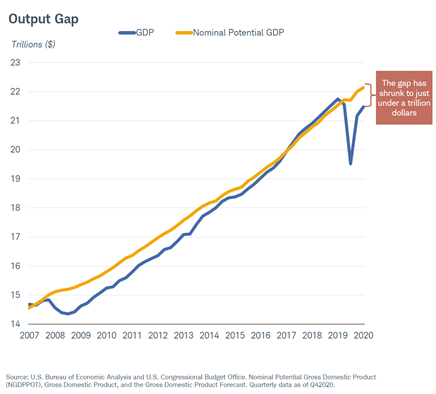

With that update, we now shift gears to the economy. We generally stand that COVID-19 is having an impact more similar to natural disasters than traditional recessions. Natural disasters are marked by a rapid economic restart versus what we typically see in a traditional business cycle. When we look back to March 2020, the recession was at its deepest point and was mirrored by lows for financial markets. Interestingly, in this episode of market stress, the scale of monetary and fiscal policy support did a fantastic job at making the financial market snapback well ahead of any signs of economic improvement. Additionally, that same support led to a quick snap back in GDP. The chart below shows just how quickly we went from a $2 trillion output gap to one where we are now only about $700 billion shy from potential GDP.

This is a massive contrast with the previous recovery, which took more than seven years before the GDP caught up to its potential. As we see it, the difference was made by decisive policy action that came in four phases.

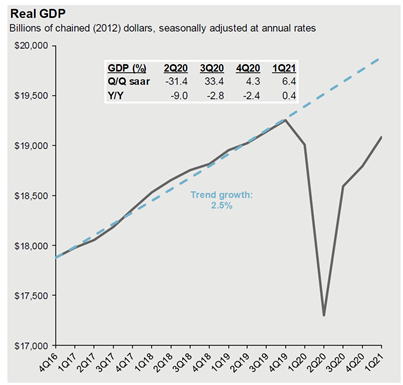

The first phase was when we saw the lifting of government-mandated lockdowns. At this stage, economic activities and consumption began to recover. Phase two was a slow return to normal for segments of the service economy. Phase three has been another economic surge facilitated by effective vaccine distribution, and lastly, we believe phase four will be a return and potential overshoot on GDP driven by pent-up demand before returning to trend GDP growth.

With these four phases of recovery well on their way to completion, many investors are now wondering what the Fed will do to respond to rising concerns over inflation and a return. The Fed needs to see some actual inflation in the economy and progress towards a stronger labor market before raising interest rates but must be very careful not to let inflation run so hot that it becomes a longer-term issue.

In the April Federal Open Market Committee meeting, the Fed was upbeat on these dimensions, given improving economic data. Yet, their commentary did not hint at when they would start tapering support, given the remaining slack in the labor market. We are thinking ahead and believe the economic data today points to an announcement of tapering sometime this summer. However, we don’t foresee it being executed until sometime in early 2022.

Further, we see the potential for rate hikes to remain low until the end of 2022 or even early 2023. This means a reduced risk on the front end of the yield curve but still leaves considerable uncertainty around whether there is a higher likelihood of inflation, reflation or weaker growth ahead. At this stage, we believe balance in portfolios is crucial, as it will make it easier to pivot as investors get more clarity from the Fed and the economy about the direction of financial markets in the intermediate term.

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*