Published on: 11/25/2020 • 7 min read

Avidian Report – Slow Population Growth, Aging Demographics, and their Impact on Inflation and Interest Rates

INSIDE THIS EDITION:

Slow Population Growth, Aging Demographics, and their Impact on Inflation and Interest Rates

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Coronavirus / COVID-19 Resource Center

For this week’s commentary, we are going to discuss the first of five major trends that we believe investors should be watching as we move into 2021. This is important for investors because from these trends we may be able to find answers to the question “how should we be positioned from a strategic asset allocation standpoint?”

[toggle title=’Read More’]

For investors’ financial outcomes, we believe being exposed to the correct long-term secular trends that ultimately determine success for portfolios. Take for example what occurred in the last business cycle when US treasuries and technology shares drove much of the returns in fixed income and equities. Not being exposed to those trends had a high probability of leaving an investor trailing the performance of broad indices.

So, with that for background, now is a good time to zoom out and look at the big picture long-term secular trends that may impact market performance into 2021 and beyond. Now is an especially fitting time to do this because we now have the US election largely behind us, progress on potential vaccines for COVID-19 being made, and some of the short-term noise that drove market volatility calming down.

In total, we have identified 5 secular trends that are likely to drive market performance over the next several years. Some of these observations have been well known by investors. However, we believe the overall impact is still likely being underestimated because there really is no historical playbook to help investors really understand how these trends will ultimately unfold. So, for that reason, it is equally important for investors to keep a close watch on these trends because how they develop may require adjustments as far as portfolio positioning in the future.

The first trend we will discuss in this series is slow population growth and aging demographics. This is a very well-known fact. If you look at the chart below, it shows the growth of global populations. The greener you see on the maps below, the faster the population growth trend has been. The yellow, on the other hand indicates slow or negative growth. From these four maps, that cover five-year periods during different decades, we can see a very clear trend of much slower growth, especially from 2020-2055.

In addition to that, the population is also getting older. The chart on the left below shows the share of US population aged 65 or older. From a quick glance, it is very clear that the share of this cohort is not only increasing, but doing so at an accelerating rate. That helps explain an almost completely vertical ascent in the line on the chart.

The implication of course is that this larger share of the population aged 65 or more, causes a reduction of working age people not only in the US but also globally. That is what the chart on the right panel below really does a great job describing. In that chart, we have similar line charts plotted for the percentage of working age population share in not only the US, but also in China, Japan and Europe. The trends are firmly trending lower.

This is very relevant to investors because from the supply side, GDP is calculated by multiplying the number of workers by the units of goods and services each worker can produce. With a shrinking workforce, it means that a negative impact to world GDP might be expected, as the world produces fewer goods and services. On the demand side, we reach a similar conclusion. The chart on the right below shows that older cohorts spend significantly less than younger cohorts. As a result, the impact to the global economy is also lower GDP.

And here is the rub — potentially negative supply and demand implications frow slower population growth and a generally older population, not only stand to negatively affect the GDP equation but can also affect corporate earnings drastically. As many investors know, stock prices over the long-term are highly correlated to the ability of those companies to generate earnings in the future. If for any reason, those future earnings decline, stock prices may face headwinds.

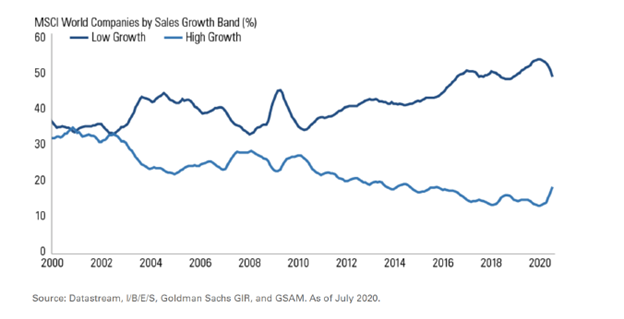

In our view, this is one of the reasons why investor dollars have shifted toward high growth companies, as investors are willing to pay a premium for a company that can consistently grow their revenues despite the macro headwinds caused by this secular trend.

