Published on: 08/19/2022 • 5 min read

Avidian Report – The Housing Market is Just Like the Stock Market

INSIDE THIS EDITION

The Housing Market is Just Like the Stock Market

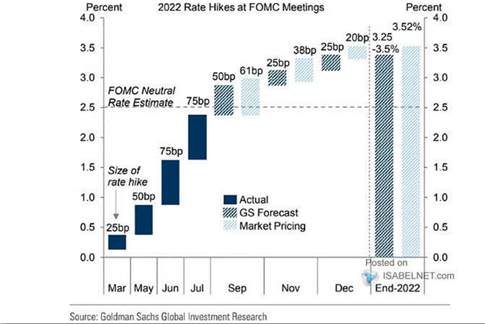

The Federal Reserve has raised interest rates this year to stymie inflation and as the chart below indicates, the rate hiking cycle is expected to continue into December, albeit at a decelerating pace.

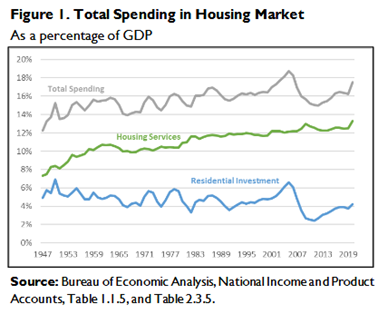

The implications of higher interest rates are large, especially as it relates to real estate and the housing market, which make up a key component of GDP. In fact, in 2020 the housing sector including all spending on housing services accounted for more than 17% of total GDP.

For that reason, it makes sense for investors to pay attention to the broad housing market as it could provide clues and insights into underlying economic trends and provide a valuable lesson to equity investors.

The Housing Market

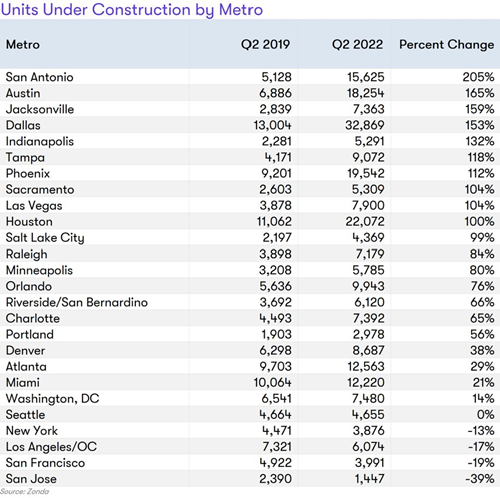

Housing prices over the last several years have undoubtedly been on an upward trajectory as supply has been insufficient relative to demand. However, there are some signs that the supply shortfall may be correcting, or at least narrowing, especially in certain growing markets. As the table below shows, from the second quarter of 2019 through the same quarter of 2022, we saw triple-digit increases in housing units under construction for many cities including San Antonia, Dallas, and Houston. As the number of available units grows, we expect prices to decrease. This is especially true as financing costs rise and home affordability declines.

According to Zillow Research, July saw the first month-over-month decrease in home prices in a decade. What’s more, is that it appears that many homeowners are scrambling to cancel their home purchases or put their homes up for sale as talk of possible recession sparks fears of another housing bust like we saw in 2008. However, we think this may be an exaggeration and merely an example of recency bias.

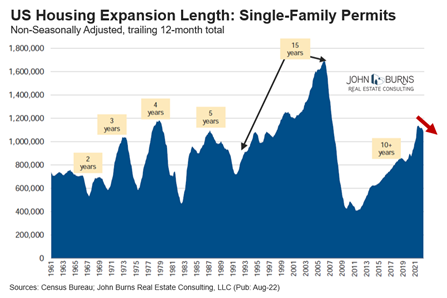

The reality is that today’s situation is vastly different from the Great Financial Crisis. In fact, banks are healthier, household balance sheets are stronger, and lending standards are more rigid than they were back then. This all makes the current correction to housing look less threatening compared to the great financial crisis, despite the 10+ year US housing expansion we are currently enjoying.

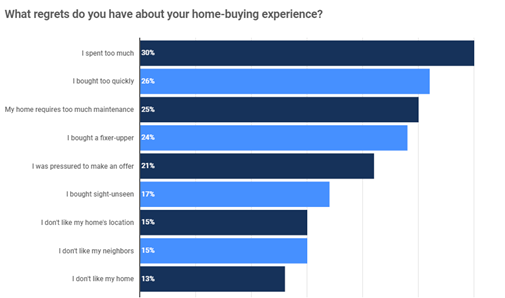

Of course, that doesn’t mean that recent price trends and recession talk have not affected sentiment with 30% of recent home buyers reporting that they believe they paid too much for their home and another 26% feeling like they bought their home too quickly.

Source: Twitter @Mayhem4Markets

And herein lies the lessons from the housing market for equity investors — human emotions often play a role in decision-making and perfectly timing an entry or exit of an investment is virtually impossible.

The reality is that the equity markets often throw us curve balls in the short run. This makes short-term performance highly variable and dependent on investor sentiment which changes constantly. It is after all why investors track The Greed and Fear Index. After all, an investor that succumbs to emotions like greed and fear is subject to potentially costly mistakes. It is also why we favor avoiding market timing.

We believe it often makes more sense to simply formulate a long-term plan, devise a well-designed strategy, and execute that strategy through the market’s peaks and troughs. Over longer periods of time, we have found that this approach not only prevents unforced errors but also helps investors achieve their long-term objectives without losing sleep over each intraday price movement.

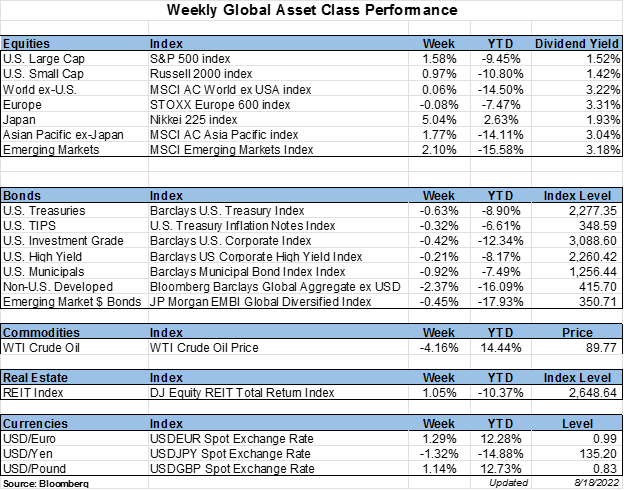

Weekly Global Asset Class Performance

Disclosure:

Avidian Wealth Solutions is a registered investment adviser. The information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Avidian Wealth Solutions may discuss and display, charts, graphs, and formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*