Published on: 11/04/2020 • 6 min read

Avidian Report – Post-Election Implications for Stocks and Bonds – copy

INSIDE THIS EDITION:

Post-Election Implications for Stocks and Bonds

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Coronavirus / COVID-19 Resource Center

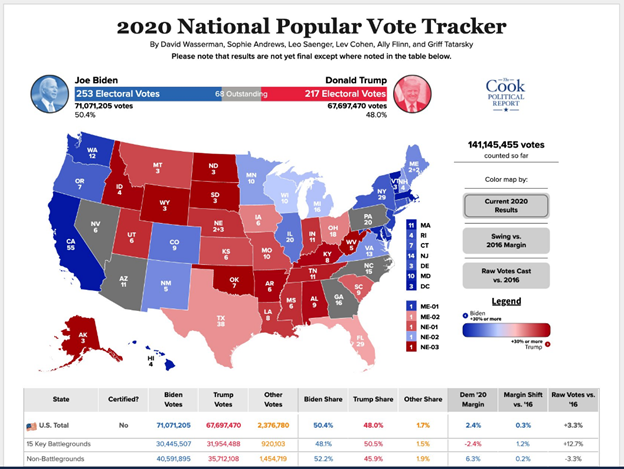

Before we get into our weekly market commentary, we thought it would be worth showing the 2020 National Popular Vote Tracker below with some interesting data that shows how voting shifted this election compared to the election in 2016, which was also hotly contested before Donald Trump won the White House.

[toggle title=’Read More’]

While this data is not necessarily indicative of who will ultimately win the election this year, it does paint the picture of a gradually shifting tide in 15 key battleground states compared to four years ago. And as we all know, the outcome of presidential races often hinges on what happens in those key battleground states.

With that said, ballots are still being counted as we write this week’s commentary in many of those key states, and because of the razor-thin margins for either candidate, it remains anybody’s race. However, to us, some of the numbers do make it seem that Joe Biden may have more possible ways to secure the 270 electoral college votes necessary to win the presidential race. Of course, we said the same thing in 2016 before Donald Trump surprised many with a down-to-the-wire defeat of Hilary Clinton.

With such a close race yet again this year, it could still be some time before a final winner is declared. Especially if the results are litigated.

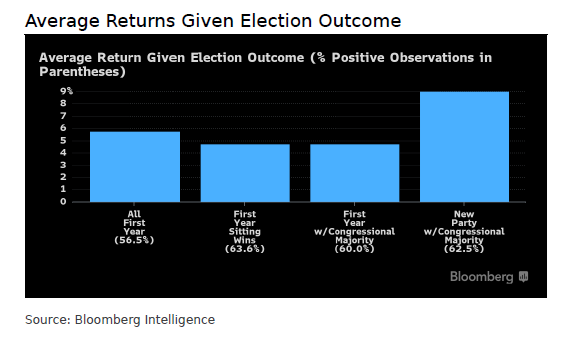

For that reason, as we assess the possible impact of the presidential election on markets going forward, we think history may be instructive. We have shared the chart below before, but we thought it would be worth showing once again as it illustrates a key point – the performance of equity markets has, on average, been positive in the year following the election. More importantly, as we weigh the possibility that the three branches of government will be split with no majority, on average returns are positive regardless of the overall make-up of the government.

We believe this is critical for investors to keep in mind because while the tendency to fear elections and shy away from some of the resultant volatility is understandable, the data does not really support the argument that one should attempt to time the market around the election cycle.

In fact, it often hurts investors to engage in this type of market timing because surprises can and do happen around election season. As a case in point, our guess is that very few people ever expected that this years’ close race chock-full of uncertainty would lead to a formidable rally in equities on Wednesday.

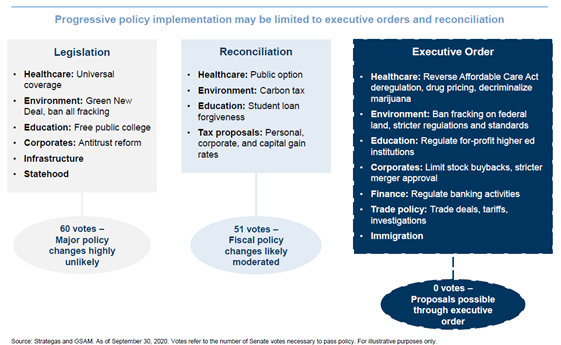

That said, we do believe this year is a bit different in that the makeup of the government could have extra significance as it relates to the passage of a new stimulus package. The reason is that policy is passed through three main channels — legislation, via executive order from the president, or lastly some form of negotiation.

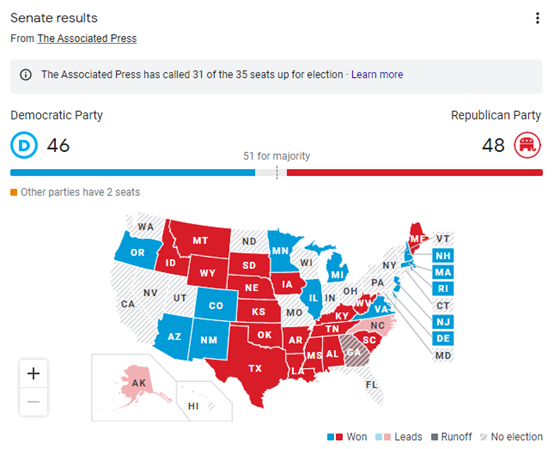

As the chart below shows, it is looking as though the Republicans just might hold the Senate while Democrats hold the House and set Joe Biden up to be a lame-duck president.

Although this scenario is politically challenging and could make it extremely hard for Biden’s administration to deliver on campaign promises in many cases, it is entirely plausible that this result, should it hold, could mean a new policy regime that includes an absence of huge spending bills to meaningfully affect the bond markets, no major tax hikes as they will be difficult to pass with a split house and senate, and plenty of liquidity to still support the market. Add to that the potential for a COVID-19 vaccine at some point in the near-term, and a possible rollback on protectionist trade policy that could boost international and emerging market stocks, and maybe things may not be that bad after all for investors holding well-diversified portfolios.

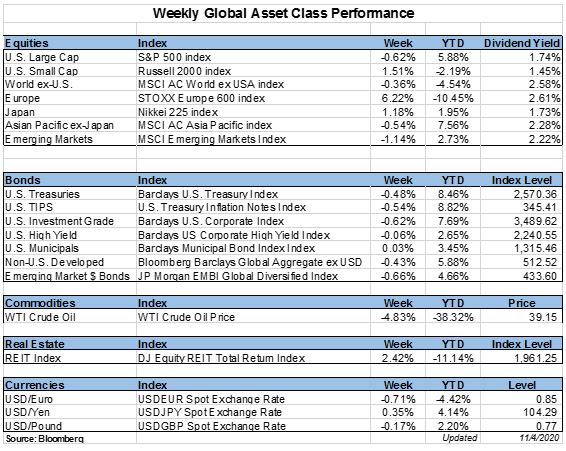

Weekly Global Asset Class Performance

[/toggle]

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

There is no question that 2020 has been a year that everyone just wants to put behind them and hope for a brighter 2021. But before you start thinking about 2021, do not forget about your 2020 year-end tax and financial planning because there are still opportunities and strategies to consider, at least from a planning perspective, to take advantage of before year-end.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*