Published on: 01/28/2022 • 5 min read

Avidian Report – Let’s Put Recent Volatility Into Context

INSIDE THIS EDITION

Let’s Put Recent Volatility Into Context

Financial Planning Ideas – Build Back Better Edition

As many of our readers may know, this has been a highly volatile week in equity markets as a confluence of events has led to seesaw pricing activity across risk assets. Those events have included inflation concerns, a widely anticipated FOMC interest rate decision this past Wednesday, and rising geopolitical tensions in Ukraine that have involved the mobilization of NATO troops to the region to guard against a potential incursion by Russia. That’s a lot for the equity market to digest in less than a week and has furthered the decline occurring in some individual securities.

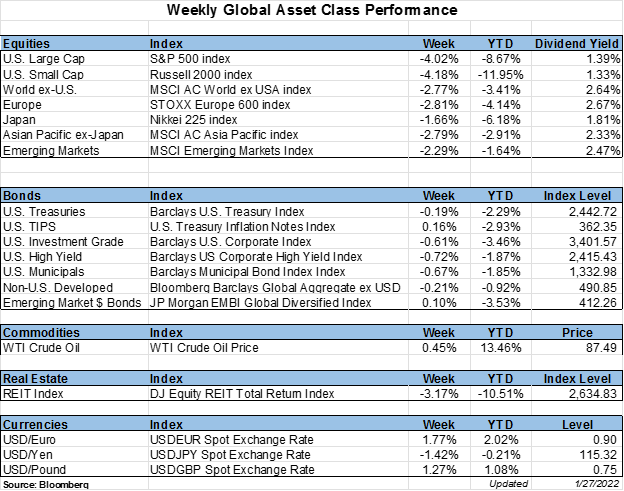

Up until this past week, the damage to indexes has been relatively minimal. But now, we are amid a formidable stock market correction. One, that we would argue is healthy considering lofty valuations, particularly in the technology sector, and the boom in meme stocks. As the table below shows, indexes have seen meaningful drawdowns but certainly not to the extent that individual stocks have experienced. Nevertheless, we know that these types of market swings can lead to feelings of both fear and greed which if not managed can be detrimental to your wealth.

Of course, leaving emotions like fear and greed out of decision-making is easier said than done. This is especially true as many investors experienced catastrophic losses during the dot-com crash in 2000-2001 and again during the financial crisis in 2008. It took years to recover from those massive drawdowns, but the pain felt by investors during those events took even longer to dissipate. In fact, the stock market crashes in 2000 and 2008 have left many investors anchored to those experiences, which create behavioral biases that make it difficult to make sound and well-reasoned investment decisions.

Although we don’t foresee an economic recession right around the corner, we do think we are progressing from the mid-stage to the late stage of the business cycle. It is during this phase that a well-defined risk management process takes on even greater importance. A rational and forward-looking game plan can never be overemphasized, particularly as the current business cycle matures. First and foremost, it is important for investors to have a clear picture of their long-term financial objectives and risk tolerance so that they take on the appropriate amount of risk. Moreover, tactical management based on macroeconomic, fundamental, and technical analysis can help reduce errors and potentially generate excess returns as volatility creates opportunity.

Let’s consider for a moment, the financial crisis in 2008. During that crisis, investors felt tremendous pain on the way down which caused many to react emotionally and sell out of investments at or near the bottom. If that wasn’t bad enough, those same investors then experienced “double-losses” as in many cases they were paralyzed by fear and unable to put capital back to work as markets entered a post-crash recovery.

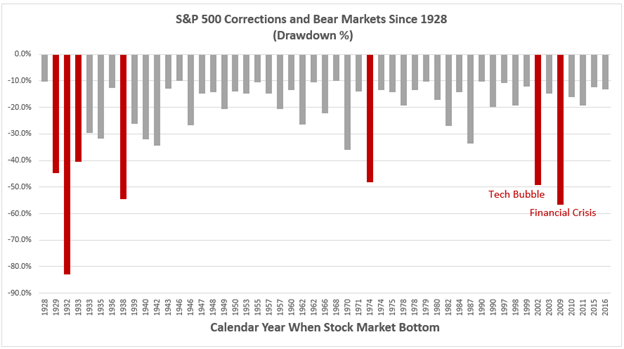

To prevent falling into the trap so many investors did during the financial crisis, it is important to not succumb to anchoring bias. For that reason, this week we want to put corrections and bear markets into a historical context. What you will find is that corrections and bear markets happen frequently. In fact, from 1928 until February 2019, there have been more than 50 corrections of at least 10%. That amounts to a 10% correction every couple of years. Do you remember the one we had in mid-2015? What about the one that lasted from November 2015 until February 2016? If you don’t, you probably have good company.

