Published on: 05/21/2021 • 6 min read

Avidian Report – Observations on the Economy and Equity Market

INSIDE THIS EDITION:

Observations on the Economy and Equity Market

10 Most Asked Tax Questions so Far in 2021

This week’s market report will focus on a review of what we are seeing in the data related to the economy and the equity markets. These data points hold essential information about the state of the post-covid recovery and, more importantly for investors, might help highlight some areas of both risk and opportunity going forward.

Large caps vs. Small Cap Stocks

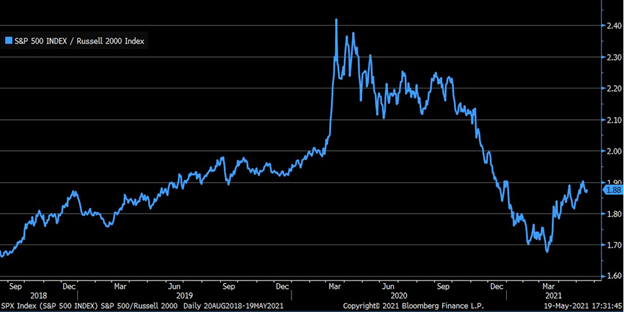

The chart below shows the ratio of S&P 500 stocks and Russell 2000 stocks (in other words, large cap and small cap stocks). We note that from March 2020 until March 2021, small cap stocks have gained relative to large cap stocks. However, most notably in the chart below, large caps have reversed the trend by taking leadership over smaller cap peers since March 2021. As the economy continues to improve and interest rates possibly rise, we think capitalizations may matter less than whether companies are value or growth names.

Value vs. Growth

As investors have rotated from growth stocks to more value-oriented stocks of late, we have been tracking the performance of heavily shorted technology stocks. As the chart below shows, a basket of technology shares with high short interest have lost 39% of their market caps since February.

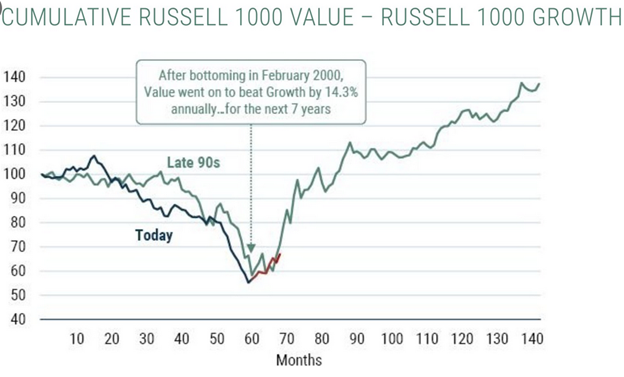

Not only is this a sharp decline, but it also begs the question of whether value will continue to shine relative to growth for the foreseeable future. We think that if history is any indication, it is certainly very possible that value takes market leadership moving forward, at least for some time. In fact, if we plot the Russell 1000 value index over the Russell 1000 growth index, we see a very similar trajectory today compared to what we saw following the market bottom in February 2000. During that cycle that followed the dot-com crash, value outperformed value by 14.3% annually for seven years. While we are not sure if this will happen again, we believe investors should review their allocations to growth vs. value to make sure they are positioned for a scenario that could see value outperform growth.

Equity responsiveness to earnings

As we entered the first quarter, we saw a chorus almost across the board of investors and economists talking about a strong post-pandemic recovery. When factoring base effects of depressed earnings in 2020 due to economic shutdowns, we are not surprised that this has materialized in the way of blowout earnings results. However, more interesting is that these expectations were truly priced in, almost fully with the stocks of the S&P 500 that have beaten estimates outperforming the broader S&P 500 by a paltry 0.02% the day following earnings releases. This lack of reaction may continue for the next quarter to some degree but should normalize gradually as we get into the 3rd and 4th quarters. The implication for investors, of course, is that earnings results to the upside may matter much less for the next several months, but results that come in under expectations could result in selling pressure to those stocks that underdeliver. This could be a risk, especially for investors in individual stocks, but also a potential opportunity for the discerning investor.

What is M&A Activity telling us?

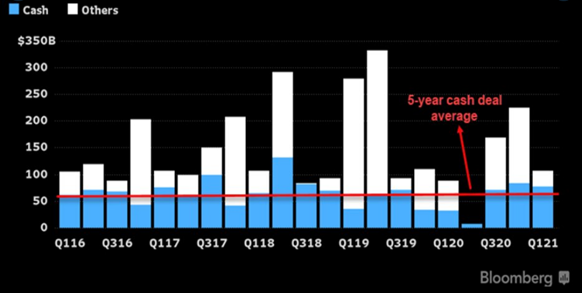

As the chart below shows, merger and acquisition (M&A) activity nearly dried up in the second quarter of 2020. In fact, that quarter saw only cash deals for companies in the S&P 500 and, in aggregate, were well below the 5-year average for both merger deals and well below the 5-year average for all-cash deals. Fast forward to today, and we have seen a drastic recovery with each of the last three quarters producing all-cash deals that exceed that 5-year cash deal average.

This is notable because it provides three key insights for the economy and health of corporate balance sheets. First, the larger than average amounts spent on all-cash M&A speaks to the strength of corporate balance sheets despite the global pandemic. Second, it highlights that companies are back to operating as usual and looking for opportunities to grow and consolidate. Lastly, it shows that corporate management teams are feeling increasingly confident in their financial forecasts and budgets.

However, we think this is something for investors to keep an eye on, especially as valuation levels are extended and calls into question whether companies are overpaying in these M&A transactions, thus hurting their intermediate-term value creation potential.

Consumers appear to be feeling less financial stress

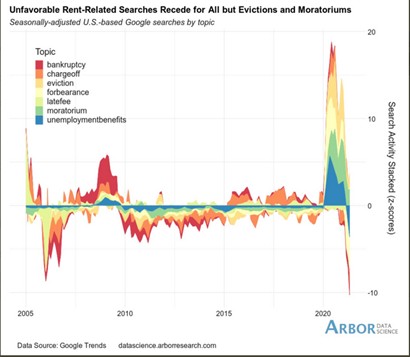

As we have continued to see continued stimulus payments, the lifting of mask requirements, and the increasing availability of vaccines, it seems consumers in the U.S. are feeling more confident. Take, for example, the search activity for things like bankruptcy, eviction, unemployment benefits as plotted in the chart below. Over the last three months, internet searches for these terms associated with financial stress have fallen off a cliff.

Weekly Global Asset Class Performance

10 Most Asked Tax Questions so Far in 2021

Written by Scott Bishop, MBA, CPA/PFS, CFP®

At Avidian Wealth, we hear from our clients frequently about pending tax law changes. If you have followed my articles over the years, you know that I often write about taxes and their impact on your estate, retirement and overall financial planning; several of these articles are referenced at the end of this piece.

With all the tax law changes we are considering as “pay for’s,” and in terms of having Americans “Pay their Fair Share,” we receive many calls from clients asking, “What should we do?” At this point, there is no immutable law and no solid guidance as to what will pass and when any changes will be effective, but we believe it is helpful to share some of our recommendations based on the ten most asked questions that we hear. But of course, before taking any action, please check with your tax and financial planning team!

Click Here to Read the Entire Article

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*