Published on: 01/29/2021 • 5 min read

Avidian Report – Do Not Forget the Importance of Rebalancing

INSIDE THIS EDITION:

Do Not Forget the Importance of Rebalancing

Coronavirus / COVID-19 Resource Center

Despite lingering economic concerns as COVID-19 continues, global stocks continue to do surprisingly well. This has been a continuation of what we have seen over the last decade with rising stock prices.

[toggle title=’Read More’]

As markets have risen, stock portfolios have risen in value, and have led investors to cheer. However, it is important to realize that with stocks at elevated levels, it means that overall asset allocations may be far from the target. To illustrate, let’s start with a 50/50 stock and bond portfolio. Let’s assume during a given period, that stocks return 30% while bonds return 3%. At the end of the period, a 50/50 portfolio would have drifted to an allocation of 56/44. In other words, the portfolio’s target 50/50 allocation would now be overallocated to stocks and under-allocated to bonds and may lead to a portfolio with a risk profile higher than intended.

The solution to prevent this from happening is rebalancing. This is where an investor systematically sells a portion of his or her portfolio’s best performers down to a target weight and buys the securities that have lagged to a target weight. This can be done from time to time, either on a predetermined schedule or on an as-needed basis to achieve the goal – to keep risk levels in line with an investor’s risk tolerance level. While this is a prudent approach for all accounts, it is especially advantageous in qualified accounts. The reason is that systematic rebalancing in these accounts does not trigger unfavorable tax consequences.

Rebalancing in a traditional buy & hold portfolio

Morningstar ran an analysis of rebalancing in traditional buy & hold portfolios that show how a 60/40 balanced portfolio, allocated 45% to the S&P 500, 15% to the FTSE All-World ex-US Index and 40% to the Bloomberg Barclays U.S. Aggregate Bond Index would have seen it’s allocations changed over a 26 year period ranging from 1994 through the end of 2019.

During that time, a 60/40 portfolio would have seen stock exposure drift as high as 76% before declining during the first bear market of the 2000s. Again, stock exposure in a balanced 60/40 portfolio at the beginning of the period would have drifted to more than 70% during October of 2007. Surprisingly, both of these levels of stock exposure is still lower than the 80% stock exposure that a buy & hold investor with a 60/40 balanced portfolio at the beginning of the study in 1994 would have today.

The implications might yet be unclear. So let’s focus on what would have happened after those peaks in stock exposure for these buy & hold investors in 2000 and in 2008 just ahead of the last two recessions. Just as stock exposure peaked, recessions began and led these portfolios to experience larger drawdowns than that experienced by an investor that rebalanced portfolios annually.

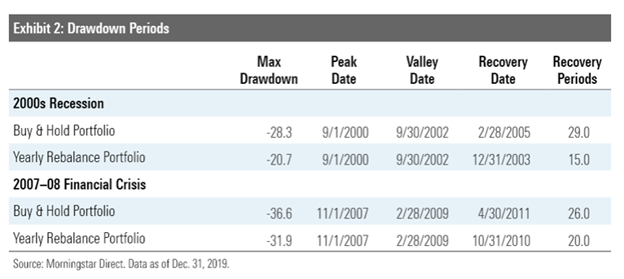

The table that follows breaks the data down nicely and we make a couple of observations. First, the max drawdown for the annually rebalanced balanced portfolio would have been smaller than the un-rebalanced buy & hold the portfolio in both instances. Second, the time it took to fully recover from the maximum drawdown was also diminished by a great degree.

What is more shocking is that this occurred in a controlled environment free of the emotional biases that often make investors sell near the bottom of drawdowns and make it very difficult to re-risk portfolios as markets recover. This emotional shortcoming would lead to worse overall performance during these periods and a much longer recovery period than the table above shows.

It becomes very clear from this study that rebalancing is important. The question then becomes, how often should an investor rebalance to maximize the benefits. Morningstar again did a lot of the heavy lifting to answer this question. They created 6 different 60/40 portfolios and rebalanced each one of them using a different frequency – daily, monthly, quarterly, semiannually, yearly, and whenever the stock and bond mix drifted from the target by 5%.

The table below shows the impact of rebalancing at different frequencies and the returns over 1-, 3-, 5-, 10- and 15-year time horizons. From a return perspective, the buy and hold portfolio won out, outperforming the rebalanced portfolios over each of the holding periods studied. However, for an investor, while absolute performance is good, if it is achieved by taking an undue risk (volatility) then it is not that great.

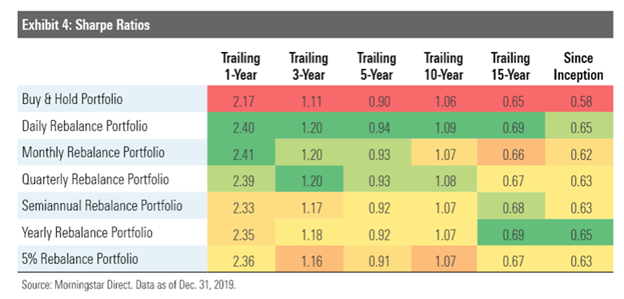

It is for that reason that investors measure their returns on a risk-adjusted basis. This can be done using Sharpe ratios. The way to interpret Sharpe ratios is that the higher the Sharpe ratio the better the risk-adjusted returns.

In the table below, what we see is that all the rebalancing frequencies studied to do a better job than a traditional buy & hold approach. For shorter holding periods, then monthly or quarterly rebalancing do quite well on a risk-adjusted return basis. However, if the holding period is long, like 15-years, then the best approach is to rebalance annually.

Of course, in the age of Coronavirus, many investors may be wondering if the playbook for rebalancing should change. In our view, it should not. In fact, with so many asset classes performing well in 2020, despite COVID-19, it is likely that weightings in portfolios have drifted far from the target during the last 12 months. To make sure that investors aren’t taking undue risks, we urge a rebalance as it is a highly effective tool investors can use to keep risk and return objectives aligned.

Weekly Global Asset Class Performance

[/toggle]

The team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*