Published on: 10/01/2021 • 5 min read

Avidian Report – Oil Market Update and Why All Investors Should Be Watching

INSIDE THIS EDITION:

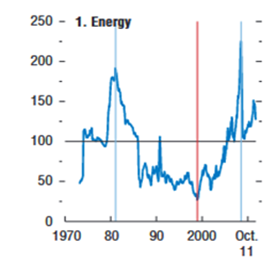

In the 1970s, an energy crisis came along with two supply shocks – one in 1973 and another in 1979. The shock in 1973 was caused by OPEC producers putting an embargo on oil exports to the US and the threat of production cuts. At that time, Americans relied on oil for nearly 50% of all energy needs, and imports were being relied upon to meet high demand. With the introduction of the embargo, shipments of oil to the US were cut, which led to shortages, panic at the pump, and higher energy prices.

Energy Prices

Fast forward to today, where we just had the mother of all negative demand shocks thanks to COVID-19 as the US and other global economies had to endure stay-at-home orders, and some are wondering what happens now.

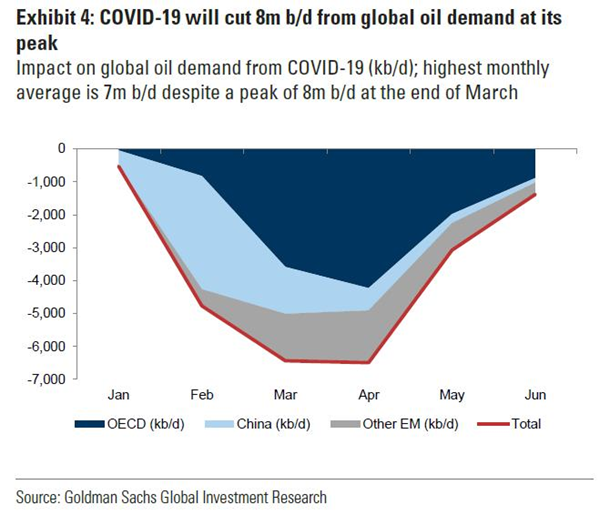

From GS Global Investment Research in early 2020

What we know is that supply and demand shocks move oil prices. The Dallas Federal Reserve Bank published a paper about how demand shocks are especially effective at driving oil prices.

Just take a look at the chart below, which shows how the COVID-19 demand shock sent crude oil prices tumbling sharply in 2020.

With the global economy now reopening, some investors think the pendulum could swing the other way with a possible positive demand shock that could send oil prices higher. Not only that, but some are seeing signs of an emerging energy crisis like we had in the 1970s marked by supply shortages.

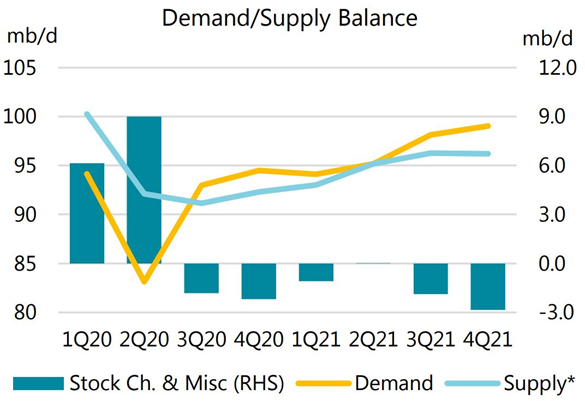

They cite that oil supply has risen slower than demand this year and has led to meaningful inventory draws that indicate that there is less production occurring than what is being used.

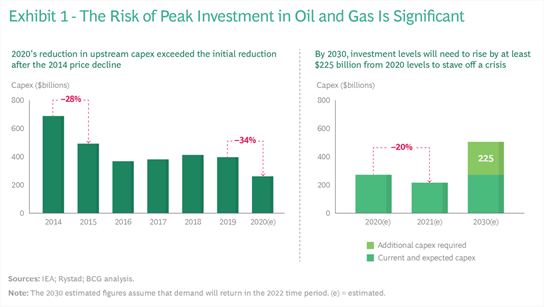

This has proven to support oil prices for the last several months, with oil prices remaining above $65/bbl since May. Historically, as prices rise, pressure increases to ramp up production to alleviate higher prices eventually. But those who are bullish energy commodities say that hasn’t happened this year and blame ESG mandates, in part, that have disincentivized investment in oil & gas production.

And, reductions in production aren’t limited to North America. They often point to data from OPEC+ countries as showing production capacity declines as well.

Although recent announcements from places like Nigeria indicate slight increases in production, those in the bull camp hypothesize that it is just lip service or that capacity to increase production is highly constrained. This leads many oil bulls to believe that whatever production increases, we get to be enough to offset rising demand and keep prices at current levels.

While we don’t know whether the hypothesis is true or not, the fact remains that following COVID-19 lockdowns, demand is recovering sharply–much faster than perhaps many expected.

And if the production capacity constraints highlighted above turn out to be accurate, the world may be set up for a longer-lasting structural supply deficit which would push oil prices higher. However, investors in the energy sector should monitor new data and developments as oil markets are notoriously volatile and can shift on a dime.

But this word of advice is not limited to energy sector investors. We urge non-energy sector investors to pay attention to what happens in energy markets as well. Shifts to supply or demand for key commodities like oil can cause significant inflections on short notice to those markets and the broader economy, especially as energy costs are a major component of producer and consumer prices that impact the real economy.

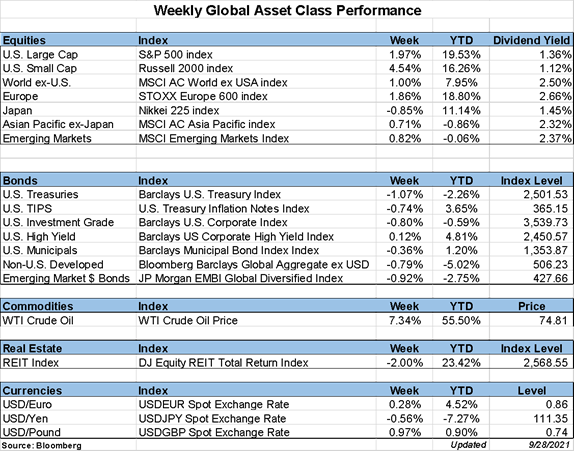

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*