Published on: 12/03/2021 • 7 min read

Avidian Report – Economic Indicator Update

INSIDE THIS EDITION:

The Conference Board is a non-partisan non-profit research organization that helps deliver useful data and insights on the economy. Today, we review some of the most recent data collected by The Conference Board that we think does a good job framing how the US economy is doing as we close out the year. More specifically, our focus will be on consumer and business confidence measures and employment data which in many ways help fuel economic activity.

Confidence

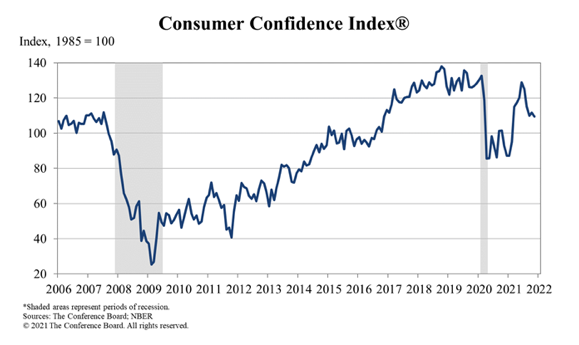

One report that The Conference Board releases each month is the Consumer Confidence Survey®. It is designed to collect data that provide insight into business conditions and how they may impact the economy over time.

The latest release of The Consumer Confidence Survey in November showed a decrease to 109.5 after rising in October to a level of 111.6. This latest downtick coincides with the November decline of the Present Situation Index which measures current business and economic conditions. We would consider the decline on both measures a moderation which has done little to negatively impact expectations for short-term growth. Unsurprisingly, data collected in the survey did indicate increasing consumer concern over rising prices which may pose some economic headwinds should the outlook for income, business activity, and labor market conditions decline meaningfully. For now, we don’t see anything that would cause us concern but do note that consumers’ views of current business conditions this month are less favorable than they were last month and with concern over a new COVID variant rising over the last few days, it is a risk that consumer confidence further recedes. The good news is that the slight decline in consumer confidence during the month of November was accompanied by more favorable views of the labor market. In fact, 58% of consumers reported that jobs are “plentiful”.

What about what we might expect moving ahead over the next six months? Luckily the survey provides insight there as well, at least as it relates to six-month expectations.

Looking at this data, we see that 24.1% of consumers expect business conditions to improve over the next 6 months. This is an increase from 22.7% last month. At the same time, we have a smaller percentage of consumers expecting that business conditions will worsen. At the same time, consumers were less optimistic about the short-term labor market outlook. We think this may simply be a moderation from elevated expectations rather than a complete sense of gloom over the short-term labor market. As we might expect, because of this slightly less exuberant set of short-term labor market expectations, it also appears that more consumers are expecting a decrease in income which coincides with marginally less optimism over their short-term financial prospects.

These insights are captured by the chart below which shows both the Present Situation Index (Blue line) and the Expectations Index (Orange line).

Of course, we would be remiss to only focus on consumers. After all, companies make their decisions with an eye on general economic conditions. To get a gauge of how corporate leaders are feeling about the economy, The Conference Board takes a survey of company CEOs.

What the November survey shows were that during the third quarter, CEOs overall assessment of general economic conditions declined. In fact, the survey showed 70% of CEOs showing better economic conditions compared to six months ago which represents a sharp decrease from the 94% that felt more positive about economic conditions in the second quarter.

When asked about how they saw conditions in their own industries, we saw a similarly sharp decline in positivity with 64% of CEOs reporting better conditions versus six months ago. In the prior survey, 89% of CEO respondents felt their industries were better than the prior 6 months. In our view, this may simply reflect less fiscal and monetary support and slowly rising uncertainty about inflation and knock-on effects on margins. It is no wonder that 9% of CEOs expect short-term economic conditions to worsen over the next 6 months.

