Published on: 05/27/2021 • 8 min read

Avidian Report – Housing Sector Update

INSIDE THIS EDITION:

Housing Sector Update

10 Most Asked Tax Questions so Far in 2021

Estate Tax Law and Strategy Changes are Coming

This week’s market report will focus on the housing sector, an area of the US economy increasing in attention, and with good reason. After all, the housing sector makes up a vast and important part of the US economy and has wide-ranging implications for the labor market, governments, and total economic output each year.

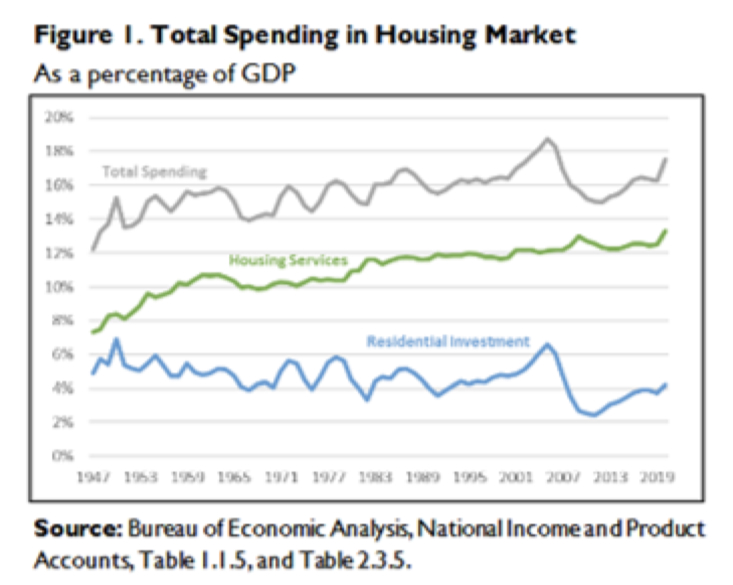

To put some numbers around this segment of the economy, we look at the total value of residential real estate in the US. According to Zillow Research, as of January 26, 2021, the total value of residential real estate stood at $36.2 trillion, a massive number. And further, as of 2020, total spending within the housing market accounted for 17.5% of US GDP. We quickly see the true importance of a healthy housing market within our domestic economy.

The question many investors are starting to ask themselves is just how healthy the housing market might be. The scars many investors sustained during the Great Financial Crisis have not entirely gone away.

To better answer this, we must lean on the data because, ultimately, the data will provide an objective view of what is happening in housing. In doing this, investors must track data that includes construction spending, residential construction data, home sales data for both new and existing homes, confidence levels, and price indices. While the review we conduct in the paragraphs that follow will not cover each of these data points, the charts and data below provide valuable insight into the current state of the housing market.

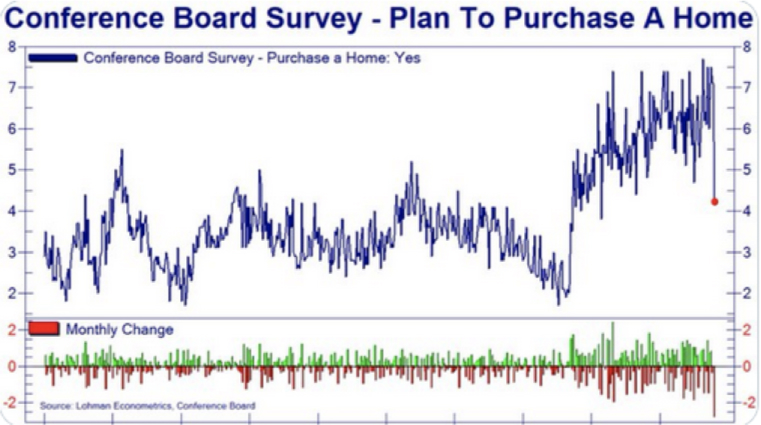

In survey data collected by the Conference Board, we see elevated levels of people looking to purchase a home. This is especially true as we compare today’s numbers to the levels we saw at the height of the pandemic. That said, we have seen a recent pullback in the last month.

We attribute part of the recent pullback to rising home prices across the country. In fact, in data collected by S&P CoreLogic’s Case-Shiller Index of property values, property values climbed 13.2% from a year before. This was a strong move considering that in February, home values also climbed 12%. Looking more closely at the data, we see that certain metro areas saw home values rise substantially more than this led by Phoenix, San Diego, and Seattle, which each saw a year-over-year rise in home values of between 18.3% and 20%.

