Published on: 01/24/2020 • 6 min read

Avidian Report – Innovative Technology as an Investment Theme

INSIDE THIS EDITION:

Innovative Technology As An Investment Theme

Weekly Snapshot of Global Asset Class Performance

Upcoming Event: 2020 M&A Insight

Financial Planning Goals for 2020

401k Plan Manager

As we start a new decade, investors may want to begin thinking about big investment themes that could be profitable over the next 10 years. In the last decade, some of the biggest themes were innovations like cloud computing and the emergence of subscription-based business models like Netflix.

[toggle title=’Read More’]

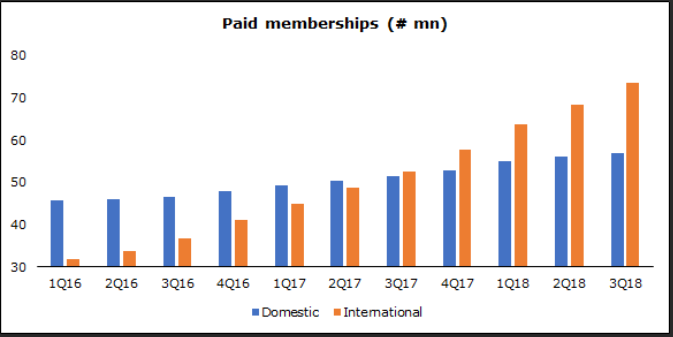

As the chart below shows, paid memberships for Netflix grew steadily over parts of the decade both domestically and internationally.

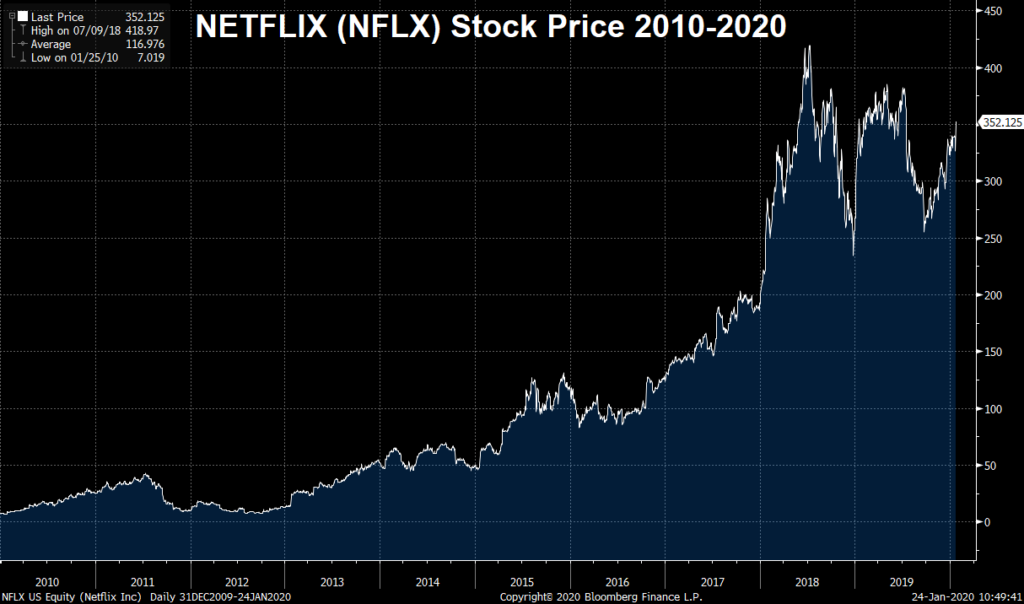

At the same time, Netflix saw its shares return more than 4,730% from 12/31/2009 until the close yesterday. In other words, Netflix is a perfect example of a company that caught a tailwind at the beginning of a decade and greatly benefited its shareholders.

Of course, Netflix had its bouts of volatility so a shareholder would have had to weather that to reap the full benefit of the returns during the decade. That is the nature of investing in the technology industry.

As we look ahead to the next ten years, it is likely that disruptive technology will continue to be a major investment theme that may further revolutionize the way we all interact, work, and play. Thus, it makes sense that this period in time is often called the fourth industrial revolution.

So what sectors/sub-sectors would be potential beneficiaries of this revolution for the next 10 years? A few contenders come to mind including blockchain, robotics, DNA sequencing, artificial intelligence, and battery technology. This week we will focus on a subset of these innovation themes called deep learning, which could become a major investment theme for the next decade as companies like Apple, Google, IBM, and others invest in this emerging space.

What is deep learning anyway?

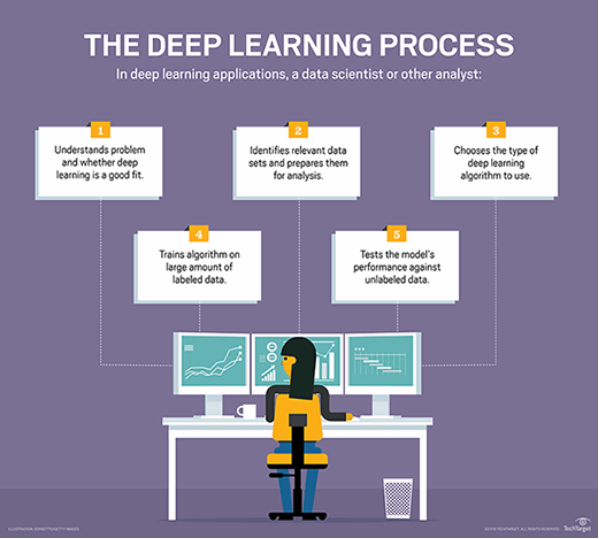

Deep learning, also referred to as deep structured learning or differential programming makeup part of the broad field of machine learning. Deep learning allows for supervised, semi-supervised and unsupervised learning that can help computers solve complex problems. To date, most of the work has been done in the areas of images, video, and language but generally follows a similar process.

