Published on: 06/11/2021 • 5 min read

Avidian Report – CPI Report and Infrastructure Sector Update

INSIDE THIS EDITION:

CPI Report and Infrastructure Sector Update

10 Most Asked Tax Questions so Far in 2021

Estate Tax Law and Strategy Changes are Coming

You may recall that we wrote about the case for including infrastructure in portfolios a couple of months ago. We discussed how it was an attractive asset class for income potential and exhibited some hedging characteristics that could help a portfolio in an inflationary environment.

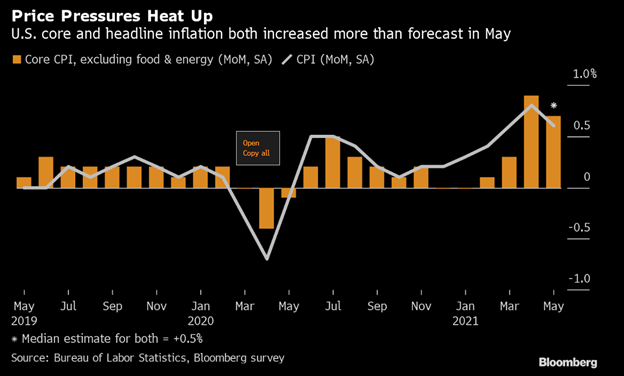

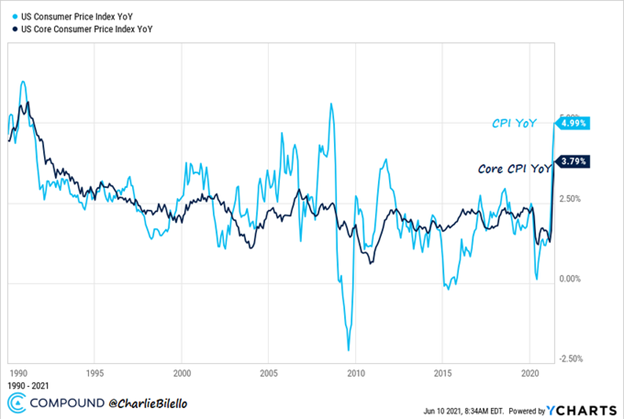

It now appears we are seeing the first hints of inflationary pressure in headline numbers. On Thursday, we received updated consumer price index numbers that showed a climb of 0.6% over last month’s reading, led by increasing costs for used cars, household furnishings, airfare, and apparel.

For some longer-term context, this is a 5% increase for the month of May compared to May of last year with the core CPI, which excludes food and energy, up 3.8% from a year ago. This is not only ahead of expectations but also the most significant core CPI increase over 12 months in the last 30 years or so.

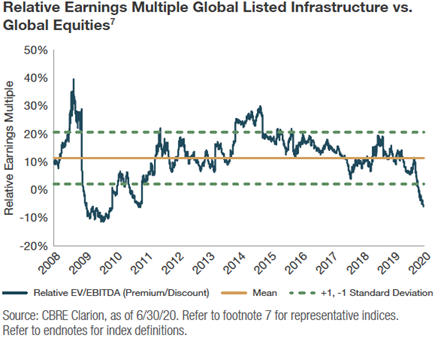

However, we do not know if this is a transitory bump in inflation or something that will stick around. The verdict remains out, and we likely won’t know for some time. When it comes to positioning portfolios for the possibility of inflation, investors must plan for a range of scenarios. We have advocated doing this by including some exposure to asset classes like infrastructure, which are historically well positioned to absorb the effects of rising price levels. Infrastructure has typically outperformed broad-based equities during inflationary periods.

So far this year, we have seen a significant performance dispersion within the infrastructure asset class, with economically sensitive sectors outpacing the passenger-focused and utilities sectors, in part due to the reflation trade that has dominated over the last several months.

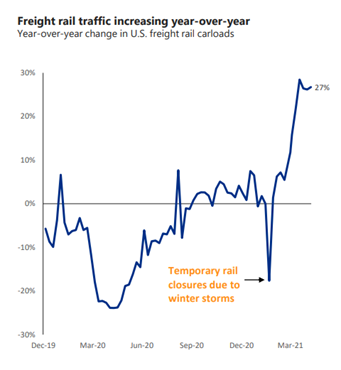

While the reflation trade remains a powerful driver of performance and is likely to continue, for some infrastructure sectors like freight rails, airports, telecom towers, and utilities, infrastructure remains attractive even outside the reflation story.

This is true especially in North America, which has seen a strong outlook for freight rail volumes and increasing air passenger volume growth. Moreover, this asset class is likely to be further supported by both attractive valuations and the prospect of a bipartisan infrastructure spending bill.

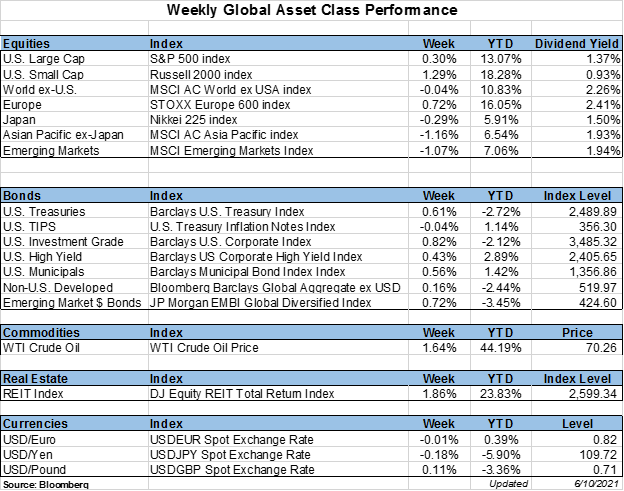

Weekly Global Asset Class Performance

10 Most Asked Tax Questions so Far in 2021

Written by Scott Bishop, MBA, CPA/PFS, CFP®

At Avidian Wealth, we hear from our clients frequently about pending tax law changes. If you have followed my articles over the years, you know that I often write about taxes and their impact on your estate, retirement and overall financial planning; several of these articles are referenced at the end of this piece.

With all the tax law changes we are considering as “pay for’s,” and in terms of having Americans “Pay their Fair Share,” we receive many calls from clients asking, “What should we do?” At this point, there is no immutable law and no solid guidance as to what will pass and when any changes will be effective, but we believe it is helpful to share some of our recommendations based on the ten most asked questions that we hear. But of course, before taking any action, please check with your tax and financial planning team!

Click Here to Read the Entire Article

Estate Tax Law and Strategy Changes are Coming

Written by Scott Bishop, MBA, CPA/PFS, CFP®

At Avidian, we hear from our clients frequently about the pending tax law changes. If you have followed my articles over the years, you know that I often write about taxes and their impact on your estate, retirement, and overall financial planning – several of the articles are referenced at the end of this piece.

Currently, many tax changes are being considered that will change the estate and gift tax exemption amounts (the amount you can exclude from estate taxes at your death or during lifetime gifting), the tax rate, and the possibility of the government legislatively ending many of the strategies we have used for decades (that have been approved by the IRS and/or through tax court cases). For more information on these specific issues, I have discussed many of these changes in previous articles listed at the bottom of this article.

Click Here to Read the Entire Article

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*