Published on: 04/23/2021 • 5 min read

Avidian Report – Is There a Growing Case for Adding Commodities Exposure to Portfolios?

INSIDE THIS EDITION:

Is There a Growing Case for Adding Commodities Exposure to Portfolios?

2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

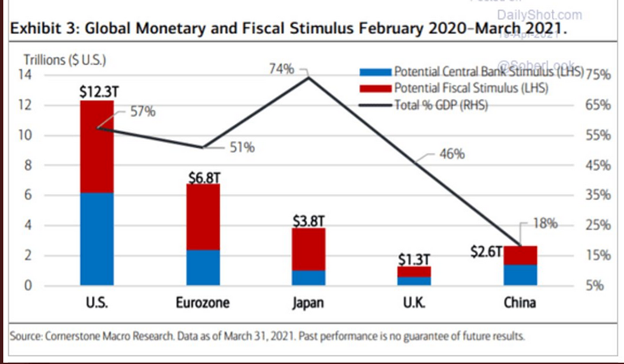

It is no secret that we have been through an unprecedented period of economic history over the last 15 months. We have seen a global pandemic shutter the world’s economy for an extended period and subsequently have witnessed policymakers come to the rescue with truly incredible amounts of both monetary and fiscal stimulus. If we look at the data going back to February 2020 when the pandemic began constraining economic activity, we can see that in the US, Eurozone, Japan, the UK and China, the name of the game has truly been to stimulate the economy until such time when the economic engines turn on full throttle.

This amount of money flooding the system has stoked inflation fears among fund managers. As the chart below illustrates, the Bank of America fund manager survey has not had inflation expectations close to this high since May 2004. In fact, the recent April reading is an all-time high going back to 1995.

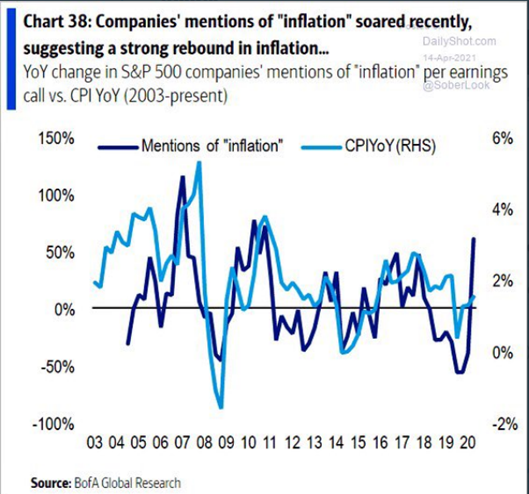

And it is not only fund managers expecting more inflation. Rising expectations for higher inflation also appear to be coming from corporate boardrooms, with a noticeable spike in mentions of inflation on company conference calls.

The Federal Reserve has similarly said that they will let inflation run hot but that they believe the bump in inflation will be transitory. While it remains to be seen whether the Fed will be correct in their assessment, we believe there is certainly a risk that some of the increases to input prices could stick around and lead to higher prices for consumers.

This is especially true for certain commodities, including copper, which sees more structural supply and demand imbalances that might only be exacerbated by the push for renewable energy and electrification.

If we survey commodity prices more broadly, we see definite signs of inflation. Whether we are looking at lumber, crude oil, gasoline, heating oil, corn, copper or sugar, the last 12 months have seen more than 50% price rises for each of these commodities. To that end, the chart below shows price increases of more than two standard deviations for over 40 major commodities.

Yet, we think investors may still have time to add some commodity exposure to their portfolios. Despite the recent short-term moves higher across many commodities, we believe many commodities still present great value. Take, for example, the chart below of the commodities to S&P 500 ratio. Going back to 1970, commodities are as cheap as they have been relative to the broad domestic equity market.

While we believe selectivity is warranted, we also believe investors should be looking at the commodity sector for potentially outsized returns. However, exposure should be kept in line with risk tolerance as commodities can be highly volatile, and price action can quickly turn.

Weekly Global Asset Class Performance

2021 Discussion of Tax and Estate Tax Changes – Barron’s Live

Written by Scott Bishop, MBA, CPA/PFS, CFP® | April 7th, 2021

Scott Bishop was on Barron’s Live Podcast (part of MarketWatch) with Andrew Keshner on April 7th. The topic was about “Make the Best out of our Complicated Tax Season”. A link to the webinar can be found below. Also, a summary of some of our discussion items can be found following the link.

Webinar Recording: Making the Best Out of Our Complicated Tax Season

Read Full Article Here

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*