Published on: 11/05/2021 • 5 min read

Avidian Report – Fed Tapering Has Arrived

INSIDE THIS EDITION:

Fed tapering has arrived

The Fed met on Wednesday of this week, so we thought this would be an excellent time to discuss what has been happening in the treasury market, the Fed’s latest decision on tapering, and more importantly, what this means for investors and their portfolios.

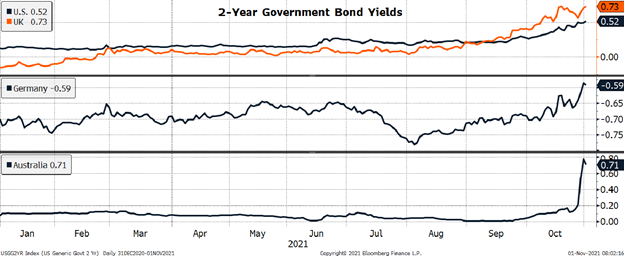

Source: Avidian Wealth Solutions, Bloomberg

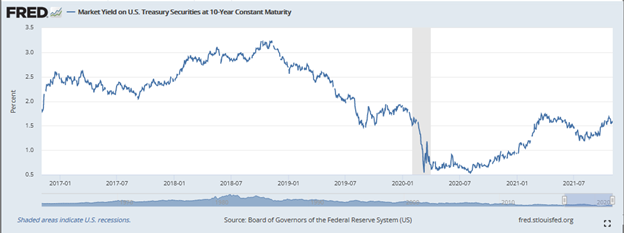

Before the Fed meeting, the 10-year US treasury had been range-bound at about 1.60%. With a corresponding flatter yield curve, it is entirely possible that we are facing a shorter business cycle than normal and quite possibly rising risks of the Federal Reserve making a policy mistake.

Unfortunately, it is nearly impossible to know whether policy mistakes are being made until the consequences of the Central Banks’ decisions become clearer. And that will take some time.

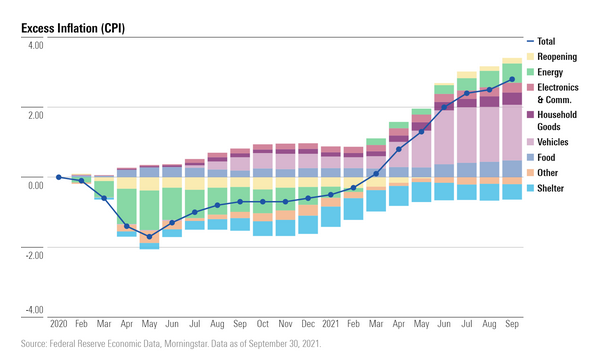

For now, we know that the Federal Reserve will begin slowing their asset purchases in a couple of weeks as they respond to rising inflationary pressures and a continuing economic revival after COVID.

As with the law of motion, every action has an equal and opposite reaction, and for the equity market, this was a non-event. We think this happened because of two main reasons. First, the amount of the decrease in asset purchases is relatively small at $15B. This still leaves the Fed able to purchase $105B worth of treasuries and mortgage-backed securities each month even after the policy announcement.

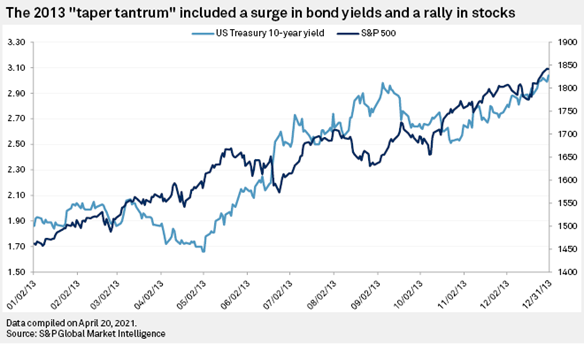

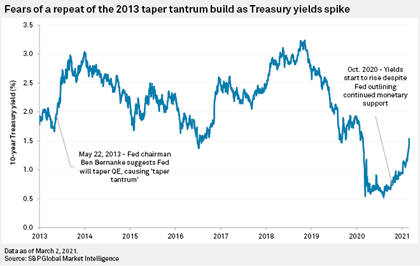

Second, because the Fed has done an exceptional job telegraphing the taper for many months, they have effectively avoided a taper tantrum as we saw in 2013.

