Published on: 06/04/2021 • 8 min read

Avidian Report – Is There More Upside Ahead for Equities? What about Oil?

INSIDE THIS EDITION:

Is There More Upside Ahead for Equities? What about Oil?

10 Most Asked Tax Questions so Far in 2021

Estate Tax Law and Strategy Changes are Coming

One of the most challenging things to do when markets decline or when the economy falters is to deploy capital. However, it is equally challenging to deploy capital when markets have ripped higher and many asset classes sport extended valuations like they do today. These two scenarios tend to be scary and uncomfortable, even for the seasoned investor.

At times like these, some investors choose to deploy capital slowly and selectively. While we do not dispute that this can help cope with investor fears, we believe it is equally important to maintain balance within portfolios. This means having exposure to value and growth, exposure to domestic and international equities, and exposure to defensive investments as well as more cyclical ones. There are too many possible outcomes that investors must be prepared for. If you look over the last 14 months or so, this has been our playbook for dealing with heightened uncertainty.

In hindsight, it has been the right approach for limiting performance drag, keeping exposure levels appropriate for the speed and pace of the post-COVID recovery, and accommodating a wide range of potential outcomes. Moving forward, this will continue to be a reasonable approach for adding exposure while managing risk.

With the markets now back above pre-COVID levels, the Avidian Wealth Solutions Investment Committee has debated whether equity markets have fully priced in the economic recovery or not and whether inflationary pressures are transitory or will be more durable than the Federal Reserve seems to believe. We have written about this on numerous occasions over the last several months and admit that it remains considerably uncertain with lingering questions around interest rates, fiscal policy, and inflation. That said, each week, we have more data points to pore over that help us gain clarity on the path forward. This process has led us on numerous occasions to make portfolio adjustments intended to position us for where the puck is heading rather than where it has been. We think the sharp broad-based post-COVID stock market recovery is largely behind us. However, that does not mean that we cannot aim higher, especially as the rest of the world sees a marked improvement in their COVID response and a commensurate improvement in confidence.

Similarly, it also does not mean that there are not pockets of tremendous opportunity available to investors in today’s market.

This week’s market update highlights some developments in the energy market we are watching that could be an opportunity in the current environment.

Energy Market

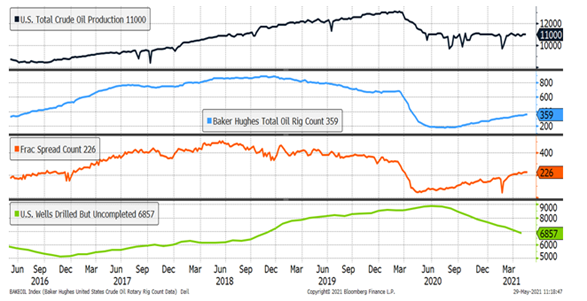

The chart that follows provides a snapshot of the energy market. It includes US total crude oil production, total oil rig count, frac spread count, and US drilled but uncompleted wells.

We will not touch on each of the panels of the chart above. However, it is somewhat noteworthy that despite an increasing oil rig count and rising frac fleet as measured by the frac spread count, US total crude oil production has not meaningfully moved higher despite higher oil prices. This may be caused by both the amount of time it takes to get wells back online and because of widespread underinvestment, a condition that could last as securing financing for these types of projects becomes more challenging and as supermajors move toward cutting emissions.

Over the last week alone, we saw key developments that support the idea that supermajors will move in this direction. Take Royal Dutch Shell, which lost a lawsuit to an environmental organization and a group of 17,000 citizens over environmental damages and could be forced to reduce emissions by 45% by 2030. Then we had Chevron shareholders vote to similarly reduce emissions at Chevron, though without any target dates or amounts given. And lastly, we had Exxon lose two board seats to hedge fund, Engine 1, nominees expected to be champions for fighting climate change inside the board room. These moves foreshadow a shifting dynamic for energy companies that could make investing in fossil fuel business more difficult and give underinvestment a longer runway.

At the same time, we have forecasts that show both global oil demand and global gas demand rising. This supply and demand mismatch, should it last (and we think it could for up to a few years), could put some upward pressure on oil prices.

Add to that expected rising demand for petrochemicals in other parts of the world, including China, and it becomes clear that supply and demand dynamics could potentially be favorable for rising oil prices.

Moreover, we have seen a weaker US dollar as of late as central bank policy looks set to potentially diverge somewhat, and we get yet another supportive mechanism for oil prices should it continue.

Of course, forecasting oil prices is complex, and risks in the sector are ever-present. There is always risk around supply/demand shifts and geopolitics, which are in many cases impossible to foresee. Some of the data looks like it could set up a tactical opportunity in the energy sector. Investors should pay close attention here as a run higher in energy prices could be a boon to some parts of the energy complex, including potentially small to mid-sized energy companies that might avoid the pressure to fulfill ESG mandates immediately.

Weekly Global Asset Class Performance

10 Most Asked Tax Questions so Far in 2021

Written by Scott Bishop, MBA, CPA/PFS, CFP®

At Avidian Wealth, we hear from our clients frequently about pending tax law changes. If you have followed my articles over the years, you know that I often write about taxes and their impact on your estate, retirement and overall financial planning; several of these articles are referenced at the end of this piece.

With all the tax law changes we are considering as “pay for’s,” and in terms of having Americans “Pay their Fair Share,” we receive many calls from clients asking, “What should we do?” At this point, there is no immutable law and no solid guidance as to what will pass and when any changes will be effective, but we believe it is helpful to share some of our recommendations based on the ten most asked questions that we hear. But of course, before taking any action, please check with your tax and financial planning team!

Click Here to Read the Entire Article

Estate Tax Law and Strategy Changes are Coming

Written by Scott Bishop, MBA, CPA/PFS, CFP®

At Avidian, we hear from our clients frequently about the pending tax law changes. If you have followed my articles over the years, you know that I often write about taxes and their impact on your estate, retirement, and overall financial planning – several of the articles are referenced at the end of this piece.

Currently, many tax changes are being considered that will change the estate and gift tax exemption amounts (the amount you can exclude from estate taxes at your death or during lifetime gifting), the tax rate, and the possibility of the government legislatively ending many of the strategies we have used for decades (that have been approved by the IRS and/or through tax court cases). For more information on these specific issues, I have discussed many of these changes in previous articles listed at the bottom of this article.

Click Here to Read the Entire Article

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*