Published on: 04/09/2021 • 7 min read

Avidian Report – First Quarter Review and Our Short Term Outlook

INSIDE THIS EDITION:

First Quarter Review and Our Short Term Outlook

2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

Coming into the first quarter of 2021, our outlook for the global economy hinged on health outcomes. We fully expected that a wide-scale rollout of vaccines in the first half of 2021 would ultimately lead to a quick and robust recovery across many economic fronts—namely, employment, spending and the broad economy. We also believed that governments would continue feeling pressure to provide support while vaccines enabled a return to more typical economic activity. And although we thought some hotly contested elections could lead to a divided government, those concerns never materialized, and so we saw no limits placed on the scale, scope and timing of further fiscal stimulus in the first quarter. Additionally, we expected all major regions to see above-average growth while not triggering a sharp increase in interest rates, as we believed central bankers understood that low rates would be critical to a post-pandemic economic recovery.

Also worth noting is that we determined early on that unlike classical recessions, which take time to work through imbalances, this recession was decidedly event-driven and would require a different set of policy responses to jump-start growth and restore a sense of economic normalcy. We witnessed early on that there was certainly the will to remain supportive to recovery, and as a result, investors started to look through the virus situation early on and were aided by ample liquidity and the easing of credit that mitigated downside risks.

When we first communicated our 2021 outlook, we also identified both upside and downside scenarios which could have caused our outlook to brighten or dim. On the upside, we identified three developments that could have provided a more robust tailwind to risk assets this year than our base case. Among them were more effective vaccines and better distribution to developed and developing countries, greater-than-expected fiscal stimulus and lastly, a more robust global economic recovery. On the downside, there were similarly some outcomes that we felt could hinder our positive outlook for risk assets. Included were more severe waves of the virus causing additional lockdowns, challenges in distributing vaccines and a slow or inadequate rollout of monetary or fiscal stimulus. As we analyze these scenarios and compare them to what has happened, we see a mix that leaves us in line with our base case thus far.

How have things gone thus far?

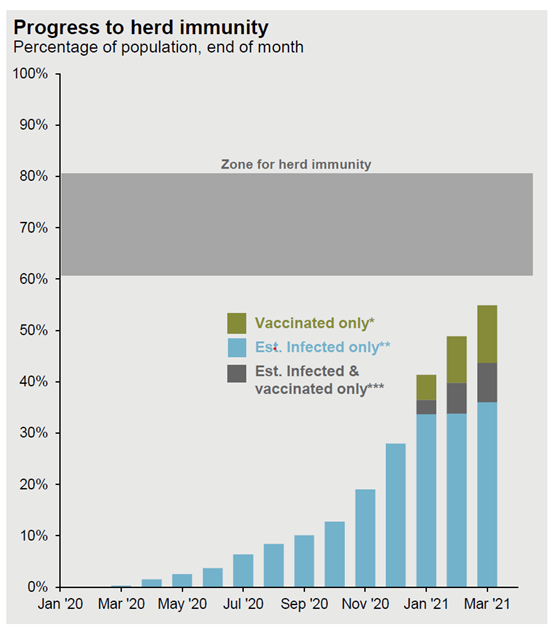

The rollout of vaccines has certainly accelerated throughout the first quarter, especially in the US and the UK. This has helped push the world ever closer to achieving the herd immunity we have heard so much about over the last year.

