Published on: 03/04/2022 • 6 min read

Avidian Report – Escalating Conflict in Europe and Expectations for Inflation

INSIDE THIS EDITION

Escalating Conflict in Europe and Expectations for Inflation

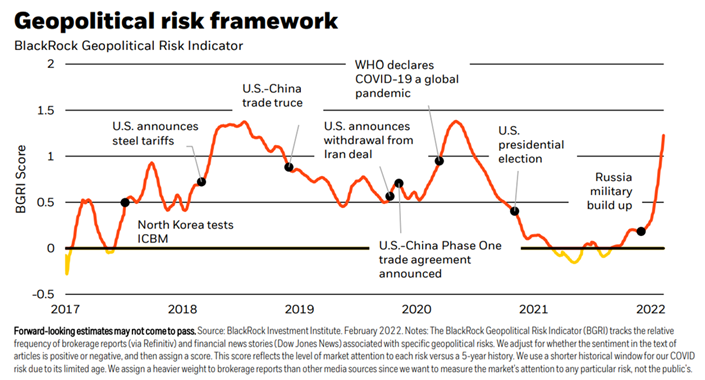

At present, the facts are that Ukraine and Russia are at war, sanctions have been levied, and market volatility has risen.

The obvious economic results of the conflict between Ukraine and Russia to date have been a sweeping cancelation of business tied to Russia, an exacerbation of supply chain issues, and a spike in oil prices to more than $100 per barrel. These facts will have a bearing on risk assets and the economy as we move forward, and as a result, we believe investors should revisit their expectations for 2022.

Possible Scenarios

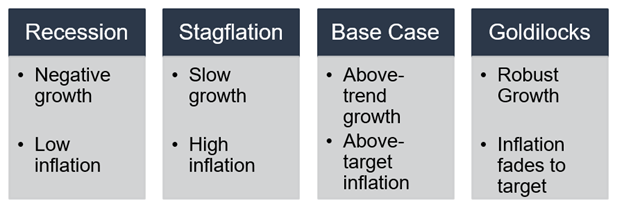

The probabilities of possible outcomes have shifted, primarily related to the impact of inflation on the global economy. The table below illustrates four possible outcomes we could face as we move through the remainder of the year. However, each outcome has a different likelihood of occurring, and we believe investors should position portfolios based on the probabilities they assign to each.

Source: Avidian Wealth Solutions

If inflation fades toward the 2% central bank target, we expect the Fed to remain in an accommodative policy stance for a longer time and to tighten financial conditions at a much more gradual pace. If, instead, inflation continues to rise aggressively and remains persistent, inflation might broaden to impact more goods and services and would likely result in a considerably more hawkish Federal Reserve. If this second scenario plays out and is combined with decelerating growth, then stagflation will become an issue for economists, policymakers, and investors to contend with. And if growth goes negative and inflation goes back toward, or below, trend, we could find ourselves in recession.

How do we see things developing from here?

First, we see a Goldilocks scenario developing less likely, especially if energy prices remain above $100 per barrel. While not quite a 0% chance, we don’t see it being a high probability outcome.

On the other hand, with the growing intensity of supply issues, labor shortages, and elevated energy prices, an aggressive Fed could tighten policy more rapidly than expected and anchor inflation expectations while slowing growth. Under this scenario, we would find ourselves in a stagflation environment. In this situation, we would expect a sharp rise in the policy rate and a revaluation of all financial assets down through a correction in the stock market. However, that does not mean there would be nowhere to hide. Instead, it means that outperformance of hard assets like gold, TIPS, and commodities might be expected. For the moment, this looks like a more probable scenario than the goldilocks scenario, but we are not prepared to say it is certain. More data still needs to be seen to support the stagflation path.

The last possible scenario is if the Fed is forced to take aggressive policy action to control inflation, commits a policy error, and sends economic growth into negative territory. In other words, a policy error that leads to recession. While we don’t believe we are likely to see that in the immediate future, the possibility is there, and investors should consider the risk, regardless of how small.

