Published on: 12/04/2020 • 7 min read

Avidian Report – Disruptive Technology and Profitability Trends that Investors Should Be Aware Of

INSIDE THIS EDITION:

Disruptive Technology and Profitability Trends that Investors Should Be Aware Of

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Coronavirus / COVID-19 Resource Center

For this week’s commentary we are going to discuss the second of five major trends that we believe investors should be watching as we move into 2021.

[toggle title=’Read More’]

As we mentioned in the last weekly market report, this is important for investors because from these trends we may be able to find answers to the question “how should we be positioned from a strategic asset allocation standpoint?”

For investors’ financial outcomes, we believe being exposed to the correct long-term secular trends that ultimately determine success for portfolios. Take for example what occurred in the last business cycle when US treasuries and technology shares drove much of the returns in fixed income and equities. Not being exposed to those trends had a high probability of leaving an investor trailing the performance of broad indices.

As we mentioned in the last report, it is an especially fitting time to do this because we now have the US election largely behind us, progress on potential vaccines for COVID-19 being made, and some of the short-term noise that drove market volatility calming down.

The second trend we will discuss in this series is disruptive technology and the implications it has on productivity, scalability, and profitability. This secular trend is more encouraging than the trend we discussed last week, slowing population growth and aging demographics at least as far as GDP goes. As a reminder, GDP is driven by the number of workers and their productivity. As you might imagine, if technology drives productivity significantly higher, it may be able to fully offset a shrinking working age population.

Back in 2017, we published a weekly market report and included the chart below. Back then we made the assertion that data was quickly becoming the new oil. Consider for one moment that back in 2010, 6 oil companies and 2 technology were ranked amongst the top 10 most valuable companies by market capitalization in the world. By 2017, the ratio virtually flipped with 6 technology companies and only 1 oil company in the top 10 most valuable by market capitalization. As Clive Humby, a data entrepreneur, once explained “data is just like crude. It is valuable, but if unrefined it cannot really be used. It has to be changed into gas, plastic, chemicals, etc., to create a valuable entity that drives profitable activity; so, must data be broken down and analyzed for it to have value.”.

As the chart below indicates, globalization appears to have peaked, and at the same time we are seeing a huge explosion in the global flow of data. This is associated with the change in market leadership that we cited above and that is also depicted in the previous chart.

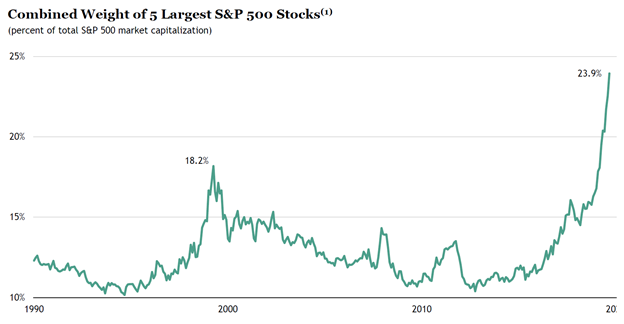

If we fast forward to today, and we see that the concentration of technology companies within the S&P 500 has only increased. As the chart below shows, the combined weight of the 5 largest S&P 500 stocks (Facebook, Apple, Amazon, Netflix, Alphabet (formerly known as Google)) is approaching 24%. Naturally, this has some investors concerned because it represents concentration not seen since the tech bubble in the early 2000s.

However, we think these concerns may be overblown for a couple of reasons. First, because these companies qualify as platform technology companies that take advantage of network effects. If you think about Facebook, the social network where you go to connect with your friends. Since your friends are on that social network rather than another, the likelihood you switch is low. The same holds true with Apple and the others, where the existing ecosystem keeps customers more fully engaged across devices and less likely to make a change. This causes many of these companies to have monopoly-like qualities that also make for a winner take all competitive landscape.

