Published on: 05/13/2022 • 6 min read

Avidian Report – Let’s Put Volatility Into Context

INSIDE THIS EDITION

Let’s Put Volatility Into Context

Considering the sharp rise in volatility this year, we share our thoughts, hoping they help put the current drawdown into context.

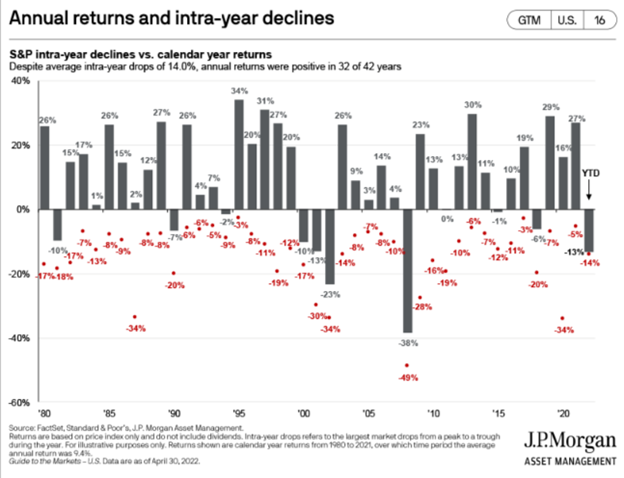

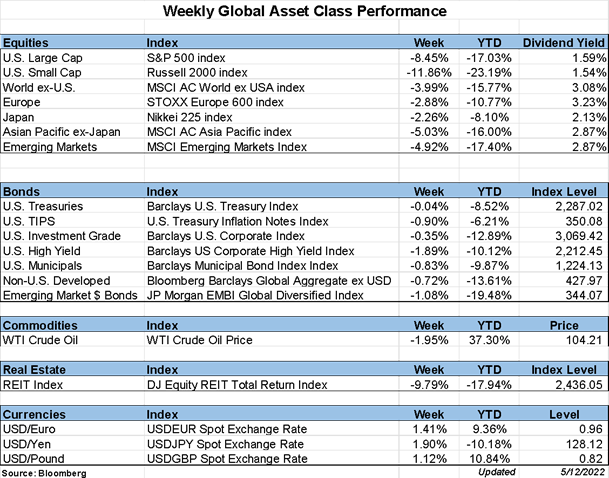

As investors know, the current drawdown across fixed income and equity markets intensified during April and has spilled over into the first week of May. However, this is a fairly normal drawdown from a historical perspective despite the volatility. As the chart below shows, the S&P 500 averages an intra-year drop of 14%. The S&P 500 is down 17.18% on a total return basis through 5/11/2022, a bit more than the average intra-year drawdown but not much. Although the tech-heavy NASDAQ Composite is down a steeper 27.08% through the same period, this is not a time for panic.

Instead, it is a time for perspective and understanding that the drivers for today’s drawdown are undoubtedly different from those in the past.

Drivers of recent drawdown

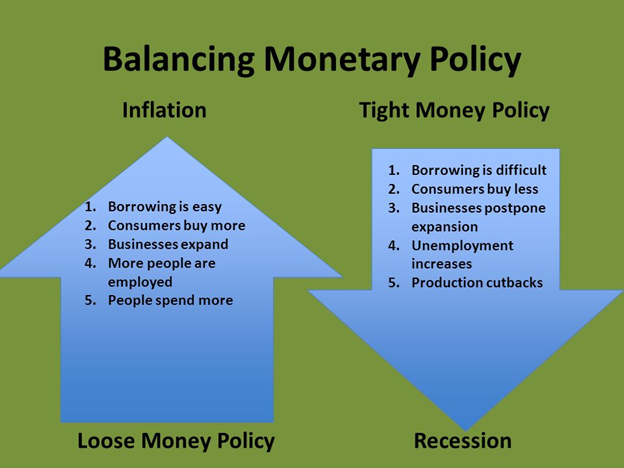

First, for many years, the Federal Reserve pursued a loose monetary policy. Last year that loose monetary stance continued despite increasing signs of inflation and growing concerns over asset bubbles. However, the Fed stuck to its “inflation is transitory” narrative, causing asset prices to rise ahead of their fundamentals. This year, the Fed pivoted as they dropped transitory from their description of inflation, and asset prices began to reprice lower, reflecting a potentially more hawkish Federal Reserve.

Second, in addition to the shift in Fed tone and rising rates, the conflict between Russia and Ukraine and supply chain issues in China have created concerns about accelerating inflation. This has only served to increase further the market consensus that the Fed would have to act swiftly by raising rates in an environment where China’s lockdown of major population centers like Shanghai would also begin to impact global growth.