With no major surprises, it is no wonder that the 10-year US treasury barely moved off 1.60% immediately following the announcement. This is perhaps because a rise in the 10-year treasury and the swap rates occurred in 2021 when investors started to think about future tapering.

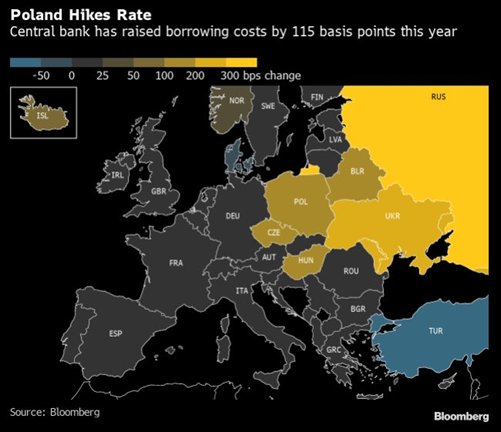

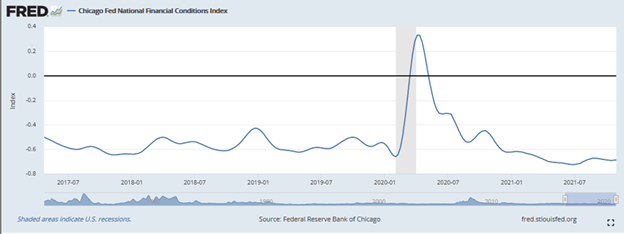

With rising inflationary pressures and less accommodation from global central banks now occurring, we might expect the emergence of tighter financial conditions. However, that has not happened. Not yet anyway.

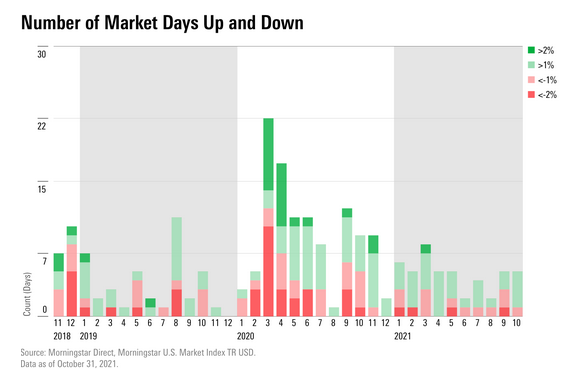

The likely passage of two infrastructure bills ahead, a good start to Q3 earnings season with limited margin compression in sectors like banking and technology, as well as strong seasonal trends, risk assets may still have a little room to run, at least in the very near term. Whether we get more market volatility than we have seen for the first ten months of the year remains to be seen.

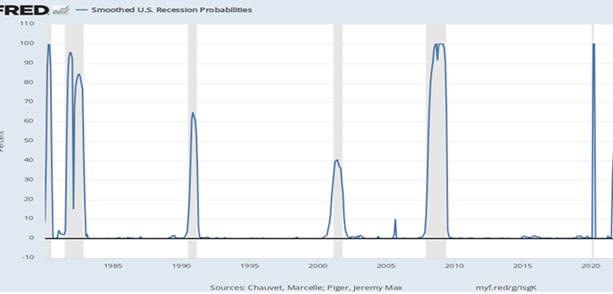

However, investors should begin thinking about how they might want to be positioned over the next few months as we shift to the late stage of the business cycle, especially if the St. Louis Federal Reserve’s recession probabilities rise from their current level of 44%.

We want to be clear that we are not calling for an imminent recession. Instead, we advocate for investors to focus on the data and think about the implications of today’s policy decisions. Although we have not seen it yet, Central Bank policy decisions could eventually tighten global financial conditions and possibly cause a booming stock market to slow its advance. And perhaps, investors should be thinking through the lens of risk and reward now more than ever.

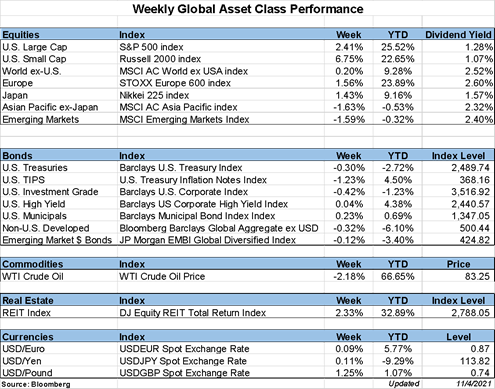

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*