Source: Avidian Wealth Solutions

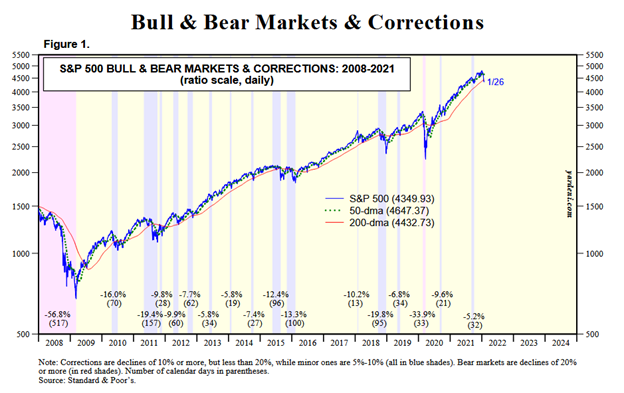

Going back to 2008, the corrections of 10% or more that we have seen for the S&P 500 have also had varying durations, shown in parenthesis in the chart below. Some have been long while others have been short-lived. Regardless, whenever they have occurred, they have been somewhat uncomfortable.

Source: Yardeni Research

This current drawdown is no different with investors feeling a bit of discomfort especially considering a stronger inflationary impulse than we have seen in a while and the specter of Fed interest rate hikes during the remainder of the year. However, we continue to believe that there is a possibility for an easing of inflationary pressures later this year and that the Fed may have a chance to be a bit less aggressive in their rate hikes as they try to navigate their way through 2022.

That said, investors should recognize, and prepare their portfolios, for potential surprises. The truth is that missteps by central banks in this process of tightening and loosening financial conditions always poses risk. To guard against the risks during a rate hiking cycle we favor diversification across strategies, sectors, and regions. Our experience has been that a comprehensive financial plan can help guide the way. Investors should also maintain a risk management discipline. It is important to know which moves you will make in your portfolio if certain scenarios play out. An advisor can help with this process.

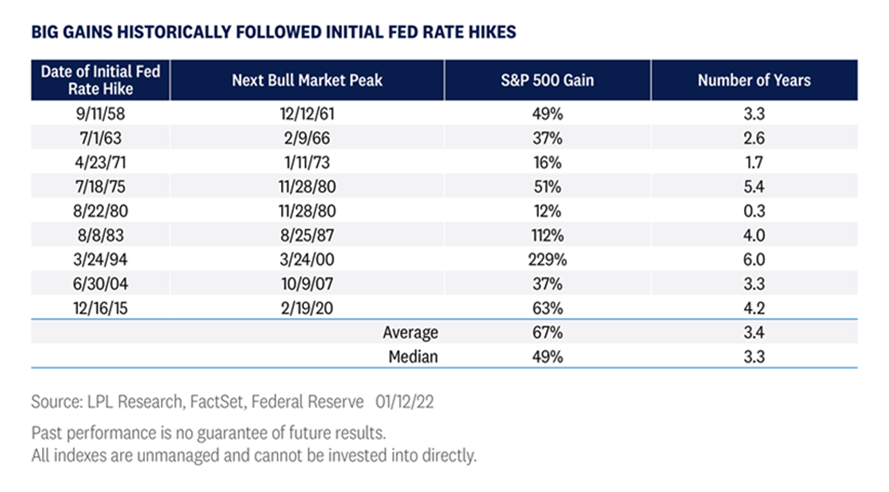

Lastly, we think investors should keep two things in mind through volatility. First, market volatility is a feature of the market and can be representative of tremendous opportunity. Second, the beginning of interest rate hiking cycles often does little to derail positive equity market performance.

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*