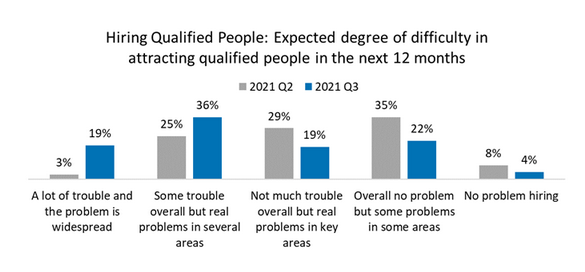

The last note on the survey of expectations we want to make is that across four key measures related to employment, hiring qualified people, wages, and capital spending, over the next 12 months, we saw increases. We think this reflects the overall view that the short-term is slightly more uncertain but long-term consumers and employers continue to believe in the resilience of the post-COVID economy.

Employment Trends

We briefly touched on employment trends above, but we think this data set captured in The Conference Board Employment Trends Index™ (ETI) is especially worth considering. For some background, The Employment Trends Index is a leading composite index for employment. That is why the red line in the chart below follows the trajectory of the blue line with a bit of a lag.

The Employment Trends Index aggregates eight leading indicators of employment, each of which has proven accurate in its own area. Namely, they are the percentage of respondents who say they find jobs hard to get, initial claims for unemployment insurance, percentage of firms with positions not able to fill right now, number of employees hired by temporary-help industries, ratio of involuntary part-time workers to all part-time workers, the number of job openings as tracked by the Bureau of Labor Statistics, Industrial production, and real manufacturing and trade sales. The data is aggregated into the composite index which helps filter out noise to show underlying employment trends more clearly.

It is also worth noting that whenever we see turning points in the index, it serves as an indication that the number of jobs is likely to experience a turning point in the coming months.

Currently, the index is at 112.23, a sharp rise from both September and October. This tells us that employment trends are likely to continue showing improvement over the coming months as spending continues to push higher toward pre-pandemic levels.

As a result of the data, The Conference Board expects the unemployment rate to drop below 4% over the next 6 months. This compares to the low before the pandemic of 3.5%. Further, they foresee labor shortage issues having durability with commensurate wage pressures also remaining stickier.

That said, we think a portion of this is likely to come from the lower end of the wage spectrum as a continuation of what we have seen since the beginning of the year. As services began to reopen their doors to in-person operations, blue-collar and manual service occupations saw a sharp increase in demand. They remain elevated today and with pent-up demand still working through the employment data, we believe recruiting difficulties and wage pressures are likely to continue into early 2022.

Source: The Conference Board

However, we don’t think it’ll all come from the low end of the labor force. Especially as 74% of CEOs are reporting some problems hiring qualified workers.

Source: The Conference Board

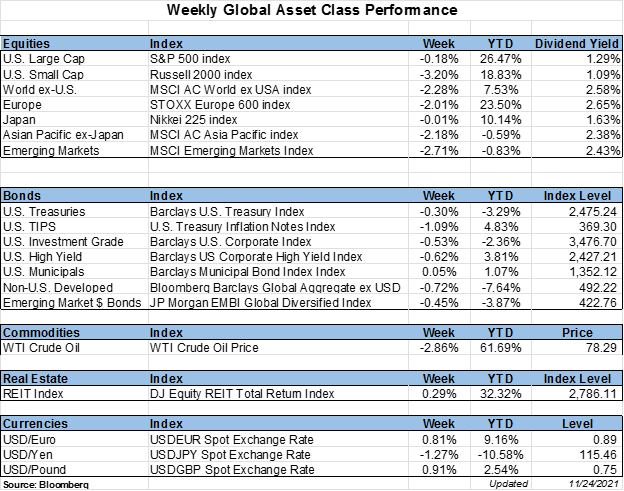

For investors, we think this looks rather inflationary. So while we don’t expect a hyper-inflation scenario to play out, we do think in the short- to intermediate-term having some inflation-protected assets makes sense. Although inflation pressures have been rising, it may not be too late to layer them into a portfolio in case inflationary pressures stick around a bit longer.

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*