Published on: 02/07/2020 • 5 min read

Avidian Report – Innovation, Coronavirus, and Risk

INSIDE THIS EDITION:

Innovation, Coronavirus, and Risk

Weekly Snapshot of Global Asset Class Performance

Upcoming Event: 2020 M&A Insight

Financial Planning Goals for 2020

401k Plan Manager

The world is changing, growth is shifting, and disruption is accelerating. The ability to envision the future, understand the latest innovation is vital to stay on top of financial markets. Economic profits are likely to be made by whoever is able to ride tailwinds created by industry and geographic trends.

[toggle title=’Read More’]

As a popular trading expression goes, “The trend is your friend.” The market has certainly embraced these trends in an accelerating speed and has re-allocated capital to those areas that offer the promise of cutting edge innovation.

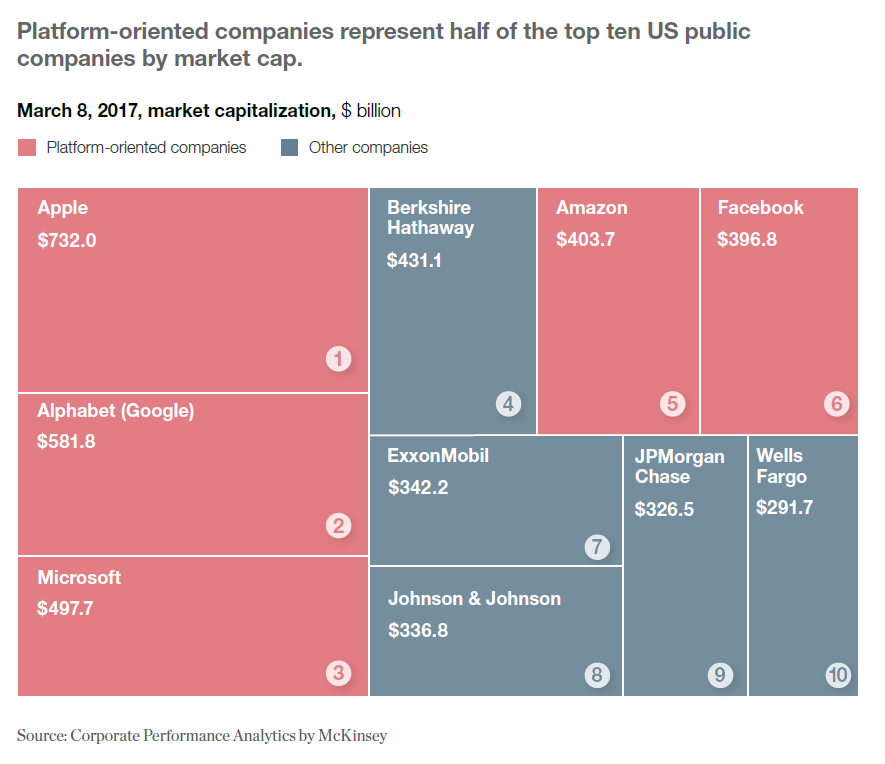

In 2010, 6 oil companies and 2 technology companies were ranked the top 10 most valuable global companies by market cap. By 2017, the ratio inverted with 6 technology companies on the list and only 1 oil company left. In many ways, “Data is the New Oil”. As cited by Clive Humby in 2006, “data is just like crude. It’s valuable, but if unrefined it cannot really be used. It has to be changed into gas, plastic, chemicals, etc., to create a valuable entity that drives profitable activity; so data must be broken down, analyzed for it to have value.”

Online connectivity, backed by evolving hardware and software, has been booming. In 2008, the number of connected devices surpassed the world population for the first time. An increasing number of people have adapted to working and living with integrated smart devices that now are fully integrated into newspapers, maps, travel agencies, credit cards, shopping carts, and more. The digitalization of our daily activities, in turn, creates huge amounts of “big data” that serve as raw materials for data mining and machine learning, where advanced analytics creates fresh opportunities to improve business performance through marketing, supply-chain, product, process and service improvement.

The explosion of data usage and storage also demands cutting-edge cybersecurity technology that can effectively protect networks, computers, and data from attack, damage or unauthorized access.

