Published on: 02/01/2020 • 6 min read

Avidian Report – Don’t Forget the Importance of Rebalancing

INSIDE THIS EDITION:

Don’t Forget the Importance of Rebalancing

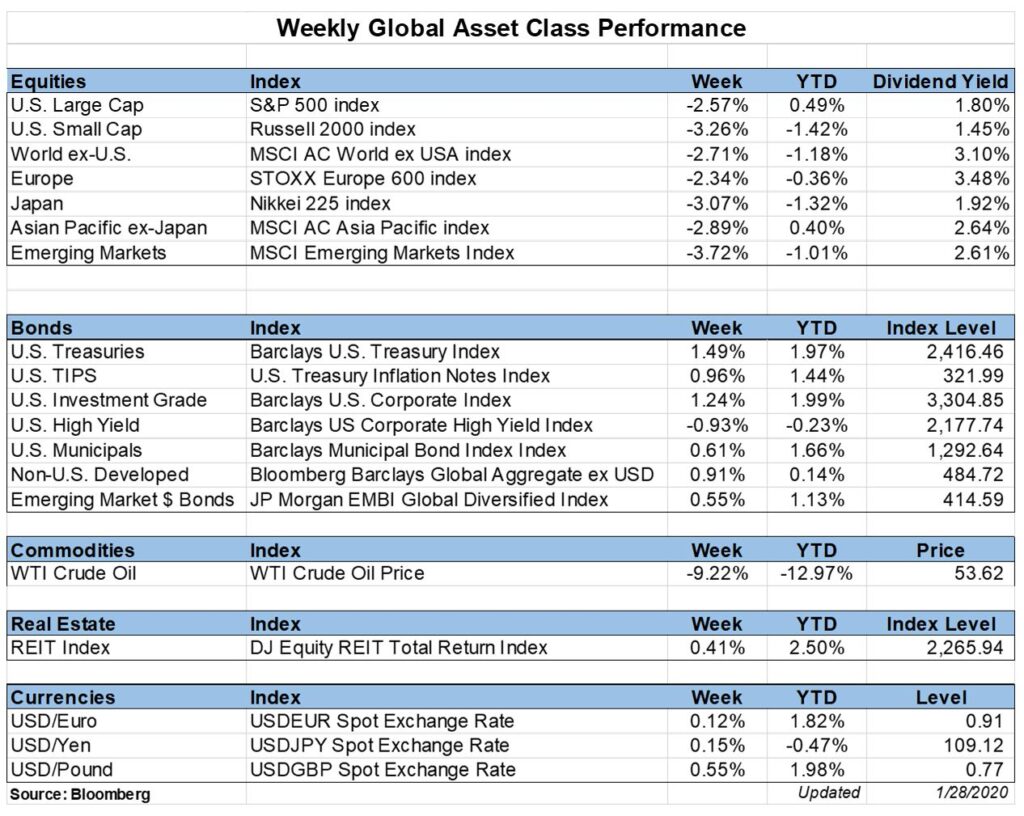

Weekly Snapshot of Global Asset Class Performance

Upcoming Event: 2020 M&A Insight

Financial Planning Goals for 2020

401k Plan Manager

Despite challenges like trade tensions and coronavirus fears, global stocks continue to do surprisingly well. The grind higher for stocks has been a continuation of what we have seen over the bull market that has now spanned a decade.

[toggle title=’Read More’]

As markets have risen, stock portfolios have risen in value, and have led investors to cheer. However, it is important to realize that with stocks at elevated levels, it means that overall asset allocations may be far from the target. To illustrate, let’s start with a 50/50 stock and bond portfolio. Let’s assume during a given period, that stocks return 30% while bonds return 3%. At the end of the period, a 50/50 portfolio would have drifted to an allocation of 56/44. In other words, the portfolio’s target 50/50 allocation would now be overallocated to stocks and under-allocated to bonds and may lead to a portfolio with a risk profile higher than intended.

The solution to prevent this from happening is rebalancing. This is where an investor systematically sells a portion of his or her portfolio’s best performers down to a target weight and buys the securities that have lagged to a target weight. This can be done from time to time, either on a predetermined schedule or on an as-needed basis to achieve the goal – to keep risk levels in line with an investor’s risk tolerance level. While this is a prudent approach for all accounts, it is especially advantageous in qualified accounts. The reason is that systematic rebalancing in these accounts does not trigger unfavorable tax consequences.

Rebalancing in a traditional buy & hold portfolio

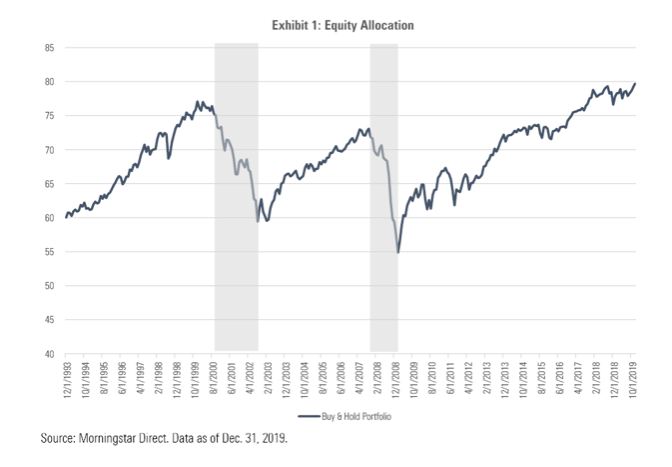

Morningstar recently ran an analysis of rebalancing in traditional buy & hold portfolios that shows how a 60/40 balanced portfolio, allocated 45% to the S&P 500, 15% to the FTSE All-World ex-US Index and 40% to the Bloomberg Barclays U.S. Aggregate Bond Index would have seen it’s allocations changed over a 26 year period ranging from 1994 through the end of 2019.