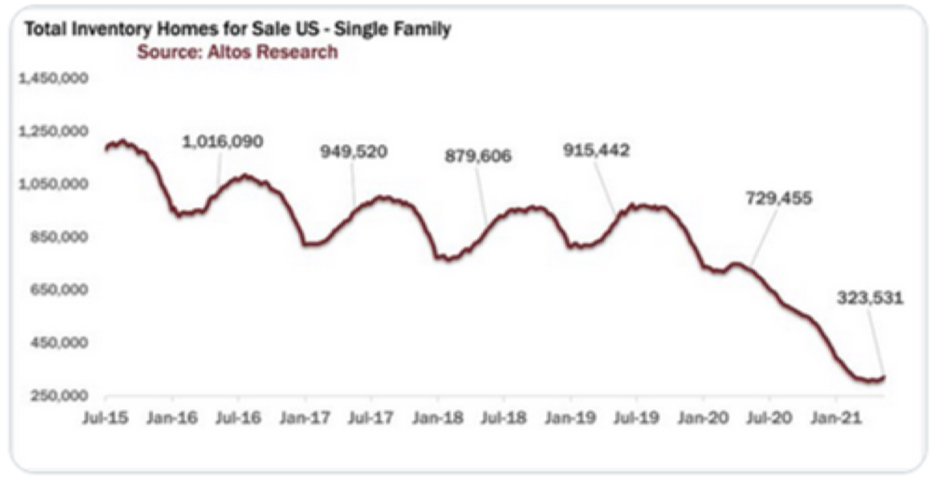

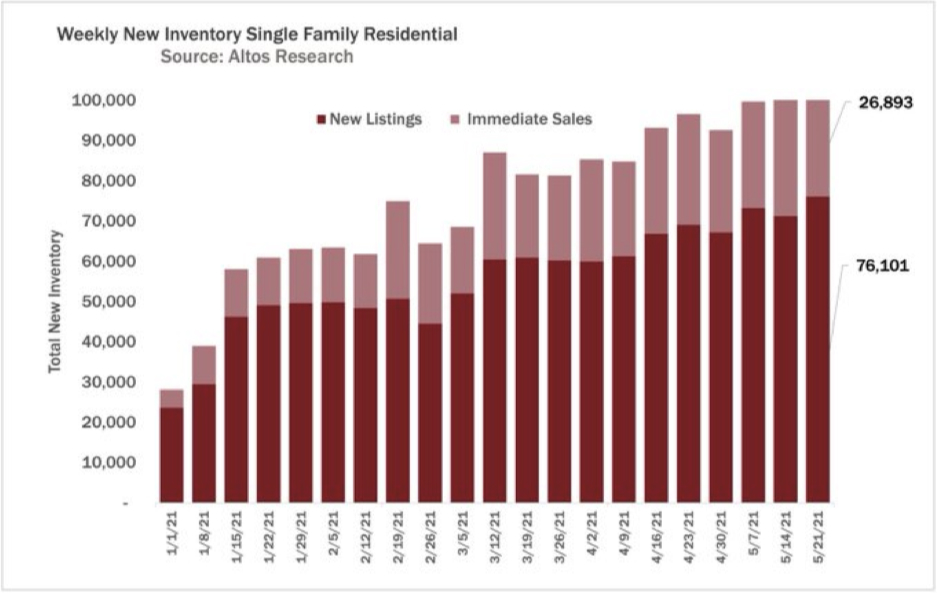

Rising home prices appear to be driven mainly by low supply relative to demand, as the two charts below indicate.

Perhaps, the good news is that we have seen inventories tick higher, with new listings trending higher almost every week since the start of 2021.

We still have a long way to go before supply and demand for housing units reaches some equilibrium. After all, before the pandemic, we would typically have an active housing inventory of around 1M units available for purchase. Today, that number is only around 323,000.

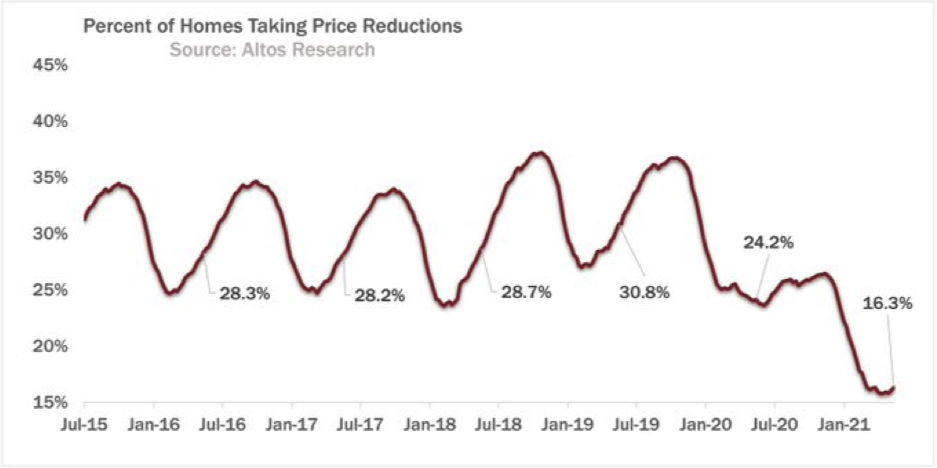

These supply and demand dynamics have also led fewer home sellers to accept price reductions relative to asking prices. The share of homes sold above their asking price is more than twice what it was in 2020.