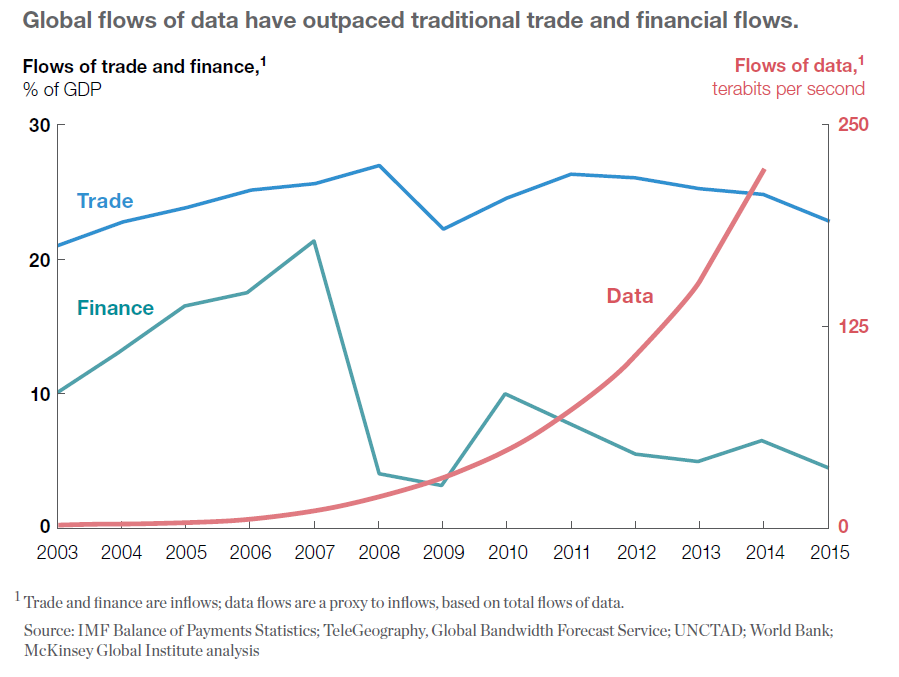

We have seen exponential growth in cross-border data flow in the last decade. According to McKinsey & Company, almost a billion social-networking users have at least one foreign connection, 2.5 billion people have email accounts, 250 billion people are currently living outside of their home country, and more than 350 million people are cross-border e-commerce shoppers.

Digitization has further blurred industry boundaries. Most of the 20th century has been dominated by linear value chains, in which a series of value-adding activities were performed to produce final goods and services. This ecosystem is now being joined by horizontal platforms, where computation and the internet become a powerful source of value creation, across various linear value chains. Horizontal platform players such as Google, Amazon, and Facebook currently account for five of the ten largest US companies by market cap. As we move further into this new decade, a new ecosystem, named “Any-to-Any” by McKinsey Global Institute, is generating a new wave of disruption. Companies in this category are distinctly asset-light. Alibaba, the world’s largest retailer measured by gross merchandise volume, does not own any warehouses; Airbnb, the world’s largest accommodation provider, does not own rooms; Uber, the world’s largest taxi company, does not own cars.

This is all very exciting from an economic perspective. However, the latest coronavirus outbreak in China that has all but brought that economy and their citizens to a halt, shows that a connected world facilitated by technology also comes with risks. In the current instance, Coronavirus fears have caused major disruptions to shipping, manufacturing, and travel all over the world as governments try to get a handle on the scale of the virus. While domestic markets have not reacted as we might have expected to date, risks to the world economy are certainly present. How it plays out remains unknown. We do believe for the opportunistic long-term investor, opportunities could emerge. For the unprepared, however, it could pose a tremendous risk and at this time you want to be sure you are in the opportunist camp rather than the unprepared camp.

Weekly Global Asset Class Performance

[/toggle]

2020 M&A Insight – Upcoming Event

What to Expect in the Year Ahead

February 26, 2020 | Vic & Anthony’s Steakhouse

Click Here to Register

Financial Planning Goals for 2020

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Carter Blackburn

The beginning of each year presents a unique opportunity to self-reflect about whether your Financial Plan is on track. Many of us set “New Years Resolutions” with no true actionable goal or follow-through. Remember a goal without a plan is just a wish!

With that in mind, especially given recent tax law changes and the passage of the retirement SECURE Act, now is an excellent time to review your plan to see if you are on track to meet your short and long-term goals. Below are some important areas which you should contemplate and plan before we get too far into the year.

Read Full Article Here

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*