Published on: 06/18/2021 • 8 min read

Avidian Report – Is Inflation Transitory

INSIDE THIS EDITION:

Is Inflation Transitory

Jimmy Barrett Show Interview featuring Mike Smith

June 2021 Update – FPA Tax and Estate Planning Knowledge Circle

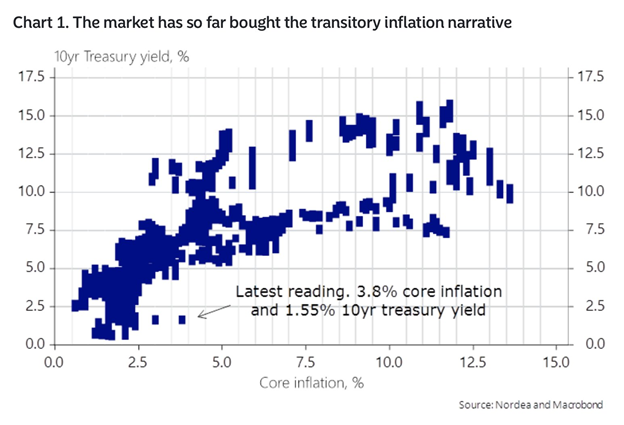

This week the Federal Reserve met and issued their customary economic commentary centered around employment, inflation, and interest rate policy. Leading up to the meeting, the market appeared to buy the transitory inflation narrative as indicated by the 10-year treasury yield remaining at 1.55% despite last week’s Consumer Price Index (CPI) coming in above expectations.

Now that the Fed has come out and said they expect headline inflation a full percentage point ahead of what they projected in March, and the 10-year remains near 1.55%, the uncertainty about inflation and whether it will indeed be transitory remain.

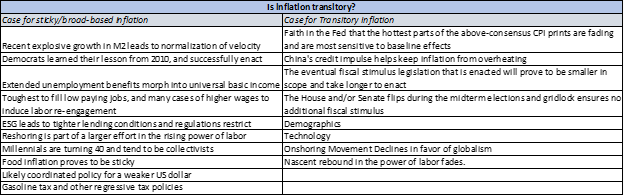

So as investors, how do we sort this out? A good place to start is to list the possible items that could tip the scales. At Avidian, we do this and monitor each of them for early signals that could ultimately lead to more clarity on the correct answer to the question, “Is inflation transitory?”

In this week’s report, we share some things we think could be meaningful to the outcome of inflation. While the items we discuss below are not exhaustive, we intend to provide insight into the types of data points and developments that could shift our views on inflation.

First, we will address the case for sticky broad-based inflation as this is not the consensus view.

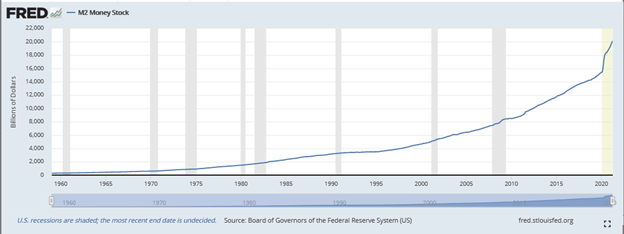

To begin, we have seen considerable growth in the M2 money supply.

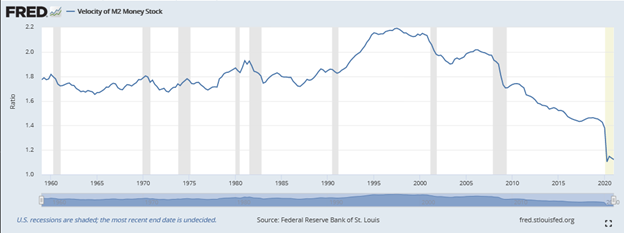

And usually, this would undoubtedly be inflationary with more money chasing the same number of goods. However, another data point is equally important – the velocity of the M2 money supply. As the chart below shows, the velocity has dropped off a cliff. If that reverses and returns to a more normal level, we would certainly think that would support a durable inflationary economic regime.

A longer-term trend that also bears watching what happens with reshoring. Reshoring is, in essence, bringing manufacturing/production back onshore after many years of US manufacturing going offshore to low-cost centers like China. If reshoring picks up, we could potentially see workers with more power to demand higher wages, likely leading to price increases on goods and services.