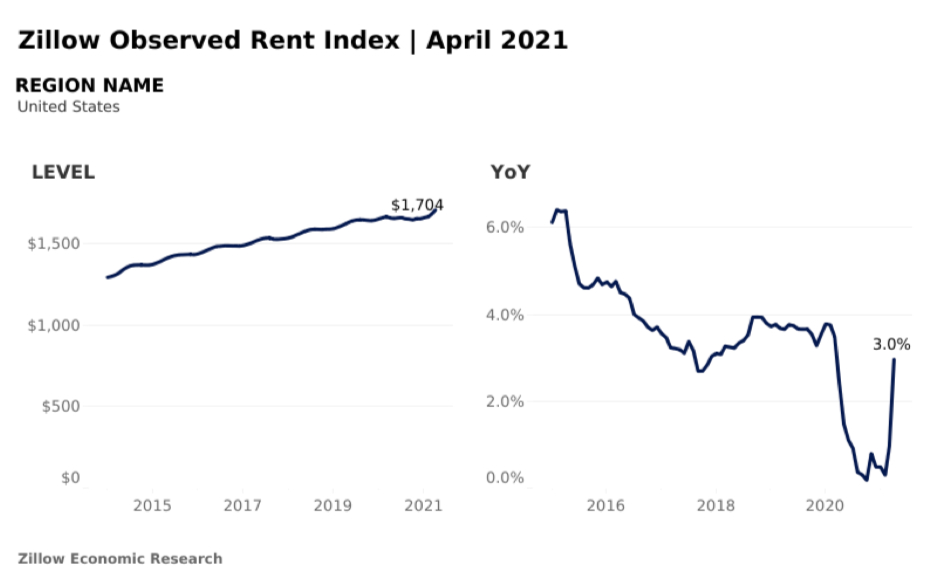

On the rental side of the housing market, which also figures into US GDP, we have rents continuing to recover after a pandemic lull with the U.S. Zillow Observed Rent Index up 1.5% from March to $1,704 per month. This is a year-over-year increase of 3%.

What does all this mean for investors?

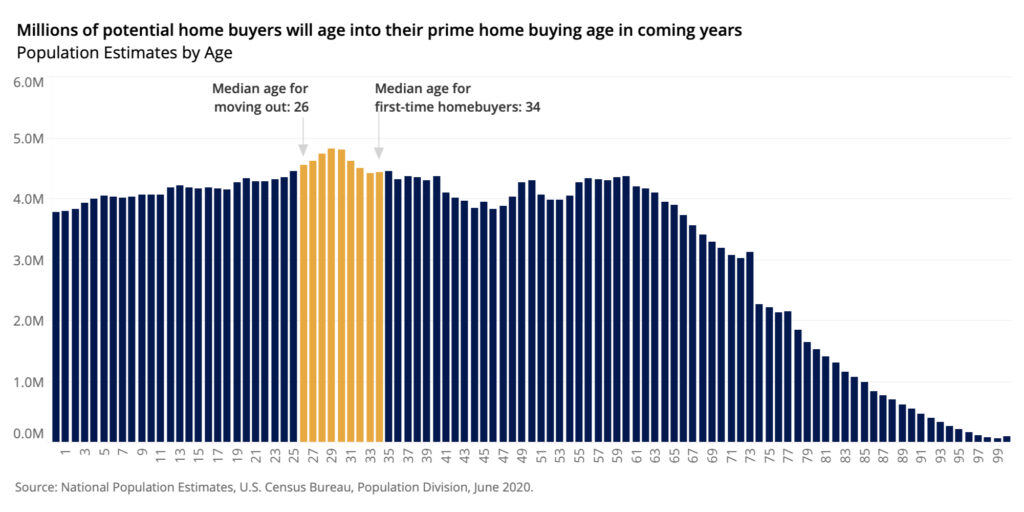

For one, it shows that housing fundamentals remain strong, which should certainly help bolster the economic recovery and GDP growth for the time being. Supply and demand trends are favorable, and despite several of the data points trending to levels not seen before the last housing-related bubble, we do not see an imminent risk of a repeat. We see housing market trends are sustainable with no sign of a wave of foreclosures, no overbuilding like we saw leading up to the last housing crisis, and demographic tailwinds that could support housing for quite some time.

