Published on: 03/11/2022 • 5 min read

Avidian Report – Could Commodities Stay This Hot for Long?

INSIDE THIS EDITION

Could Commodities Stay This Hot for Long?

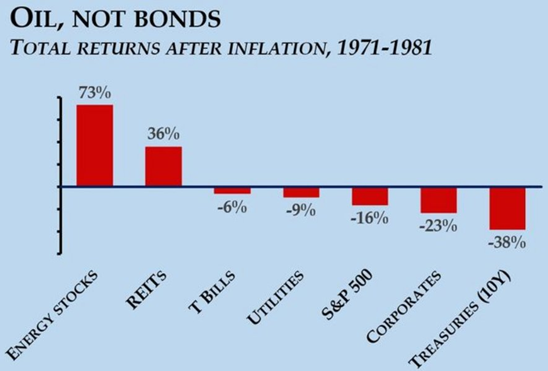

The asset class performance in the 1970s largely tracked what we see in the chart below, with Commodities leading the way with a 73% total return.

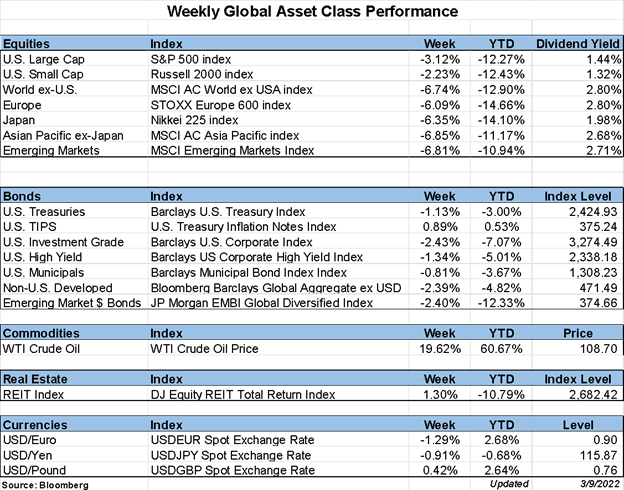

This time around, commodity prices have also been rising, with copper, nickel, oil, and natural gas all posting impressive price rises as sanctions and supply/demand imbalances factor into pricing. A couple of days ago, nickel went parabolic as it experienced a short squeeze. While this moment in time may support some commodities, we must also acknowledge that the world is also drastically different than it was in the 1970s.

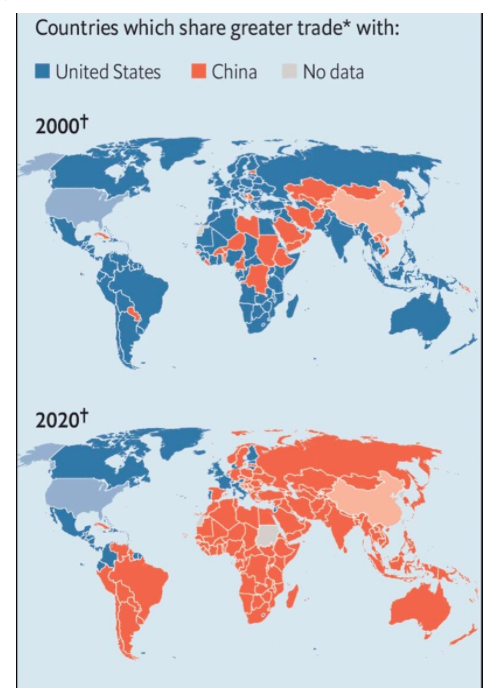

China now makes up a larger percentage of world GDP and global trade. The shift has intensified even in the last 20 years as more countries now share greater trade with China.

Demographics have also shifted, resulting in some meaningful changes in consumption patterns and demand drivers. Take, for example, the deceleration in growth of the working-age population over the last several decades. As the chart below shows, there appears to be some correlation between this growth rate and the US Treasury Term Premium declining.

For those unfamiliar, the Term Premium is simply the difference between what you get for locking up money for long periods and what you would get if you were to merely roll that cash into short-term instruments over the same time frame. While not apparent on the surface, this has significantly impacted how money flows through the economy.

Regardless, we are at an interesting junction in history with considerable uncertainty and the need for investors to position portfolios to weather a range of potential outcomes. One potential outcome is that commodity prices remain elevated and rise even further beyond current levels, and the federal reserve hikes rates aggressively to try to contain those inflationary forces, and then drives risk-assets outside of commodities lower. The Federal Reserve is being forced to grapple with this today, and there are no easy answers. A lot will hinge on how the Ukraine/Russia conflict evolves.

It appears there is growing polarity between investors that believe commodities will continue to move higher and those that believe this recent rise is a short-term phenomenon that might reverse. A valid case can be made in defense of both camps at present. That said, investors should consider whether commodity exposure makes sense as a hedge against a more inflationary outcome.

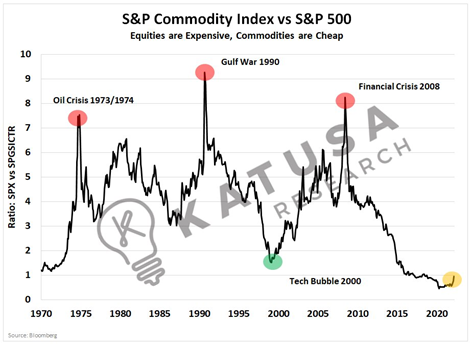

Valuations certainly appear to support a more constructive view of commodities than we have had in a long time, with the S&P Commodity Index to S&P 500 ratio at its lowest level since the early 2000s.

Back then, we had the tech bubble and set off a period of relative outperformance for commodities over the broad S&P 500, which lasted until the financial crisis in 2008. Today, we could be set up for a reversion to the mean for commodity valuations and make commodities an attractive place to put some capital.

However, investors may fear doing so as commodities have already run higher over the last several weeks, and the broad market is notably bearish, with the Fear & Greed Index showing extreme fear.

Unfortunately for investors, often the best course of action is the one that feels scariest and most uncertain. To determine what is right for your situation, we encourage leaning on financial planning, diversification, and risk management.

The macroeconomic environment has gotten considerably more complex in 2022 than it has been over the last couple of years, and using these tools can ensure that you make better decisions moving forward. With an inflection likely ahead, either up or down, now is the time to make sure you don’t miss the opportunities that likely await the prepared investor as a chaotic macroeconomic and geopolitical environment becomes less so.

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*