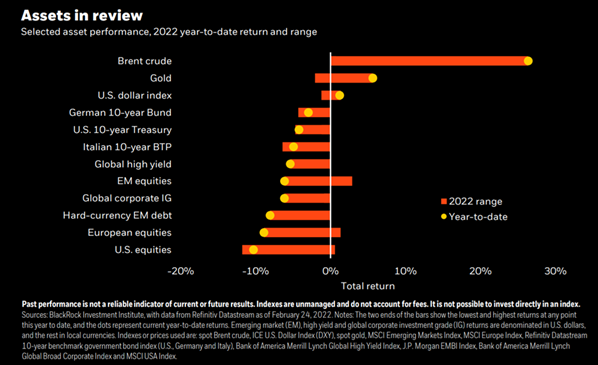

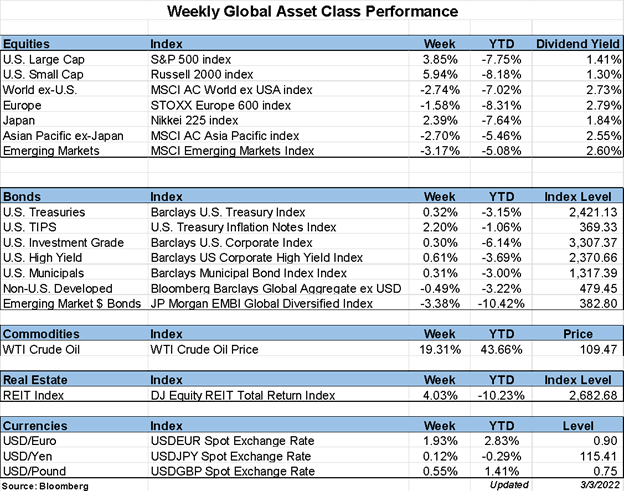

The chart below shows you year-to-date returns of major asset classes and reflects a difficult start to 2022.

As we mentioned earlier, under some of these scenarios, all financial assets from core bonds to high yield bonds, US equities, developing international equities, emerging market equities–everything you know would be impacted. But since we see an increase in stagflation risk at present, we must acknowledge that most major financial assets would likely experience negative returns under this scenario. The only real exceptions are crude oil-linked stocks which typically benefit from higher oil prices and gold. And the reality is that the rotation we have seen in markets over the last ten days or so as tensions ratcheted up reflects the rising risk of stagflation and investors’ positioning, albeit gradually for this type of return environment.

So how should investors manage their portfolios considering these developments?

Investors should consider time frames. In other words, they should consider both short-term and long-term perspectives.

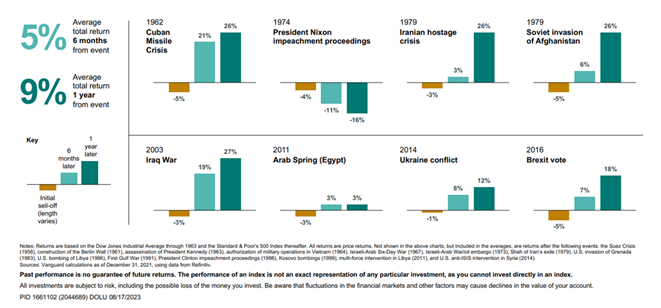

Investors should consider that historically, geopolitical shocks tend to be short-lived from a long-term perspective. Although we are not sure how this plays out in the near term, history tells us that after a geopolitical shock, returns during the following six- and twelve-month periods tend to be in line with long-term average returns. In more specific terms, stocks have generally returned about 5% in the six months following the event and 9% in the 12 months that follow.

The one exception was the 1974 impeachment of Richard Nixon when six months later, markets were down 11%, and one year later, markets were down 16%. However, there is sufficient data to conclude that in most cases, shocks happen, and then markets eventually begin looking forward more optimistically, leading to positively trending markets as uncertainty also dissipates.

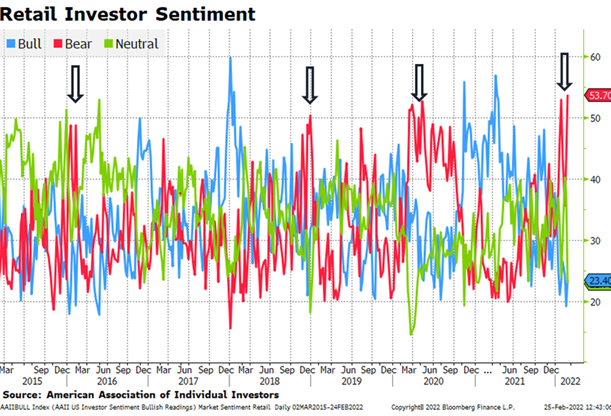

Of course, retail investor sentiment is extremely important and should be considered. Typically, sentiment that swings to extreme levels can be contrary indicators. With bearish sentiment at an extreme high right now, we believe this is a possible indicator that equity prices inflect high, and we see a recovery, especially if some geopolitical resolution comes about.

For now, investors should watch developments, keep an eye on new data, and remain nimble in their portfolio allocations. The situation in Ukraine and Russia is unprecedented in some ways, and as a result, the time-tested benefits of diversification should not be forgotten. Similarly, a risk management strategy takes greater importance at times like these. But it must also be said that volatile times also present a significant opportunity. During these times, tactical management can add incremental returns that can make big differences to overall investment performance over long time horizons.

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*