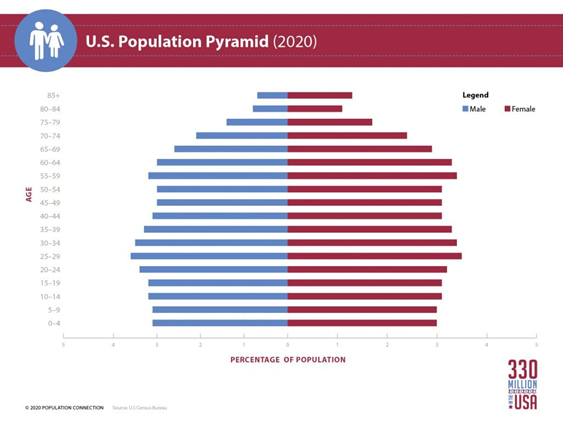

And this is connected to a growing number of millennials turning 40, finding themselves in managerial positions, and potentially pushing for more collectivism which could, in our view, lead to some inflationary outcomes.

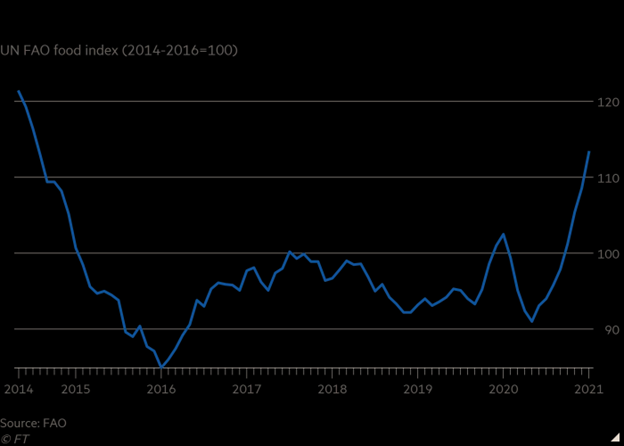

As we have seen over the last year, supply chains have been restricted due to COVID. This has led to a difficult environment for moving products around the globe and pushed shipping costs higher. On the labor side, COVID has also limited the ability for workers to keep the free flow of goods at pre-pandemic levels, which has led to prices of major grain, oilseed, edible oils and other food stock near eight-year highs and has led to a sharp rise in food inflation. The question is whether this remains with us after supply chains normalize.

While it remains to be seen, investors should be paying attention as stickier food inflation certainly would strengthen the case for more stable inflation.

As mentioned at the beginning of this report, we also see several things that, if they occur, could tip the scales in favor of a short-lived transitory bout with inflation before seeing things normalize.

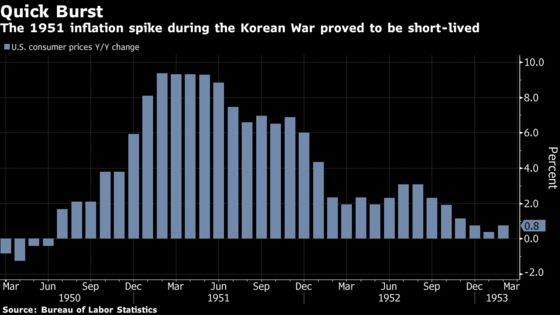

For example, there is an unwavering faith in the Fed and its economic assessments. This has helped keep inflation fears in check and the 10-year treasury from running materially higher, despite some signs of price pressures in the economy. Thus, for those looking for a key sign that inflation and its effects, especially on stock prices, are transitory, this is the place to look. Moreover, if the Fed can continue to keep their credibility and we see above consensus CPI reports fade toward consensus, then it is likely any inflationary pressure ends up being transitory. After all, history tells us that spikes in inflation can be short-lived, as we saw during the Korean War.