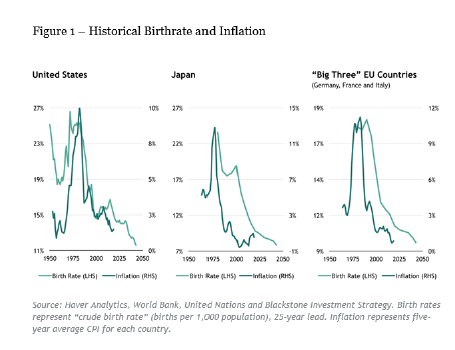

.This trend also has a big impact on interest rates. The reason is that aging demographics has greatly muted inflation, which is very much tied to interest rates. What we mean is clearly displayed in the chart below which shows the relationship between historical birth rates and historical inflation. As you can see in the US, Japan, and EU countries that inflation, which is shown in the dark green below, closely follow birthrates, with some lag. This leads back to lower interest rates because lower inflation and lower growth, necessitates the need for the World’s central banks to stimulate the economy and try to generate some healthy levels of inflation.

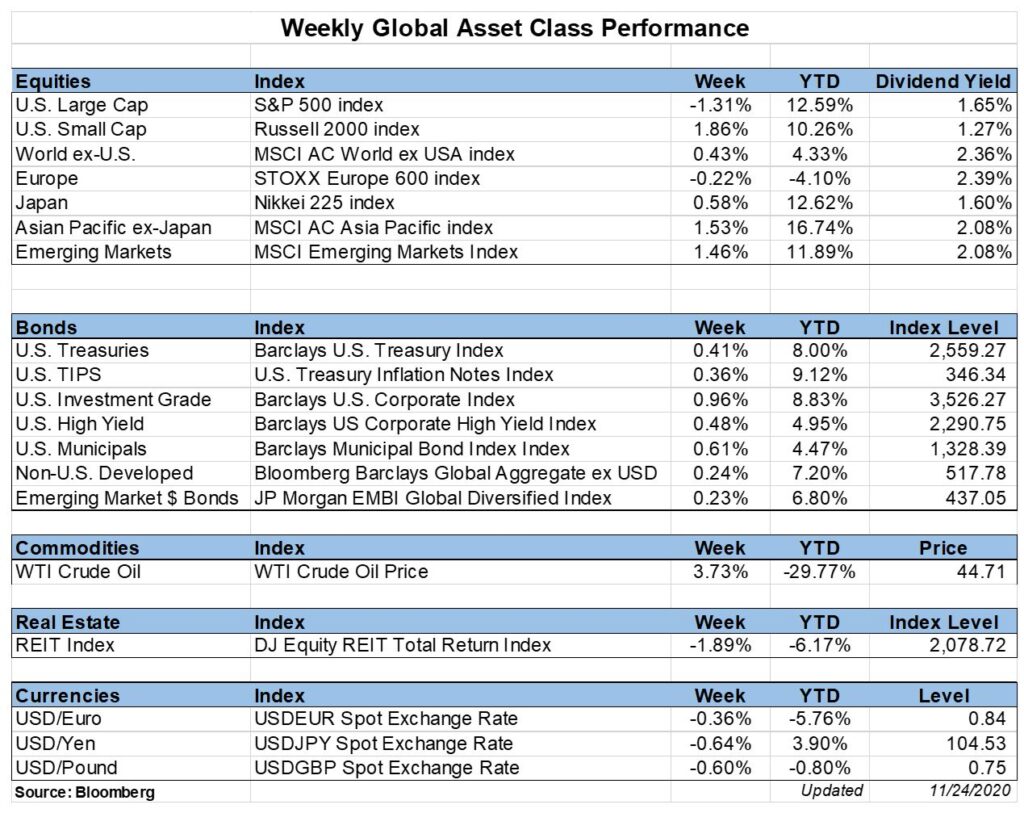

Weekly Global Asset Class Performance

[/toggle]

Year-End Tax and Financial Planning Ideas Coronavirus / Election Edition

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

There is no question that 2020 has been a year that everyone just wants to put behind them and hope for a brighter 2021. But before you start thinking about 2021, do not forget about your 2020 year-end tax and financial planning because there are still opportunities and strategies to consider, at least from a planning perspective, to take advantage of before year-end.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*