Published on: 07/02/2021 • 6 min read

Avidian Report – Should investors be concerned about renewed volatility?

INSIDE THIS EDITION:

This past week we saw an increase in volatility as concerns about the Delta variant of COVID-19 worried investors, specifically after the Centers for Disease Control cited a 70% increase in case count over the prior week. With that, on Monday, stocks opened the week with the Dow falling 2.1% and the S&P 500 down 1.6%. Less affected was the Nasdaq, which fell 1.1%, helped in part by that index’s tech exposure, which has shown to be quite resilient in the face of the pandemic. Naturally, we got questions about whether we should be concerned about a COVID resurgence or the renewed volatility in equities.

To answer this, let us take a look at some data.

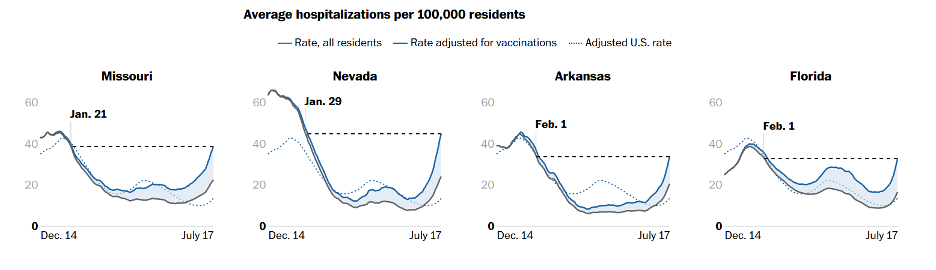

Data in the table below shows the spread of the highly contagious Delta Variant between May and June. We see that the Delta Variant is making up a larger proportion of COVID cases across the country.

Perhaps a silver lining is that the hospitalization rate, while increasing, has not broadly spiraled out of control. Rising vaccination rates across many states likely support this. In some smaller pockets, some strain is being seen in intensive care units, but at this stage is merely something to be watched and does not at present give us concern of either a more intense and deadly wave of COVID or broad-based economic shutdowns. Instead, the Delta variant could cause the return of mask mandates in some places rather than economic lockdowns.

Source: Washington Post

Outside of COVID developments, we see a generally stable backdrop even with the recent market volatility. We consider equity markets to be in a consolidation phase of sorts with pockets of volatility.

Much of this week’s volatility can be attributed to a pullback in smaller cap companies. As the chart below shows, the Russell 2000 has seen a more pronounced decline relative to its 200D moving average when compared to NASDAQ and S&P 500.

Source: Bloomberg

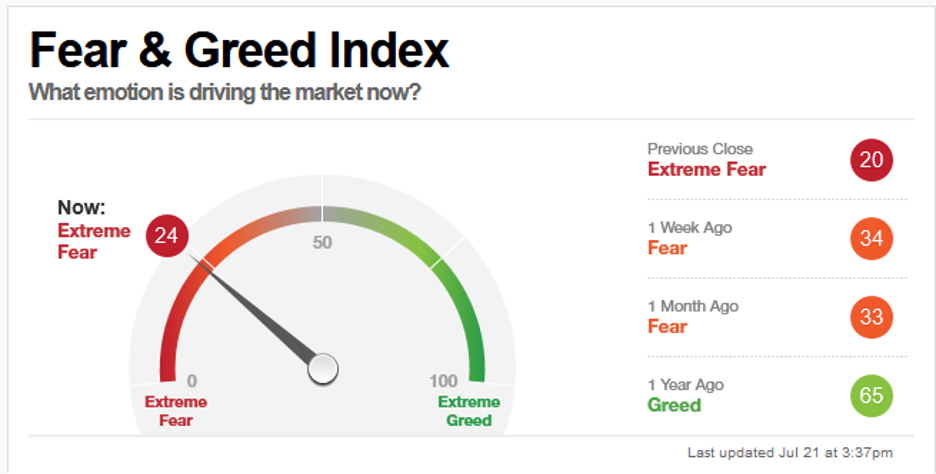

Further, the profitability factor is outperforming growth, which at this stage in the cycle may be a healthy sign insofar as investor behavior goes. And, of course, it makes sense that some of this rotation is being driven by investor fear. As the chart below shows, the fear & greed index is toward the extreme of fear, which indicates that investors are generally worried and could be reason to take the other side and view things through a more positive lens.

Source: CNN

Source: Bloomberg

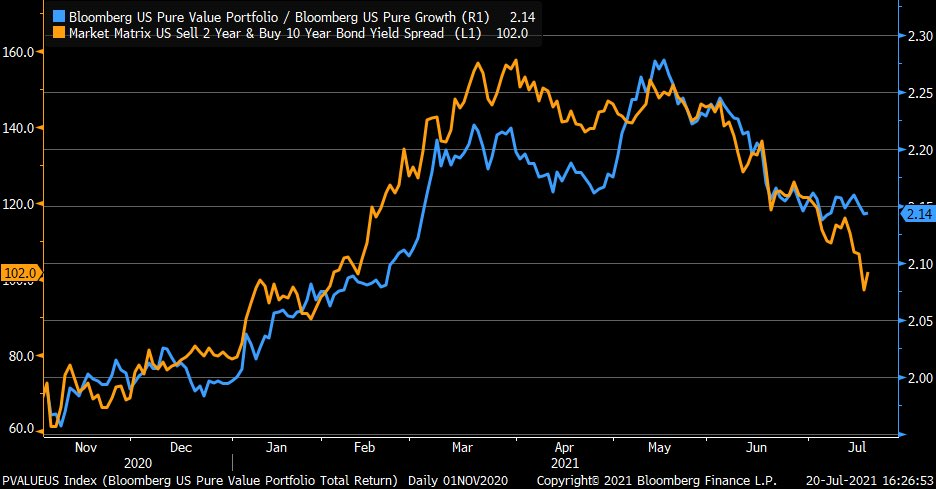

That being said, growth continues to hold up well which should not really be much of a surprise to investors who have been tracking the performance of value versus growth and the yield spread between the 2- and 10-year treasury. As the chart below clearly shows, at least going back to last year, there has been strong correlation between the two datapoints.

Source: Bloomberg

This has led to a healthy reduction in multiples in the largest growth stocks, especially the FANG stocks. This is certainly healthy considering how the NYSE FANG Index, which tracks the top 10 largest, most popular, and growth-oriented technology companies, have seen forward price to earnings multiples decline from a high of 51 in September 2020 to just north of 34.

Source: Twitter @LizAnnSonders

Consumer credit looks healthy with low delinquency rates in auto loans, credit cards, mortgages, and other unsecured debt.

Source: BCAResearch & Transunion

Corporate credit markets also look healthy with rating agencies holding a more constructive outlook for US corporate debt.

And US GDP growth forecasts look to be improving as we look ahead to the third quarter.

Source: Bloomberg

In short, we don’t believe now is a time to panic. A little volatility is to be expected as we have seen a historic run higher for stocks and look to be in a summer consolidation phase. While risks are certainly present, current investor sentiment, high levels of liquidity, a fairly stable economic backdrop with strong earnings being reported we think we trade within a range before seeing the next directional move, up or down, for stocks.

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*