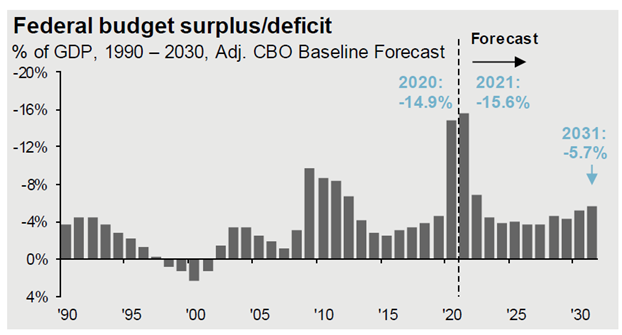

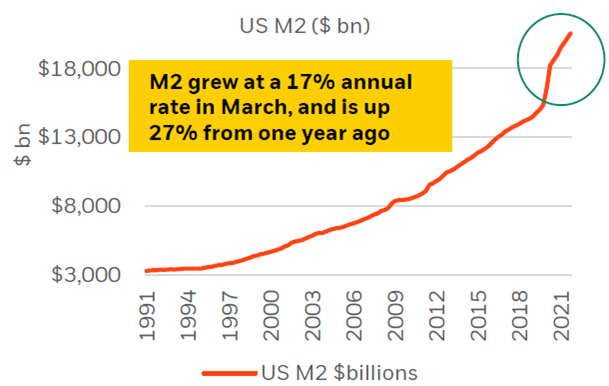

We have also seen fiscal policy support drive deficits in the US to support economic recovery. While this decision has led to concerns about the sustainability of these programs and rising national debt, the M2 money supply growing 27% over the last year indicates that the policy measures have been successful in getting money into the hands of consumers.

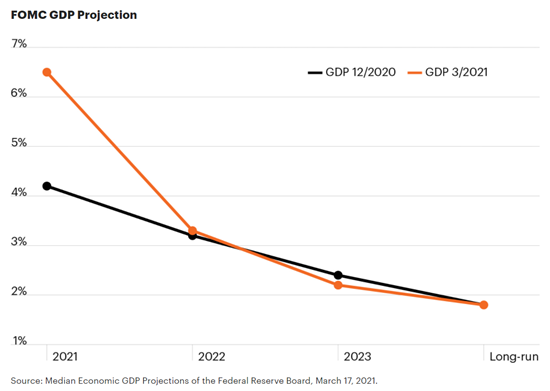

Ultimately, we believe this all sets the stage for the most vigorous GDP growth we have seen in nearly 40 years, going back to 1984. Already, the first quarter is putting the economy on track to grow nearly 7%, though expectations are for growth levels to normalize toward trend over the long run.

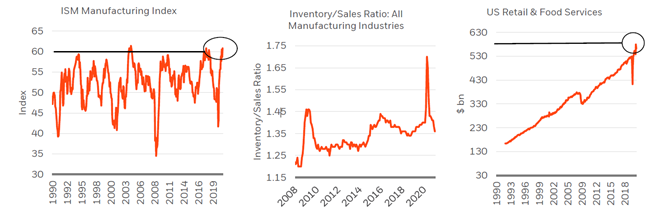

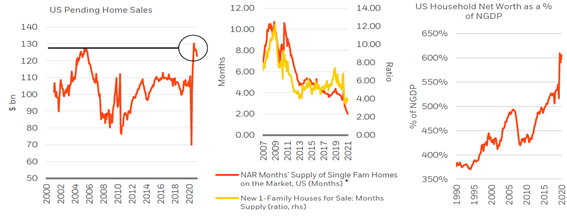

And it isn’t just GDP seeing a solid recovery thus far. It is also seen across several economic data points, including manufacturing, inventory levels, retail & food services, pending home sales, a drop in housing inventory and a sizable jump in household net worth.

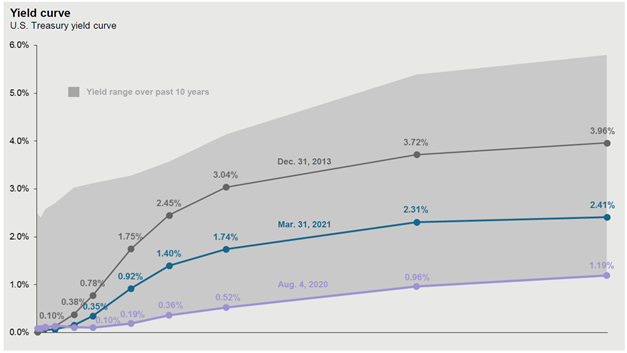

Although we do believe the magnitude of the rise in interest rates through the remainder of the year is a key risk to asset prices, we see moderate returns for risk assets through the remainder of the year, especially on a relative basis compared to growth expectations for the economy and corporate earnings.