During that time, a 60/40 portfolio would have seen stock exposure drift as high as 76% before declining during the first bear market of the 2000s. Again, stock exposure in a balanced 60/40 portfolio at the beginning of the period would have drifted to more than 70% during October of 2007. Surprisingly, both of these levels of stock exposure is still lower than the 80% stock exposure that a buy & hold investor with a 60/40 balanced portfolio at the beginning of the study in 1994 would have today.

The implications might yet be unclear. So let’s focus on what would have happened after those peaks in stock exposure for these buy & hold investors in 2000 and in 2008 just ahead of the last two recessions. Just as stock exposure peaked, recessions began and led these portfolios to experience larger drawdowns than that experienced by an investor that rebalanced portfolios annually.

The table that follows breaks the data down nicely and we make a couple of observations. First, the max drawdown for the annually rebalanced balanced portfolio would have been smaller than the un-rebalanced buy & hold the portfolio in both instances. Second, the time it took to fully recover from the maximum drawdown was also diminished by a great degree.

What is more shocking is that this occurred in a controlled environment free of the emotional biases that often make investors sell near the bottom of drawdowns and make it very difficult to re-risk portfolios as markets recover. This emotional shortcoming would lead to worse overall performance during these periods and a much longer recovery period than the table above shows.

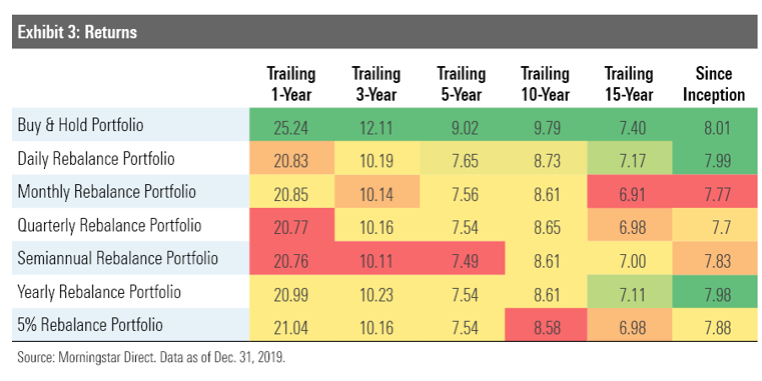

It becomes very clear from this study that rebalancing is important. The question then becomes, how often should an investor rebalance to maximize the benefits. Morningstar again did a lot of the heavy lifting to answer this question. They created 6 different 60/40 portfolios and rebalanced each one of them using a different frequency – daily, monthly, quarterly, semiannually, yearly, and whenever the stock and bond mix drifted from the target by 5%.

The table below shows the impact of rebalancing at different frequencies and the returns over 1-, 3-, 5-, 10- and 15-year time horizons. From a return perspective, the buy and hold portfolio won out, outperforming the rebalanced portfolios over each of the holding periods studied. However, for an investor, while absolute performance is good, if it is achieved by taking an undue risk (volatility) then it is not that great.

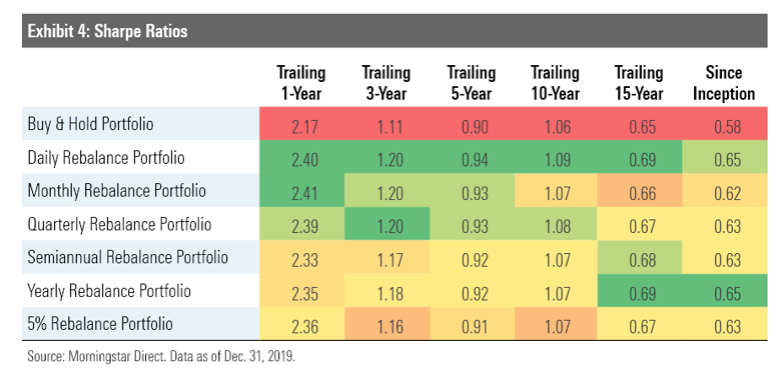

It is for that reason that investors measure their returns on a risk-adjusted basis. This can be done using Sharpe ratios. The way to interpret Sharpe ratios is that the higher the Sharpe ratio the better the risk-adjusted returns.

In the table below, what we see is that all the rebalancing frequencies studied to do a better job than a traditional buy & hold approach. For shorter holding periods, then monthly or quarterly rebalancing do quite well on a risk-adjusted return basis. However, if the holding period is long, like 15-years, then the best approach is to rebalance annually.

[/toggle]

2020 M&A Insight – Upcoming Event

What to Expect in the Year Ahead

February 26, 2020 | Vic & Anthony’s Steakhouse

Click Here to Register

Financial Planning Goals for 2020

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Carter Blackburn

The beginning of each year presents a unique opportunity to self-reflect about whether your Financial Plan is on track. Many of us set “New Years Resolutions” with no true actionable goal or follow-through. Remember a goal without a plan is just a wish!

With that in mind, especially given recent tax law changes and the passage of the retirement SECURE Act, now is an excellent time to review your plan to see if you are on track to meet your short and long-term goals. Below are some important areas which you should contemplate and plan before we get too far into the year.

Read Full Article Here

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*