Inflation is at the center of recent volatility. While inflation is running hot both domestically and abroad, there are possible signs that it is peaking, especially when we consider a reduction in the ship backlog outside the port of Los Angeles, wages hitting an apparent plateau, and some anecdotal evidence of consumers opting to delay purchases in response to high prices. These all could present possible catalysts for less inflation moving forward. However, there are questions about whether these would be enough to offset inflationary pressures from rising crude oil and natural gas prices.

And that is not the only uncertainty. Investors must also acknowledge uncertainties around how the conflict between Russia/Ukraine will evolve, whether China will ease COVID restrictions and lead to an easing of supply chain issues and whether inflationary tailwinds will be eased sufficiently to make the Federal Reserve turn more dovish. Until these questions are answered, we expect to see more volatility in markets despite relatively constructive economic fundamentals.

Range of Possible Scenarios

As always, this leaves investors grappling with a range of possible scenarios that we must consider as we manage portfolios. Today, we see three possible scenarios playing out regarding inflation.

The first is perhaps the most favorable, a scenario where the Fed can rein in inflation without causing a recession. While this is ideal, it is not an easy task as the Fed would be tasked with making the correct policy decisions and restoring its credibility.

The second is a middle-of-the-road outcome where the Fed acts swiftly to get inflation under control but causes a shallow recession. Although nobody likes to hear the word recession, the shallowness of a recession under this scenario could surprise investors and possibly lead to a more stable market after heightened volatility.

Last, and perhaps the worst possible outcome, is one where inflation continues to run hot, and the Fed is forced to be more aggressive than current expectations. This would almost certainly cause a sharper decline in risk assets as investors might head for the exits. However, we see this as a low probability outcome, especially considering that the Fed has responded to equity market volatility in a supportive fashion over a period of years. The Fed would likely again step into calm investor anxiety and lend some stability to stocks and bonds at a certain price level for significant indices.

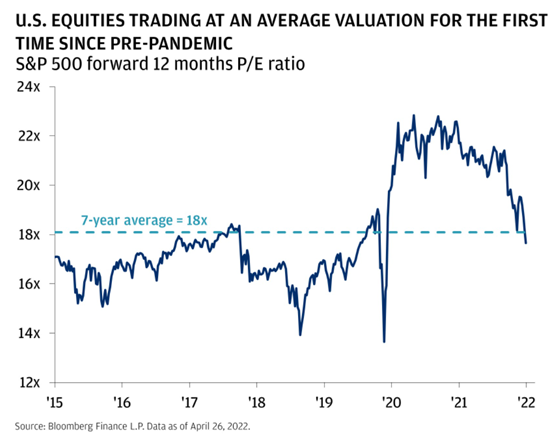

The market came into 2022 overvalued and with limited expected future returns. However, after the current sell-off, we see much more attractive valuations for the first time since the start of the pandemic. The chart below shows that US equities are now trading at an average valuation below the 7-year average of 18x earnings. This is a meaningful reduction from even the start of this year and is a very positive step for the long-term health of the market. More importantly, lower valuations also support better future expected returns which should be music to investors’ ears.

So, what should investors do in their portfolios? Everyone has a different situation that will factor into portfolio decisions, but over the last year, we have advocated for investors to prepare for this environment by building a risk management discipline and focusing on diversification. Then we started to highlight the merits of value and quality, emphasizing strong balance sheet businesses and sectors. This shift would have mitigated some of the downsides, albeit not entirely.

Investors should monitor inflationary indicators as they could be the key to successfully navigating the environment ahead. Further, investors should consider value and quality factors in their portfolios with some inflation hedges for added protection as we await a better read-through of inflation data.

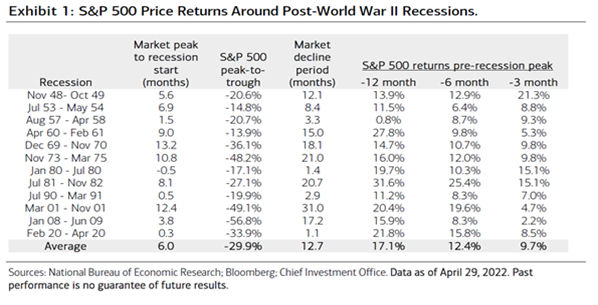

We think it is valuable to see S&P performance leading up to and during recessions in the table below. Overall, the key takeaway is that with the market down considerably and much of the excess being burned off, we may be closer to a trough than the decline’s start.

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. The information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, and formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*