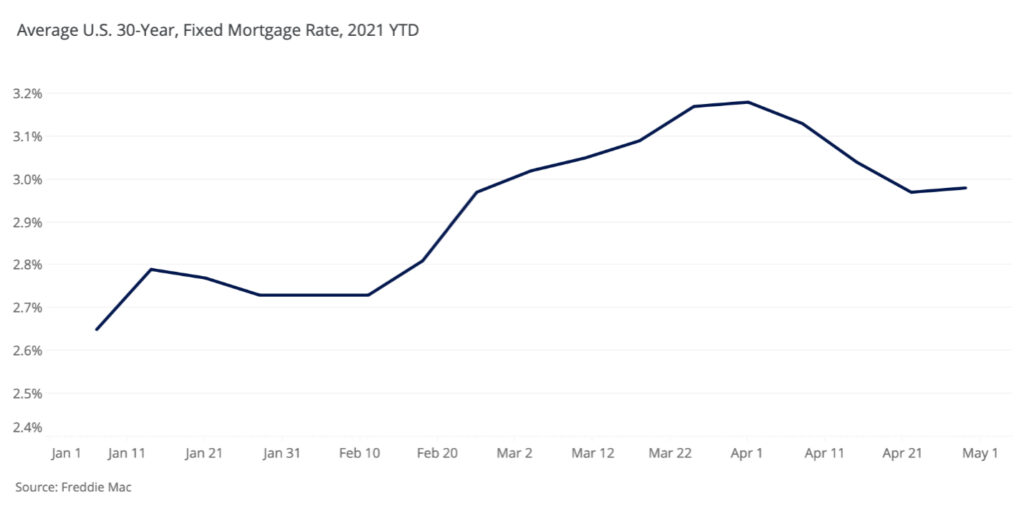

Further, we have seen a recent pullback in the average 30-year fixed-rate mortgage since the start of April, which provides yet another tailwind, at least in the short-term, to the housing market.

This is because low mortgage rates help improve homebuyer budgets that can better accommodate recent price appreciation.

However, to keep this going, the labor market will continue improving with both job growth and wage growth. Thus, these numbers need to be watched closely, in addition to inflation data which could lead to rising interest rates that could be a risk to housing’s bullish trends and lead to an eventual cooling of economic growth in the US.

For investors with diversified portfolios, this data should be closely monitored. Real estate has some room to run, but there are certainly some sectors in real estate that are more attractive than others. Also, the housing market could be an indicator for things to come for the broad economy and could point to necessary portfolio adjustments as things evolve. For that reason, we advocate the ability to adjust portfolio positioning tactically.

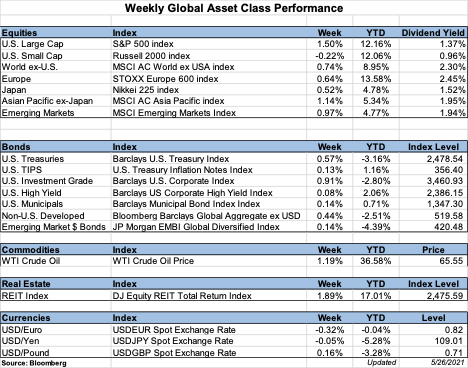

Weekly Global Asset Class Performance

10 Most Asked Tax Questions so Far in 2021

Written by Scott Bishop, MBA, CPA/PFS, CFP®

At Avidian Wealth, we hear from our clients frequently about pending tax law changes. If you have followed my articles over the years, you know that I often write about taxes and their impact on your estate, retirement and overall financial planning; several of these articles are referenced at the end of this piece.

With all the tax law changes we are considering as “pay for’s,” and in terms of having Americans “Pay their Fair Share,” we receive many calls from clients asking, “What should we do?” At this point, there is no immutable law and no solid guidance as to what will pass and when any changes will be effective, but we believe it is helpful to share some of our recommendations based on the ten most asked questions that we hear. But of course, before taking any action, please check with your tax and financial planning team!

Click Here to Read the Entire Article

Estate Tax Law and Strategy Changes are Coming

Written by Scott Bishop, MBA, CPA/PFS, CFP®

At Avidian, we hear from our clients frequently about the pending tax law changes. If you have followed my articles over the years, you know that I often write about taxes and their impact on your estate, retirement, and overall financial planning – several of the articles are referenced at the end of this piece.

Currently, many tax changes are being considered that will change the estate and gift tax exemption amounts (the amount you can exclude from estate taxes at your death or during lifetime gifting), the tax rate, and the possibility of the government legislatively ending many of the strategies we have used for decades (that have been approved by the IRS and/or through tax court cases). For more information on these specific issues, I have discussed many of these changes in previous articles listed at the bottom of this article.

Click Here to Read the Entire Article

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*