Published on: 06/05/2020 • 9 min read

Avidian Report – The Importance of Patience in Today’s Market – copy

INSIDE THIS EDITION:

The Importance of Patience in Today’s Market

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

There are several things in the current environment that give us pause despite some of the good news that we are seeing in the data. For one, we believe that the continued trek higher for indices like the NASDAQ, which just made a new all-time-high, have been fueled by a fear of missing out. This is something we first posited a week ago as we observed that as prices for risk-assets moved higher, investors appeared to be panic buying.

[toggle title=’Read More’]

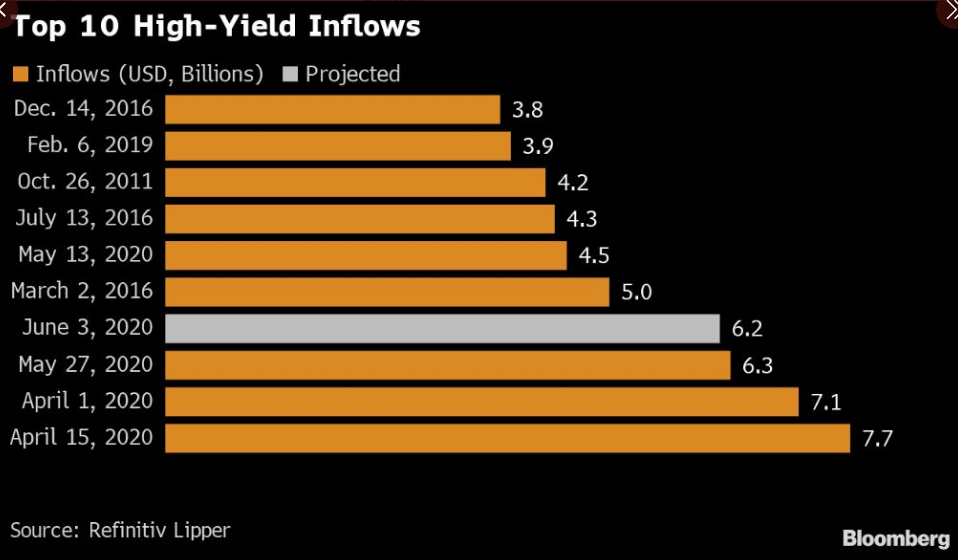

A perfect example of this can be seen in the fixed income market believe it or not. In that corner of the investment universe, we are seeing investors buy up increasingly risky securities in response to central bank stimulus. In fact, US junk bonds have gained more than 20% since the March 23rd market bottom as money has flowed into high yield debt.

Animal spirits and fear of missing out, should not be ignored and rather could still serve as a warning for investors should they emerge even stronger following this Friday’s surprise reversal in unemployment numbers. It is this dynamic that would lead us to become more patient when it comes to deploying incremental capital into stocks.

Patience in deploying capital is important because the upside and downside risks are somewhat equal at this stage of the market cycle. Even with the surprise jobs number, and run-up to close this week, it is prudent to deploy incremental capital to equities selectively or on a pullback as this is likely to offer better valuations and better expected future returns.

While getting a gauge of appropriate valuation levels currently is challenging due to the uncertain path forward for the economy and earnings, some data points suggest that stocks are potentially expensive. Of course, there are several examples, but for instance the MSCI All Country World Index estimated P/E ratio shows that the index currently sits at its highest estimated P/E ratio since the early 2000’s. Investors know how that turned out, and as is customary when valuations are elevated, forward returns tend to be lower than when valuations are low. While we are not prognosticating that the market will do exactly what happened in early 2000, we are saying that investors should prefer buying stocks when they are inexpensive.

Similarly, most investors like to buy stocks when we understand the risks present, and further, when those risks are fully priced in. Along those lines, there are several things today that could be potential catalysts for a pause in the recent rally. While it is unknown whether any of these will be a catalyst for increased volatility or a drawdown, they must be factored into decision-making.

First, high frequency data may begin to show a deceleration in improvement. This is particularly true as new COVID-19 cases have risen in several states over the last week or so.

In fact, first signs of some bumpiness in the data may be showing through as the NY Federal Reserve Weekly Economic Index has ticked lower this week. However, it remains to be seen whether the high frequency data further turns lower over the coming weeks as a sign that it is COVID-19-related or whether it is the one-time effect of recent protests and rallies across the country that have in some necessitated the reclosure of some retail and non-retail business in major US cities. If it is in fact, a one-time dip in the data, investors might be less concerned. However, if in the coming weeks we see this index not resume its upward march, it could produce some investor concern and increased downside volatility as investors adjust their expectations.