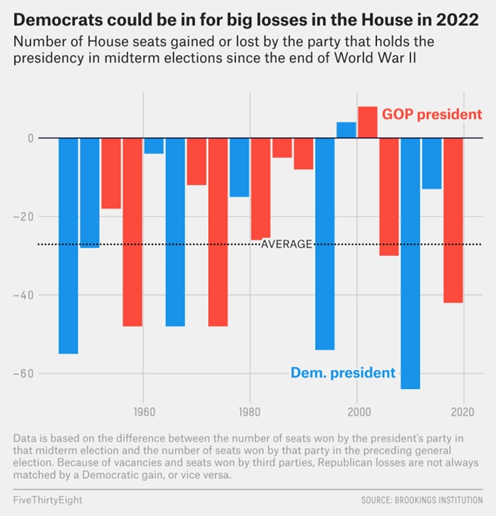

While still some time away, mid-term elections could be critical for determining whether inflation proves to be transitory. The makeup of the House and Senate is important for passing additional fiscal stimulus. Further fiscal stimulus beyond what has already been discussed could drive prices higher. However, if the House or Senate majority were to flip during the midterm elections in 2022, then the probability of getting additional fiscal stimulus measures passed is likely reduced. And, if we look at history, democrats could be in for big losses in the House in 2022.

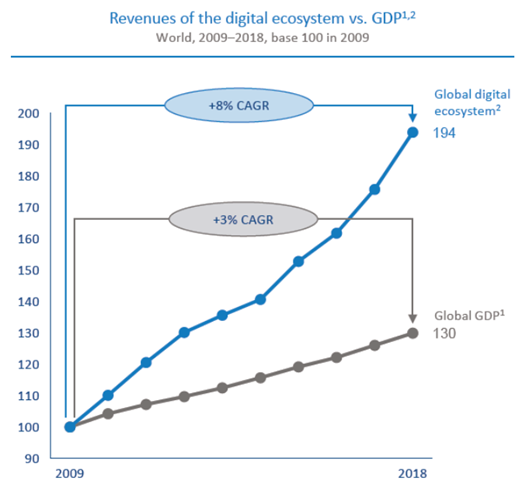

Lastly, we are now very much in a global digital economy, with the last nine years showing global GDP growth at 3%, while global digital growth has far outpaced that figure with an 8% compound annual growth rate (CAGR). This digital ecosystem is the area where profit margins are healthiest and sets the stage for the trends we see with technology, profitability, and scalability only to gather steam.

In other words, as more technology is used across sectors and industries, efficiencies are gained, and there is a natural downward pressure on prices.

Summary table of key factors to watch

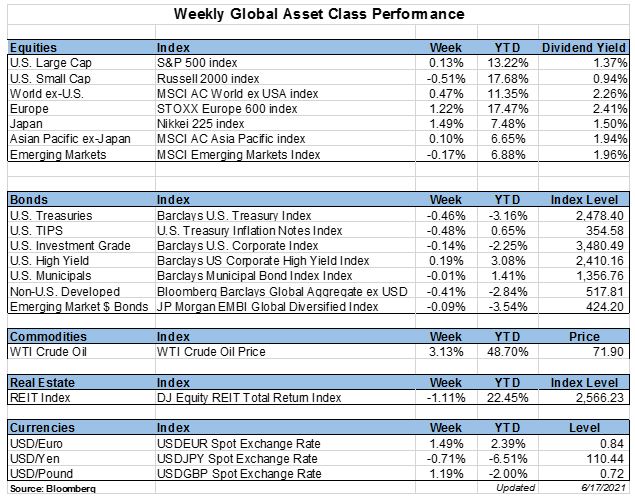

Weekly Global Asset Class Performance

Interview with Jimmy Barrett

Featuring Mike Smith, President Avidian Wealth Solutions

Mike Smith was interviewed on The Jimmy Barrett Show AM740 KTRH. Mike spoke about inflation, volatility, and the Fed potentially raising rates. “It is very important to have a well-diversified portfolio,” says Mike, President of Avidian Wealth Solutions. During the interview, Mike also discussed commodities such as Gold and Lumber.

Listen to the Interview Here

June 2021 Update – FPA Tax and Estate Planning Knowledge Circle

Written by Scott Bishop, MBA, CPA/PFS, CFP®

Since the election last November, I have been talking with experts and writing articles on potential income and estate tax changes under the new Biden Administration and Democratic Congressional majorities. Several of these articles are listed below.

Early in the new year, I wrote an article called Key Estate and Income Tax Planning Takeaways from the “Blue Wave” Democratic Victories based on my interview of and discussions with Marvin Blum, JD/CPA of the Blum Firm.

Click Here to Read the Entire Article

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*