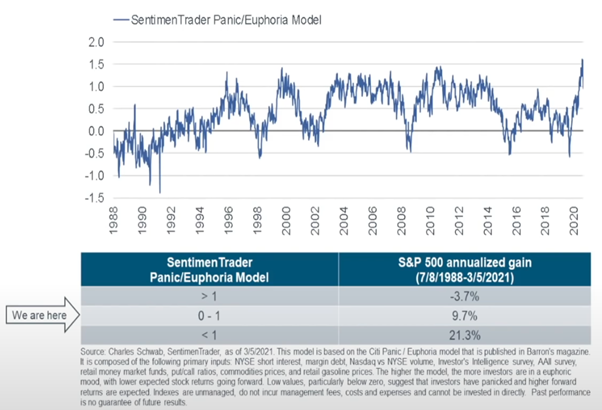

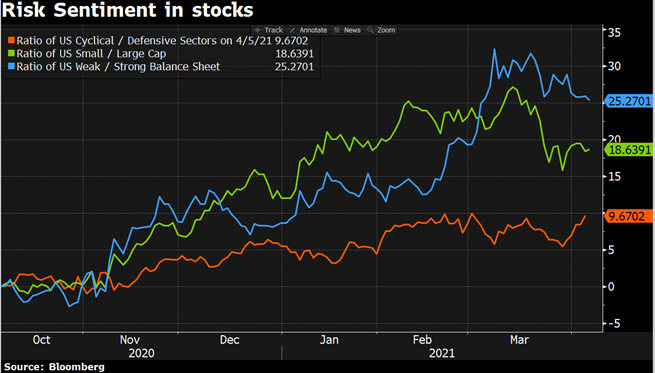

To move meaningfully higher, we would likely need to see substantial upside surprises to consensus, especially as we consider elevated levels of investor optimism and what appears to us as a waning appetite for riskier, weak balance sheet companies.

For investors, we think this all signifies a gradual transition from early cycle recovery to mid-cycle. While the economy is likely to remain strong on the back of continued fiscal policy support, we believe the rest of 2021 will be characterized by several themes – strong growth, rising inflation pressure, low but gradually rising interest rates and persistent volatility. This leaves us less bullish on financial assets than we were at the beginning of the year as valuations have risen, and the rise to interest rates poses some risks to the valuation multiples at which stocks are currently trading. However, as always, there are certainly pockets of opportunity that investors should be considering with their advisors. This could include inflation-protected asset classes and the eventual addition to longer duration assets when we get more clarity on the interest rate path.

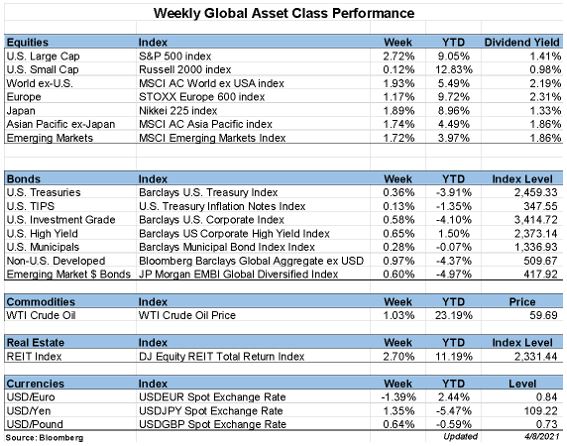

Weekly Global Asset Class Performance

2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

Written by Scott Bishop, MBA, CPA/PFS, CFP® | April 7th, 2021

Scott Bishop was on Barron’s Live Podcast (part of MarketWatch) with Andrew Keshner on April 7th. The topic was about “Make the Best out of our Complicated Tax Season”. A link to the webinar can be found below. Also, a summary of some of our discussion items can be found following the link.

Webinar Recording: Making the Best Out of Our Complicated Tax Season

Read Full Article Here

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*