Published on: 10/22/2021 • 5 min read

Avidian Report – Investor Sentiment and Today’s Market

INSIDE THIS EDITION:

Investor sentiment is often used by investors to gauge the overall attitude investors have toward a market, sector, or security. This is valuable because, with an indication of sentiment, an investor might have an objective way to know just how bullish or bearish they should be or in some circumstances to determine how they should position their portfolios at a particular point in time. For example, a contrarian investor might use overwhelmingly bearish sentiment to go long the market or overwhelmingly bullish sentiment to dial back exposure.

There are several indicators that are commonly used to measure market sentiment including the VIX, the high-low index, or for more technicals-focused investors the bullish percent index (BPI) or moving averages. However, these are not the only ways to glean useful information about investor sentiment. For this week’s report, we will focus on sentiment surveys and what it is they are signaling to investors.

The table that follows comes from the American Association of Individual Investors. Going back to 1987, the organization has asked its members whether over the next 6 months the stock market will be higher, at the same level, or lower when compared to today. On average, investors answering the survey have been more bullish than bearish. This is reflected in the historical view section of the chart below which shows that on average 38% of investors have felt bullish, 31.5% have felt neutral, and 30.5% have felt bearish looking ahead 6 months. This is not too surprising as historically markets have trended higher despite periodic corrections, crashes, crises, and shocks.

What we find interesting about the results of this last survey is how bullish respondents have gotten compared not only to the historical averages but also to the last few releases. More specifically, for the week ending October 20, 2021, we saw 46.9% of respondents indicate that they are feeling bullish about the stock market’s direction for the next 6 months. This represents 8.9 percentage points more bullish compared to the historical average and perhaps more importantly is 9 percentage points more bullish compared to the week prior.

It is such a sharp acceleration of bullish sentiment that should make investors take a pause and ask why sentiment has improved so much over a period of only weeks. From where we sit, we posit it could be because of a relatively strong earnings season thus far and improved consumer spending, which combined indicate that consumers are feeling optimistic about the economy.

However, this is just one of many surveys that are conducted to gauge sentiment.

And when we look at fund manager sentiment, we are seeing a bit of a disconnect when compared to the retail investor crowd. Bank of America conducts a Global Fund Manager survey periodically and the results on sentiment are telling of interesting behavior from professional fund managers.

As the chart that follows shows, since the beginning of 2021, the percentage of fund managers expecting a stronger economy has declined sharply. Yet, those same fund managers have kept their allocations to equities high. Thus, we have a widening disconnect between growth optimism and allocation to stocks.

Some of this could be performance chasing as only four major industry subsectors in the S&P 1500 have produced a negative total return this year. What’s more, is that the leading 10 subsectors have each turned in a total return performance of more than 34%.

However, we think more than likely this is attributable to the low-interest rate environment and the negative sentiment some investors have for the fixed income asset class moving forward. In fact, as the chart below shows, this month we have seen the most pessimistic outlook for bonds in the history of the Bank of America Fund Manager Survey, which dates to 2001.

However, negative sentiment does not mean that investors holding fixed income should completely abandon the asset class. In fact, we think fixed income still plays an important role in a well-diversified, multi-asset class portfolio, especially should we get a drawdown or correction in equity markets.

And while we don’t necessarily believe a correction is imminent, we believe investors should be aware of the high degree of correlation between major central bank assets and the S&P 500. As the chart below shows, since the financial crisis in 2008, the S&P 500 has followed a trajectory that follows the size of Central Bank balance sheets. If investors expect this relationship to hold then perhaps in addition to sentiment, they should be watching the size of Major Central Bank Assets as a potential catalyst for a pullback which for now we haven’t seen any sign of.

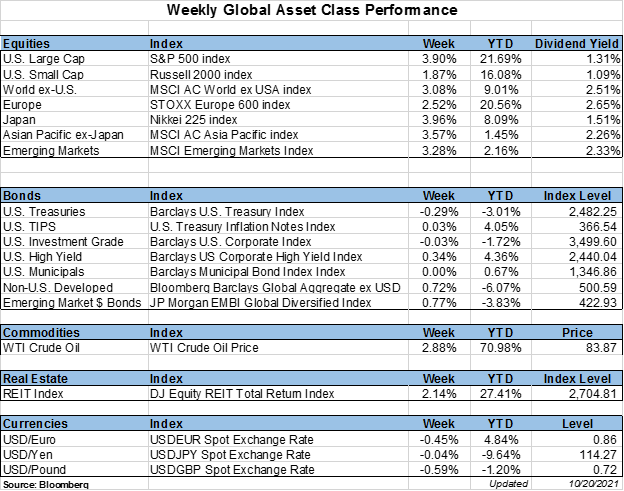

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*