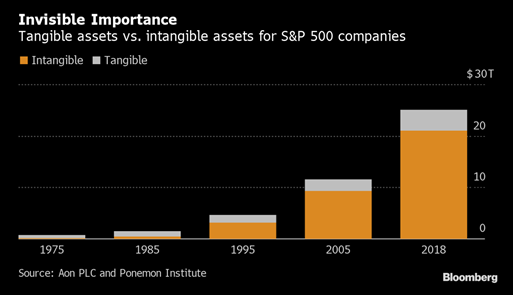

Second, these companies take advantage of asset light business models. In other words, they are highly successful because of assets that cannot be seen or touched. We can think about patents or trade secrets as examples of these intangible assets. And we believe the trend in asset light business models has only increased as represented by an increasing share within the S&P 500 over time.

As you can imagine this has major investment implications. Take for example, the chart below which shows that it is these asset light businesses that have performed best relative to their non-asset light S&P 500 peers.

What this tells us is that we are now very much in a global digital economy with the last 9 years showing global GDP growth at 3% while the global digital growth has far outpaced that figure with an 8% compound annual growth rate (CAGR). This is important because this digital ecosystem is the area where profit margins are healthiest and sets the stage for the trends we see with technology, profitability, and scalability to only gather steam.

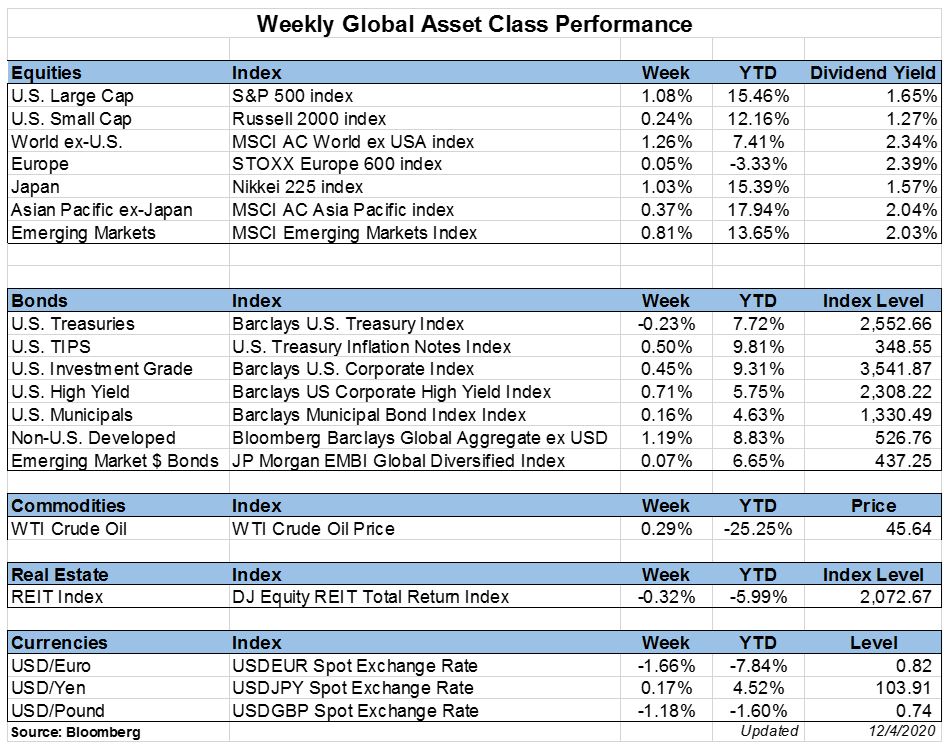

Weekly Global Asset Class Performance

[/toggle]

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

There is no question that 2020 has been a year that everyone just wants to put behind them and hope for a brighter 2021. But before you start thinking about 2021, do not forget about your 2020 year-end tax and financial planning because there are still opportunities and strategies to consider, at least from a planning perspective, to take advantage of before year-end.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*