Published on: 02/14/2020 • 6 min read

Avidian Report – Economic Impact of Coronavirus – Large but Temporary?

INSIDE THIS EDITION:

Economic Impact of Coronavirus – Large but Temporary?

Weekly Snapshot of Global Asset Class Performance

Upcoming Event: 2020 M&A Insight

Financial Planning Goals for 2020

401k Plan Manager

Despite many people possibly reaching peak levels of fear and fatigue as it relates to Coronavirus related news, we thought this would be a good time to visit the economic impact on the Chinese economy.

[toggle title=’Read More’]

This is especially important for investors as the Chinese economy currently represents a large part of global GDP. In fact, as of 2018, China accounted for 15.4% of the world economy compared to the United States’ 24.4%, but that percentage has only grown since then. It is for that reason that often times economists say that if China sneezes the whole world can catch a cold. So the question is what happens when the China catches the flu, or in this case the Coronavirus?

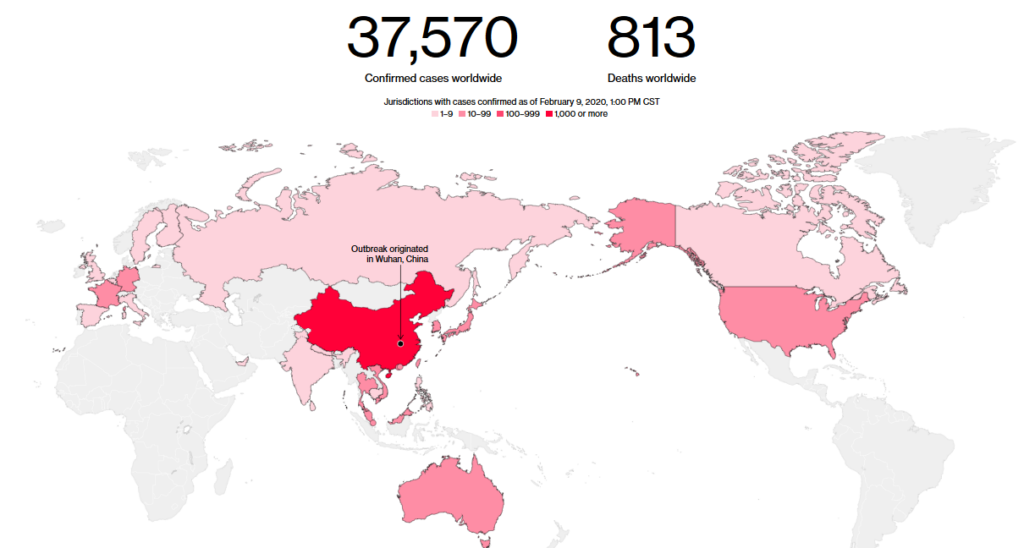

Despite the emergence of the Coronavirus as a threat to world health and the global economy, it has to date had the biggest impact on China.

As of mid-day on February 9th, nearly 40,000 people had contracted the Coronavirus across the globe, with the vast majority of confirmed cases being in mainland China.

With the number of cases in the tens of thousands in China, it has put a strain on their healthcare system while wreaking havoc on Chinese business. And it is no wonder because as the spread of the virus intensified over the last month and a half, China’s government instituted what amounted to mandatory closures of its cities. Wuhan, the epicenter of the outbreak has a population of 11M people – nearly 2M people more than New York City. For some context, imagine if New York City closed its doors and forced its residents and visitors to stay in their dwellings for not only days but rather weeks.

Obviously, this would be expected to cause a drop off in manufacturing activity, consumer spending, airline travel, and world energy demand.

The charts that follow show what the mandatory lockdowns of major cities have done to domestic air travel in China. All these cities saw travel demand fall off a cliff during the last week of January. How much does this hurt airlines in China? In short – it hurts a lot and may cost them a quarter, if not more, in earnings. Now imagine similar impacts on manufacturing and consumer sectors. The impact is difficult to get one’s head around and has some investors pondering whether this will finally tip the world into recession or worse yet, a crisis of some kind.

In the grand scheme of things, we think these are possible outcomes. However, possible is very different from highly probable. In reality, we have seen other viruses historically crop up, and after a period of intense fear, get dealt with effectively, thus allowing the economy to continue ahead. We think about the positive market performance we saw following the SARS outbreak in the early 2000s as an example and can’t help but feel optimistic. However, we also are keenly aware that markets can always surprise us. For that reason, we must as investors maintain a probabilistic view of possible outcomes. How it all plays out nobody knows for certain.

What we do know is that China is doing all it can from an economic perspective to keep markets afloat as the world grapples with a very complicated health situation. A couple of weeks ago, we mentioned the increasing likelihood that China announces unprecedented stimulus to get the world economy restarted. Almost on cue, the People’s Bank of China announced they would inject $173B into the economy via reverse repurchase agreements intended to ensure that there is ample liquidity in the system. In layman’s terms, a reverse repurchase agreement is the purchase of securities with an agreement to sell them at a higher price at a pre-determined future date. To us, it sure sounded like the Chinese central bank was signaling to the world that they would do all that was necessary to keep the economy on track. Over the weekend the Chinese central bank also announced they would provide the first batch of re-lending funds to nine major national banks and several local banks as they hope that this action will help businesses get shored up as they work through multi-week shut-downs across China. Moreover, if recently released Coronavirus models prove to be correct, these actions may coincide with the peak of the virus in Wuhan, where the most cases have originated in what could ultimately be a very positive development for the world and its equity markets.

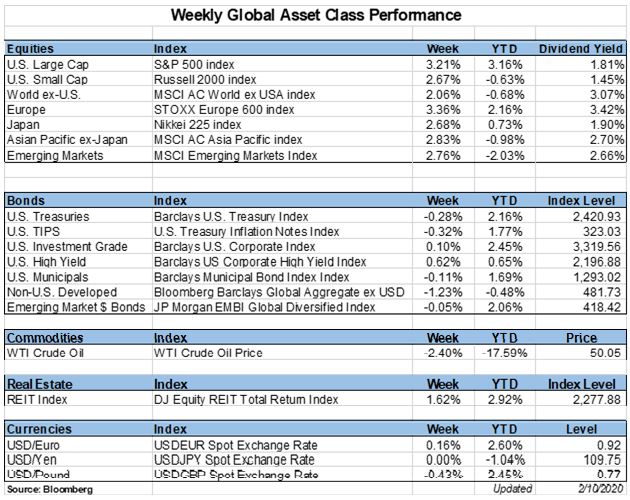

Weekly Global Asset Class Performance

[/toggle]

2020 M&A Insight – Upcoming Event

What to Expect in the Year Ahead

February 26, 2020 | Vic & Anthony’s Steakhouse

Click Here to Register

Financial Planning Goals for 2020

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Carter Blackburn

The beginning of each year presents a unique opportunity to self-reflect about whether your Financial Plan is on track. Many of us set “New Years Resolutions” with no true actionable goal or follow-through. Remember a goal without a plan is just a wish!

With that in mind, especially given recent tax law changes and the passage of the retirement SECURE Act, now is an excellent time to review your plan to see if you are on track to meet your short and long-term goals. Below are some important areas which you should contemplate and plan before we get too far into the year.

Read Full Article Here

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*