Before going further, it should be said that the protests and riots we have seen over the last week are unlikely to change the intermediate- and long-term fundamentals for the US economy. Instead, there is a high likelihood it will all be brought under control and businesses that have had to shut their doors again to protect their employees and property will re-open. If this occurs, the impact to the US economy should be both small and short-lived.

Another risk stems from corporate earnings and the impact that COVID-19 may have on earnings for the balance of 2020. There is a chance that earnings estimates are not fully reflecting the economic realities of the post-pandemic world. Investors have seemingly taken a very long-term view and have chosen to ignore the short- to intermediate-term earnings challenges that may lie ahead.

For some context, the S&P 500 has seen a 28% decline in earnings over the first 5 months of the year, a fact that investors have simply chosen to look past. It is difficult to believe that an earnings decline of this magnitude will reverse quickly and sets the stage for investors to find a fair share of disillusionment when earnings are released over the coming quarters.

That said, this data must be balanced by the acknowledgement that some sectors have been disproportionately hurt by the shutdowns and their earnings going forward may begin to show more substantial dispersion, with some sectors faring better than expected while others fair substantially worse than expected. The takeaway is that investors must not paint the earnings picture with a broad brush. Instead, investors must have a keen understanding of the underlying sector dynamics at play. In fact, it is this understanding that can help investors avoid the traps created by overly optimistic earnings expectations going forward that might lead to more wide-spread volatility.

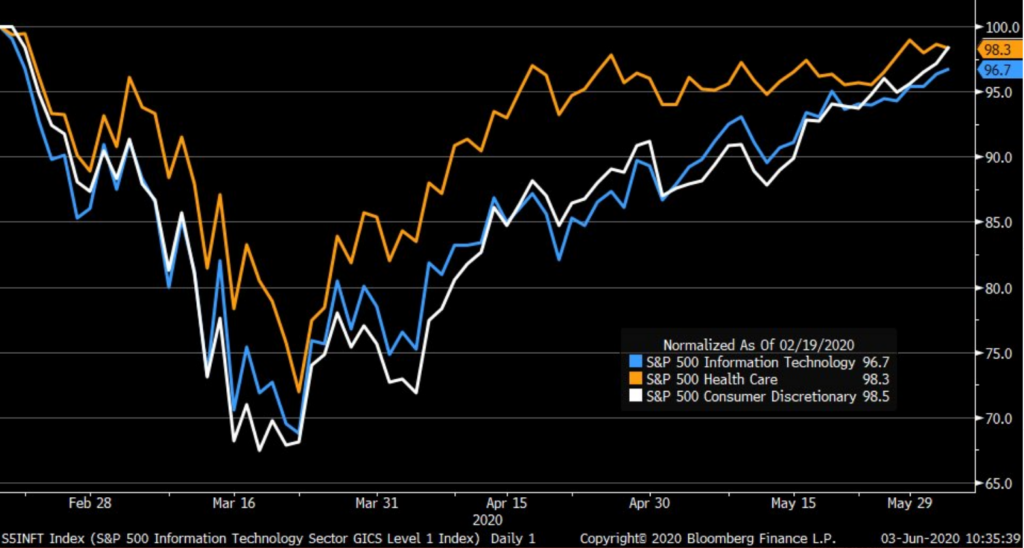

In today’s market, earnings disappointments from sectors like information technology, health care, and consumer discretionary that have led the recovery off the March 23rd bottom could be especially dangerous.

Third, investors should closely watch the risks associated with trade policy. Currently there is a ratcheting-up of tensions between the US and China with the announcement just days ago that the United States would ban Chinese airlines from flying into the US. From a risk perspective, investors must take note as it could certainly be a signal that more economically dangerous trade spats may lie ahead. Any unforeseen development on the trade front could certainly be catalysts for market volatility.

As we made the case at the beginning of this week’s report however, upside and downside risks are currently balanced. So you may be wondering what the bull case looks like to balance out these, and other potential risks we face. And truthfully, it won’t take long to make the bull case – It’s the Fed. In our opinion, there is no bigger risk-balancing mechanism in the markets today than central bank stimulus.

Herein lies the challenge for investors today.

While there are a lot of reasons to be cautious in today’s market, the liquidity provided by central banks might be enough to tilt the scales and overwhelm the risks. Especially when investors consider a measure like S&P 500 market cap relative to M2 money supply as shown in the chart below. By this measure, there is certainly a case to be made that with all the liquidity in the market from the Federal Reserve, the S&P 500 might continue moving higher.

However, it is impossible to truly know what the limitations of this liquidity are.

When it is difficult to determine whether the odds are truly in our favor like is the case today, investors should consider erring on the side of caution. Doing so should leave investors well-positioned to capture a meaningful amount of upside should markets continue higher while not taking undue risks.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*