Published on: 04/29/2022 • 7 min read

Avidian Report – Investors Need To Be Paying Attention to These Things

INSIDE THIS EDITION

Investors Need To Be Paying Attention to These Things

Investors have faced heightened volatility over the last week or two, especially in once high-flying technology stocks. This, as rising inflation pressures have shifted the consensus view to now believe that the Fed is on the verge of committing either a policy error or that they may be overly hawkish and bring asset prices down.

That said, there is more to discuss outside of the Fed. This week’s report will highlight some of the data we see and discuss the potential implications for investors as we move through the remainder of the year.

One thing that has been getting mixed coverage in the media is the situation in China related to renewed COVID lockdowns. The Chinese government has taken an aggressive approach to control COVID from spreading. This has led to a decline in traffic inside major cities in China and between them. The chart below shows the number of daily operating flights dropping below the levels we saw during the first quarter of 2020 when China’s first round of lockdowns went into effect.

Source: Twitter @MacroAlf

None of this is surprising because long ago, China adopted a zero COVID policy that effectively set the stage for the recent lockdowns of major cities like Shanghai. However, these lockdowns are not without consequence. They hold tremendous economic implications for the broad Chinese economy and the global economy.

Take, for example, Shanghai, a city with a population of about 25M people and home to a large part of China’s manufacturing industry. With manufacturing grinding to a halt and shipping of goods slowing, we have the making of a significant supply chain disruption with the potential to increase inflationary pressure and the possibility of emboldening the Fed to be more aggressive as they hike rates toward neutral.

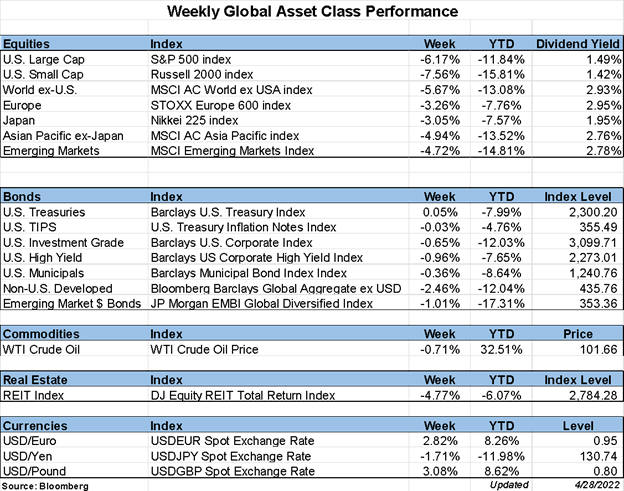

With rising inflationary pressures domestically and abroad, it is no wonder we have seen commodities perform so well year-to-date. Crude oil, as an example, has stayed close to $100 per barrel for the last few months after seeing several years below $60 per barrel. The regime appears to have shifted, with commodities outperforming stocks year-to-date. And despite that, the commodity sector still seems to be a “must-own” for a well-diversified portfolio both for the upside potential they hold but, more importantly, as a hedge against persistent inflationary pressures. Investors would be wise to view the commodity to S&P ratio charted below as an indicator of potential value should inflation continue on its current trajectory. After all, there appears to be a ton of room to run if we challenge the peaks seen in the early 1990s and again in the 2005–2010 time frame.

The size of exposure to commodities in a portfolio should also be guided by economic growth projections moving forward. After all, economic slowdowns can diminish demand for commodities, at least temporarily.

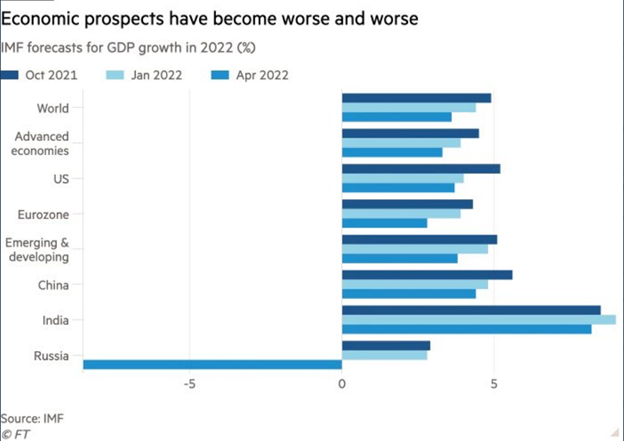

And with the US seeing a negative GDP print this week, which surprised some investors, and the IMF forecasting decelerating growth trends globally, this is something to certainly watch and factor into position sizing decisions not only for commodities but for all assets classes.

Investors should be sure that their allocations align with their financial plans and objectives.

Another consideration for investors today is sentiment. Consumer sentiment is a significant driver of demand, and consumer spending makes up a large portion of US GDP.

