Published on: 11/12/2021 • 5 min read

Avidian Report – Is Inflationary Pressure Rising In Real Estate?

INSIDE THIS EDITION:

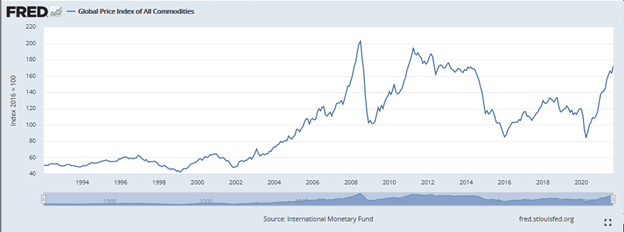

It is no secret that at this point, prices are rising. In just about all corners of the US economy, there is inflationary pressure building. As mentioned previously, it may all be transitory, as the Fed says. However, the fact remains that, at least for now, consumers are paying more than in years past.

In prior reports, we have focused on many commodity sectors, which have seen moves higher as demand outstrips demand in many instances.

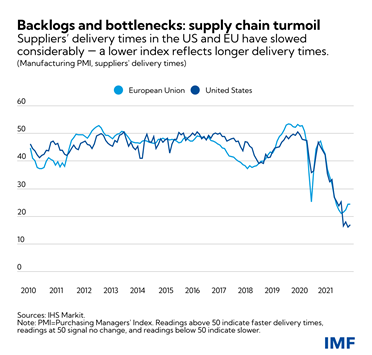

We have also discussed the impact that supply chain disruptions have had on other costs. These are no longer a secret.

What we have not touched on as much is inflationary pressures in the real estate market. So today, we will address that part of the economy as it makes up a large part of household budgets. Before looking at pricing, however, it is helpful to look at some supply data.

The chart below shows the monthly supply of homes in the United States. After falling to a record low in the second half of 2020, the monthly supply of available homes has risen toward a more normalized level.

On the rental side, we have seen a considerable drop-off in vacant housing units for rent in the United States, according to data collected by the U.S. Census Bureau.

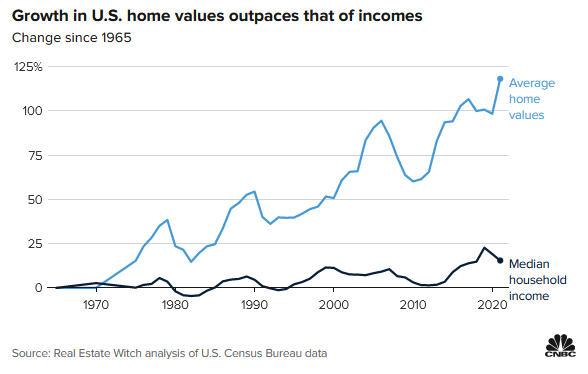

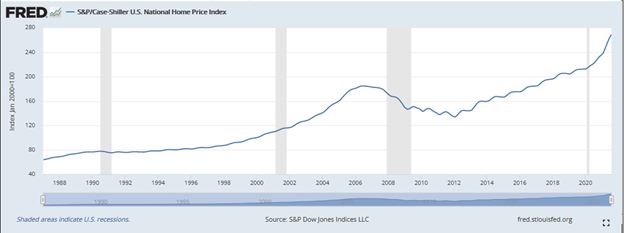

All of this has led to rising prices in housing markets throughout the United States. The chart below shows how much average home values have risen going back to 1965. We see a sharp increase since 2020, while at the same time median household incomes have fallen.

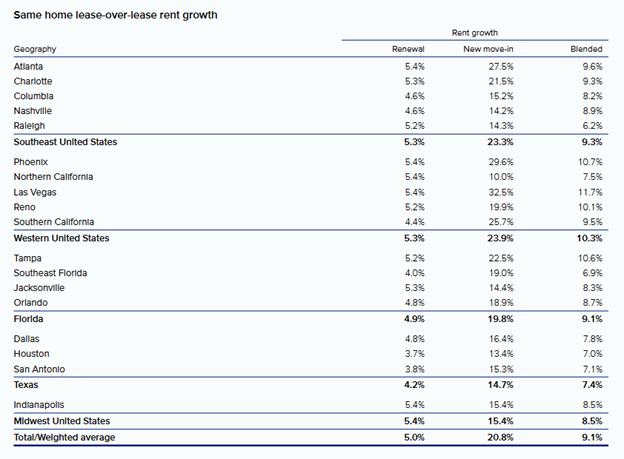

On the rental side of the housing market, rents are exploding higher. Take, for example, information from Tricon Residential Inc.’s (TCN) latest third-quarter earnings call. Tricon Residential (TCN) is a publicly traded rental housing company with visibility into diverse US and Canada markets. Because of their broad geographic footprint, the data they are reporting is highly indicative of what is being experienced by landlords across the US, particularly in the South and Western US.

More specifically, there is a sharp increase in rent growth across major metropolitan areas on a lease-over-lease basis. While renewed rentals have seen a 5% increase, the increase in new move-ins is most eye-popping. Las Vegas new move-in rents are up 32.5%, in Phoenix they are up 29.6%, and in Atlanta they are up 27.5%.

In Houston, the new move-in rents are up 13.4%, and although not as meaningful as in parts of the Western US, double-digit rent growth is impressive.

Tricon Residential Inc. Quarterly MD&A Q3 2021

Of course, this has all contributed to record high valuations across parts of the residential housing market in the United States.

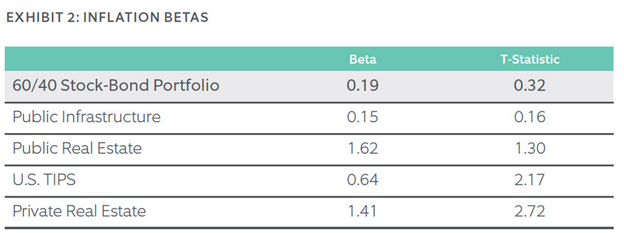

That said, some pockets of real estate offer more attractive valuations that investors should consider as real estate can be an effective inflation hedge, often offers an income stream, and adds diversification.

Source: Northern Trust Research, Morningstar

Those are reasons we continue to include real estate in our core portfolios at Avidian Wealth Solutions and why we believe all investors should consider whether an allocation to this important asset class is warranted in portfolios.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*