Published on: 01/07/2022 • 5 min read

Avidian Report – Let’s Talk China

INSIDE THIS EDITION

Let’s Talk China

Financial Planning Ideas – Build Back Better Edition

The truth is that if you don’t have China on your radar, you’re probably not paying much attention. China has been in the headlines over the last twelve months for several reasons including a regulatory crackdown, concerns about its property sector, political tensions over Taiwan, and of course the pandemic.

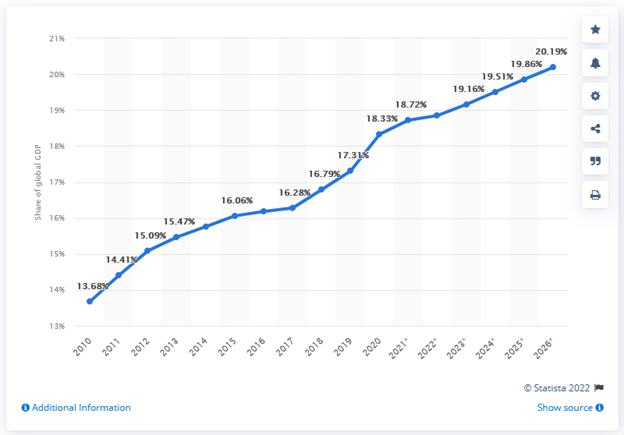

Clearly, cover the next several years as their economy is among the largest in the world and is forecast to only grow larger in terms of world GDP.

China Share of Global GDP

For that reason, we think investors should pay attention to China rather than dismiss it. After all, markets are global in nature and as investors, we have a duty to try to better understand anything that might impact our investments.

As is often said, to understand where we are going, sometimes it is helpful to have an awareness of where we have been. Since we only have a few pages to touch on the topic, we will be brief and focus on the last year.

Following a V-shaped recovery in 2020, China was widely expected to be a driver of global economic growth in 2021. However, shifting regulatory priorities changed that view. Especially when considering that those changes coincided with the rapid deceleration of economic growth.

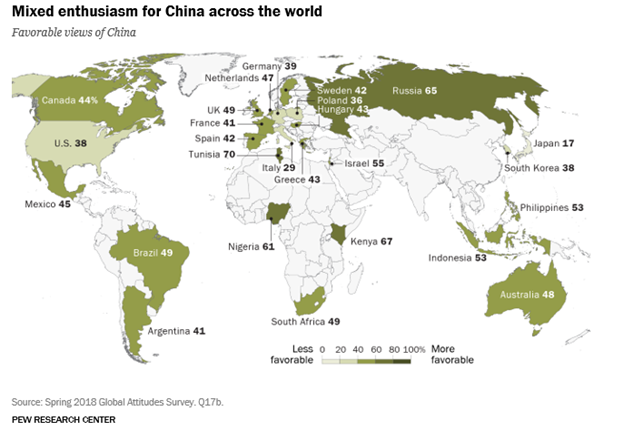

With such sharp shifts, especially as it relates to policy, investors were both surprised and confused. Not a great combination for strong equity performance. As a result, investors responded by taking a sell first and asking questions later approach to their Chinese stock exposure in the latest sign that domestically the view of China continues to skew negative.

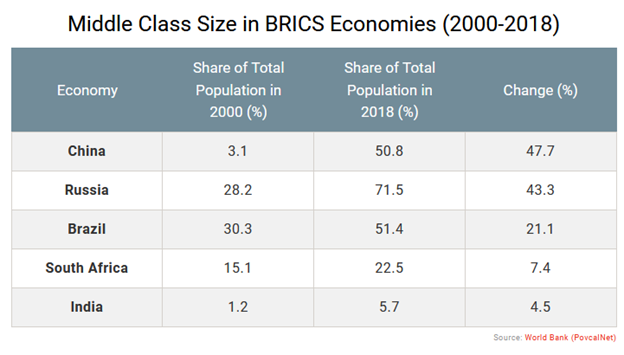

However, we think the investor reaction to the latest policy shifts in China was largely overdone. This is especially clear when we consider their history. The record supports the view that the Chinese government tends to institute reforms whenever the economic conditions are favorable to do so. This is clearly the case today as their leadership understands their role as the world’s “factory” helped lift the country out of poverty, but not enough to escape the “middle income” trap.

Recognizing this challenge, policymakers in China seemingly instituted policy to facilitate secular change that tilts the country away from the old model of heavy industry and towards a more knowledge-based and service-oriented economy. All with the goal of narrowing their existing wealth gap and promoting more long-term sustainable growth.

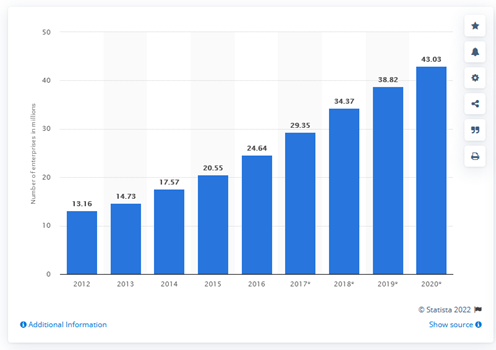

Number of Small to Medium-sized Enterprises in China

In their eyes, this is a noble cause that would support middle-class households as well as small- and medium-sized private businesses which in turn should encourage domestic production and consumption. A move that because of their place in the economic pecking order might be viewed as favorable to the global economy.

That’s where we have been with China but where could they be heading as we move through the remainder of this year and into next?

For one, it is now becoming clear that Chinese policymakers no longer focus exclusively on the quantity of growth, but also on its quality. This shift should make the Chinese economy more resilient in the long term with a stronger emphasis on growth for small and medium-sized private businesses, high-end manufacturing, technological innovation, domestic consumption, and green sectors. It appears that for this to materialize, Chinese policy must first deleverage, second bring prosperity to the middle class, third focus on decarbonization initiatives and lastly improve public health.

As they pursue these goals, we expect short-term costs to pile up in China in the way of weaker economic growth through the first quarter of 2022. However, beyond that, we think a growth acceleration could be in the cards as policymakers balance long-term goals with the need to support present-day growth. We think more stability is ahead as growth is showing early signs of reacceleration.

This is one reason we believe some investors maintain some, although not excessive, international exposure that includes China today. The other is seen in the historical record which shows that during historical episodes of reform, Chinese markets have been positive by an average of 28% in the six months after a market trough. Further, investor confidence about the end of surprises could help the market find its footing sooner rather than later with inflows to Chinese markets returning and supporting better performance to international and emerging markets.

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*