Published on: 03/25/2022 • 7 min read

Avidian Report – Did You See What The Dallas Federal Reserve Energy Survey Just Said?

INSIDE THIS EDITION

Did You See What The Dallas Federal Reserve Energy Survey Just Said?

The Dallas Federal Reserve asks oil and gas firms located in the 11th Federal Reserve district a handful of questions every quarter to get a better idea of the state of energy activity. Earlier this week, the latest survey results were released on the Dallas Fed website, and we thought this would be a valuable report to review, especially considering the recent run-up in energy prices over the last several months.

Federal Reserve 11th District Map

The survey data was collected March 9-17 and included responses from 141 energy firms, with 91 being exploration and production companies and the remainder from oilfield service firms. At the time, WTI crude traded in a range of between $95.04 and $109.33.

Perhaps unsurprisingly, the survey showed exploration and production (E&P) activity accelerating during the first quarter as prices rose. The oil production index, which the Fed tracks quarterly, more than doubled from 19.1 to 45. During the same period, natural gas saw a rise, albeit less impressive, from 26 to 40. And the takeaway was clear, E&Ps now find themselves in a much more favorable operating environment.

Of course, it takes money to make money in oil and gas, so the cost side of the equation is also important. On the cost side of the equation, the survey showed that inflationary pressures have risen in the energy sector as they have for other industries. Costs paid by oilfield service firms rose for a 5th consecutive quarter. This last reading marked a new record high-cost index level going back to when the survey began to track cost components six years ago. More importantly, the uptick in cost appears to be flowing to nearly every firm surveyed, with only one of fifty firms polled reporting a reduction in input costs to production.

Overall, the survey showed encouraging signs for the energy sector with improvement across all major indicators, including equipment utilization, operating margins, and prices for services.

As E&P companies and service companies see improving current conditions, it should be no surprise that the survey also produced favorable results related to the energy sector’s labor market. For example, during the first quarter, the survey showed growth in employment, hours, and wages for workers in the energy sector.

All of this, of course, is a backward-looking set of results that tells us very little about what survey respondents view as the path forward for the energy sector. As investors, this is what we care about. After all, investors typically value assets based on future cash flows and their future expectations. Luckily, the survey also asks several questions designed to capture the forward-looking sentiment.

In the pages that follow, we will see a series of forward-looking charts that cover everything from what survey respondents expect for WTI crude oil prices by year-end, how high oil prices must be to cover operating expenses fully, and how high oil prices will need to be to make the operation of new wells profitable.

A good starting point is the go-forward view of future oil prices, as this sets the stage for firms’ major decisions, including hiring, investments, and capital expenditures.

Here, we see that 138 oil and gas firms executives have wide-ranging views on where WTI crude oil prices will be by year-end. However, more than 2/3 of respondents expect crude oil to settle in a price range of between $80 and $100 per barrel. This is lower than today’s closing price of nearly $113 per barrel. However, more than 10% of executives believe oil prices will be above $120 by year-end.

Who is correct remains to be seen, but investors should not completely discount the chance that oil prices continue to move higher.

As many investors know, oil prices are important to producers because there is a certain oil price where operating expenses are fully covered, making these businesses wildly profitable. The following chart looks at different break-even points across various geographic regions and basins. From what the chart shows, E&Ps will need WTI spot prices to remain above $80 to support existing wells’ operating expenses in totality. Some wells may have better economics that allows for break-even operations with a lower oil price, but generally, $80+ looks to be the point of maximization.

However, the economics of existing wells are quite different from the economics of new wells. More up-front costs need to be covered, which operators must consider. In fact, at a WTI spot price above $80 per barrel, several survey respondents still indicate difficulty achieving profitability on some new wells. This is especially true of new wells in regions outside the Eagle Ford and Permian basins. Some wells require oil prices above $140 per barrel to support the profitable drilling of new wells. Although we aren’t quite there yet, we may be getting closer to a trend that could continue if sanctions on Russian oil continue and if underinvestment persists into the future.

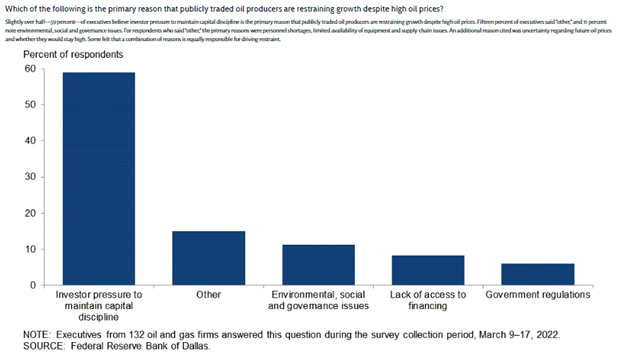

And this brings us to another important insight, which is why underinvestment continues to plague the industry. Here we see that the biggest driver of underinvestment that restrains growth is investor pressure to maintain capital discipline. This is very different from what some believe is largely driven by ESG mandates or lack of financing.

Could it be that rising oil prices may finally lead investors to deemphasize maintaining capital discipline? Although it is possible, we aren’t sure that happens soon and likely sets the stage for continued underinvestment that could lengthen the current oil price regime.

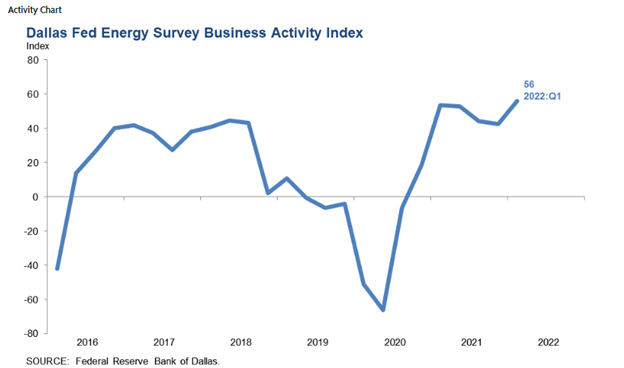

If the regime continues, we expect business activity measured by the Fed’s Energy Survey Activity Index to continue rising over the next quarter or two, even beyond the 6-year high we just saw.

However, this must also be balanced with an acknowledgment that volatility in the sector is always high, and tail risks from geopolitical events are always present and can rapidly shift sentiment.

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*