First, a problem is identified and understood and then an assessment is made about whether deep learning is a viable approach to solve the problem. Second, relevant data sets are identified and prepared for deep analysis. Step 3 entails choosing the type of deep learning algorithm to be used. Fourth, the algorithm is trained to process large amounts of data that can then be used to test performance against unlabeled data. The idea is that over time, deep learning processes can eventually generate solutions to new problems with only a limited series of data.

That may sound like a highly technical process that is hard to comprehend for most people and the real-world application somewhat nebulous until of course, we highlight some tangible examples. Take for instance the self-service chat applications you may have used in customer service environments. Or perhaps you use news aggregators to get your news and have used them to filter particularly negative news or exclude information about specific topic areas from your news feed. These examples are deep learning in action.

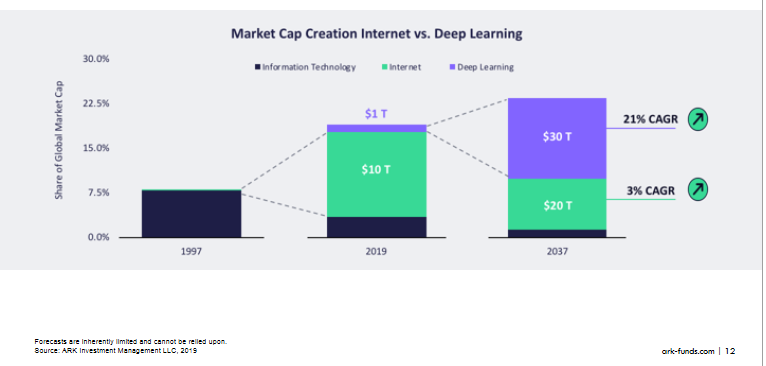

For investors, the key takeaway is that continued efforts in deep learning may lead to more efficiency along the corporate value chain. This stands to improve efficiency, drive margins higher, potentially improve profits, and impact stock prices. In fact, the expectation from some is that the market cap attributable to deep learning could reach $30T by 2037, a 30-fold increase over what it accounts for today.

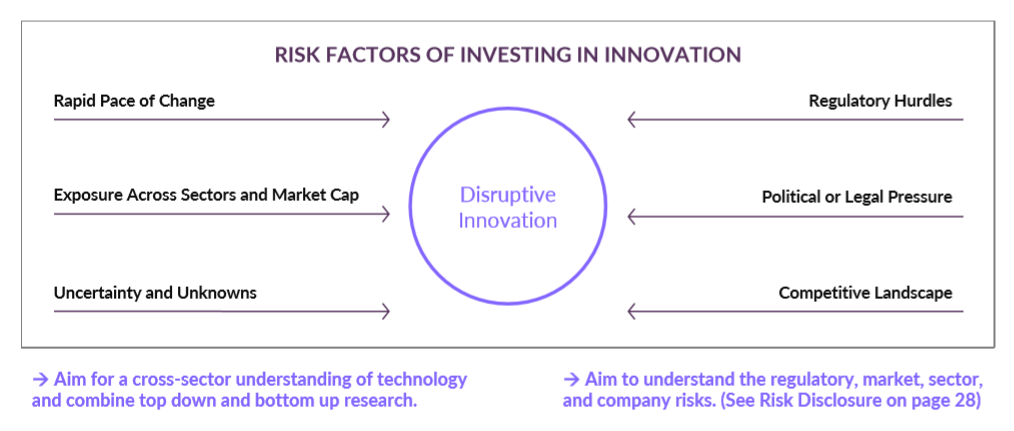

It is obvious that if these estimates prove to be correct, deep learning could offer tremendous opportunities for investors. However, as investors, we must weigh risks as well. Disruptive innovation like that offered by deep learning certainly offers tremendous potential rewards but comes with six major risks. First, innovation happens at a rapid pace and seems to only accelerate throughout time. Rapidly changing industries can make early successes merely short-term blips if companies are not built to keep up with the pace of change. Regulatory hurdles are another risk that can be difficult to overcome considering the speed of innovation. Of course, regulatory hurdles come with associated political and legal pressure which can make success more elusive for firms ill-prepared for them. Competition is also fierce and only adds to potential risks.

Despite these risks, investing in innovative technology like deep learning does stand to capitalize on Wright’s Law, which describes the rapid decline in cost curves that make technology more affordable and more profitable for the companies and investors making investments in the space. However, it is also important for investors to consider today’s frothy technology valuations and whether a better opportunity to participate in this potential long-term trend may not lay on the horizon.

[/toggle]

2020 M&A Insight – Upcoming Event

What to Expect in the Year Ahead

February 26, 2020 | Vic & Anthony’s Steakhouse

Click Here to Register

Financial Planning Goals for 2020

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Carter Blackburn

The beginning of each year presents a unique opportunity to self-reflect about whether your Financial Plan is on track. Many of us set “New Years Resolutions” with no true actionable goal or follow-through. Remember a goal without a plan is just a wish!

With that in mind, especially given recent tax law changes and the passage of the retirement SECURE Act, now is an excellent time to review your plan to see if you are on track to meet your short and long-term goals. Below are some important areas which you should contemplate and plan before we get too far into the year.

Read Full Article Here

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*