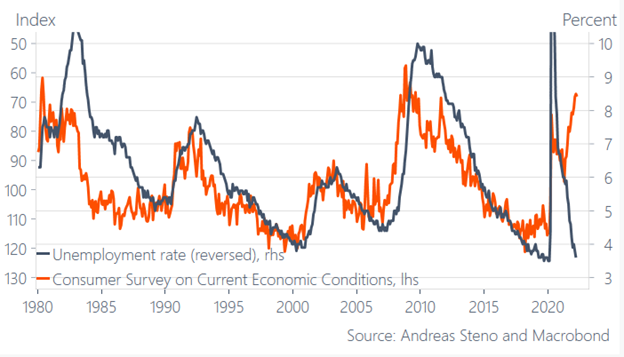

There are many ways to track sentiment, but one is the Consumer Survey of Current Economic Conditions. To make the data more meaningful, compare it with unemployment trends. While historically, the unemployment rate tracks closely with the consumer survey results of Current Economic Conditions, a divergence shows that an inflection may be in play today. Could this be a sign that sentiment may sour?

While difficult to say at present, investors should monitor these data points. Sentiment broadly affects economic demand and asset prices as money moves between risky and less risky asset classes when sentiment changes occur.

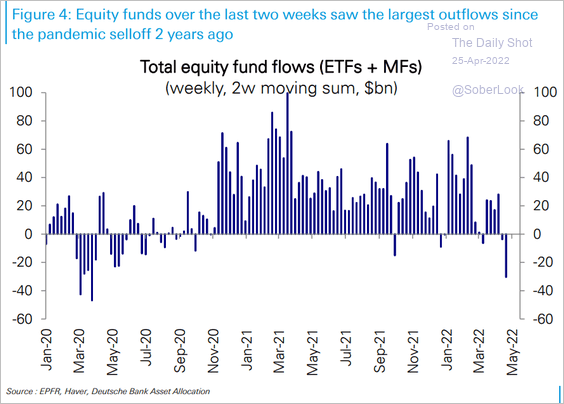

With investor anxiety on the rise over the last couple of weeks, data from equity funds have already shown some rotation to safety as outflows have outpaced inflows at ETFs and Mutual Funds. The outflows have been the largest since the pandemic-related selloff we saw in 2020.

Investors should be thinking about whether this continues or not and, more importantly, have a plan for scenarios where it does to manage risk.

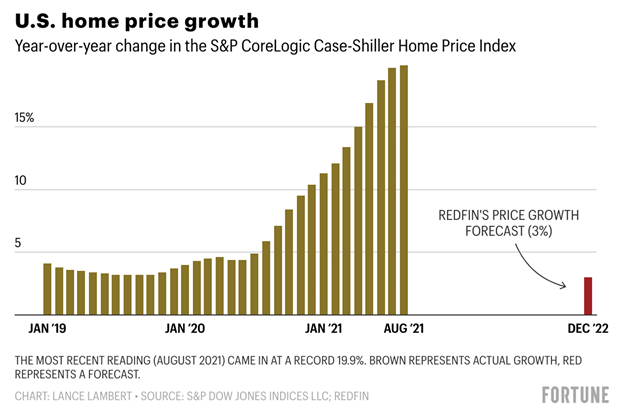

Lastly, we think investors should be closely watching the housing market. We talked last year in one of our reports about significant supply shortfalls that were helping push home sales prices and average monthly rents higher.

Today, with interest rates beginning to rise, we see the emergence of a reversal of those trends. Homes are anecdotally taking a bit longer to sell, and prices appear to be easing. Redfin is forecasting a sharp decline in price growth by year-end.

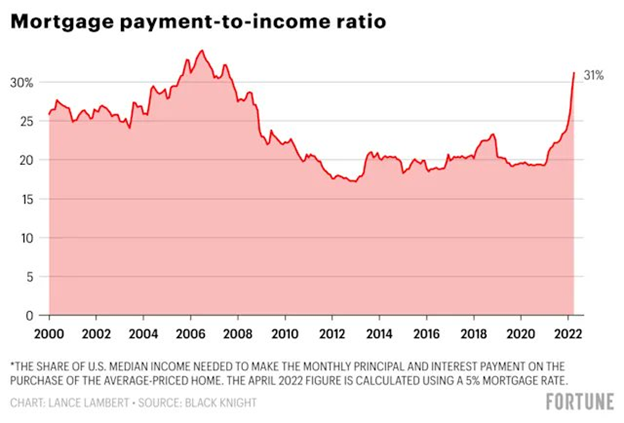

These apparent shifts within the housing market are echoed by the mortgage payment-to-income ratio shown below.

Leading to the Great Financial Crisis in 2008, the ratio peaked at under 40%. Today we are seeing a sharp increase in the ratio to 31%. If this continues, home prices could decline further as affordability becomes an issue for many would-be buyers and could bleed into the appetite for risk in other asset classes.

As data continues coming in over the coming weeks and months, investors should be paying close attention to significant inflections. However, this does not mean investors should be in a hurry to panic if economic conditions show signs of deterioration.

Instead, shifts merely present opportunities to capture future returns for the long-term investor.

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. The information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, and formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*