Published on: 02/18/2022 • 5 min read

Avidian Report – Is The Fed Trapped?

INSIDE THIS EDITION

Is The Fed Trapped?

Is Your Estate Plan Up To Date?

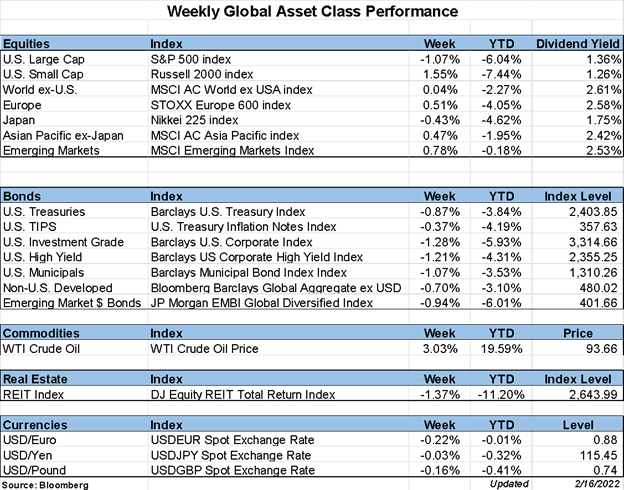

It has been six full weeks since 2022 started, and investors have already dealt with increased market volatility, a correction in technology-related shares, surprisingly hot inflation data, a jump in short-term yields, and heightened geopolitical tensions. And those are just the headlines. We have seen even more interesting data points that suggest investors have a very eventful 2022 ahead under the surface.

Take retail sales, which came in above expectations for the month of January after taking a bit of a breather in December. Total retail sales saw the most significant month-over-month upside surprise since March 2021, with non-store retail and autos/parts delivering the largest contribution to the January numbers.

Source: Twitter @Kathyjones

Although generally considered a sign of a strong economy, strong retail sales like this in an economy concerned with rising inflationary pressure only raised further concerns over what action the Federal Reserve Bank will take on monetary policy this upcoming March.

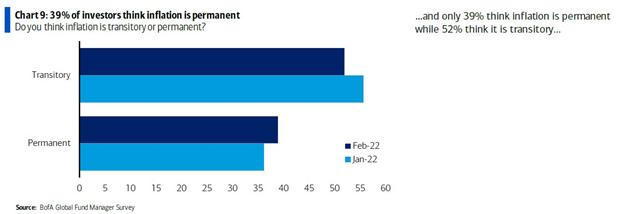

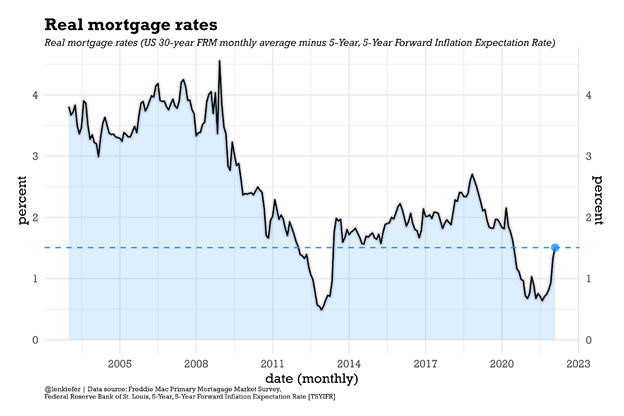

Part of the uncertainty is that while we have inflation, there are differing views on if the inflationary pressure we are seeing is transitory or more permanent. It is a polarizing topic, with 52% of Global Fund managers surveyed by Bank of America still saying it is transitory. And this matters quite a bit because if it is indeed transitory, there may be less of a need for the Federal Reserve to take aggressive action on interest rates. If it is more permanent, the Fed may be painted into a corner where they have to decide between raising interest rates aggressively and causing an economic slowdown or simply taking a less hawkish position and possibly risk higher, more persistent inflation to destroy buying power.

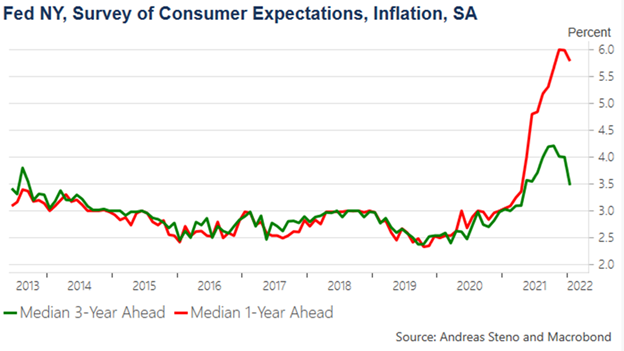

And as the chart below indicates, consumer expectations seem to agree with the transitory inflation camp.

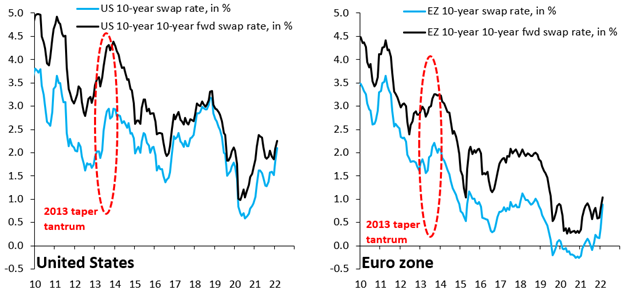

This is, in essence, what a flattening yield curve reflected in the US and Eurozone 10-year swap and 10-year forward swap rates are telling us – the Fed could potentially have to pick its poison.

Source: Twitter @RobinBrooksIIF

This is undoubtedly not an enviable position to be in because not only are the stakes high, but the calculus to determine the correct path is akin to threading a needle.

That said, consumer expectations for inflation appear to be trending lower, and it appears if these expectations prove incorrect, they are likely still believers of the Fed put.

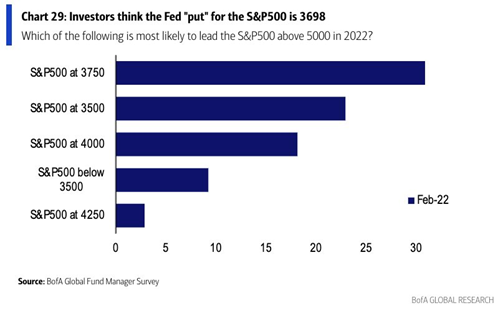

And who could blame them after seeing the Fed quickly turn dovish at the first sign of market volatility so many times over the last 15 years? However, there are signs that perhaps they believe the level at which a Fed put kicks in is considerably lower than it has been.

We would argue that investors shouldn’t place so much faith in the Fed put, especially seeing how the Fed appeared to reiterate its intentions to hike rates despite increasing market volatility to start the year. Could it be possible that the nature of the catch-22 they are in has forced the Fed to accept that policy decision for the economy’s long-term health is more important than the market levels?

Only time will tell how it works out, but one thing is for sure — a repricing for higher rates is already occurring, and the implications for consumer sentiment could be meaningful.

Since sentiment can drive investor behavior and thus market price action, investors should be considering value, quality, and some defensive equity in a portfolio. If optimism for the real economy declines, we could see some of that reflected in markets and get increasing levels of volatility. To be prepared, investors should look to these types of tilts to preserve capital and manage volatility if things get bumpy.

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*