Published on: 02/21/2020 • 5 min read

Avidian Report – The Relationship Between Markets and Elections

INSIDE THIS EDITION:

The Relationship Between Markets and Elections

Weekly Snapshot of Global Asset Class Performance

Upcoming Event: 2020 M&A Insight

Financial Planning Goals for 2020

401k Plan Manager

It seems that few investors are thinking about the presidential election, much less talking about it. With headlines lately alternating between Coronavirus fears and stocks hitting new highs, who can blame them?

[toggle title=’Read More’]

However, now might be a good time to begin thinking about elections as they are closely tied to markets. After all, presidential administrations guide policy, can remove uncertainty, and influence market performance as a result.

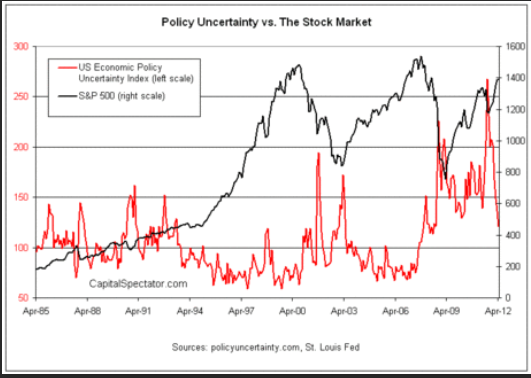

The initial thinking is that the run-up to an election is fraught with uncertainty that can provide a market headwind, followed by the lifting of the uncertainty which should make markets calmer and more likely to move higher. But is that true? To answer that, let’s look at data and the actual results after elections.

Take Barack Obama’s first election campaign. Despite the intuition we mentioned above regarding the reduction of uncertainty that naturally comes with the close of an election, the S&P 500 declined 5.3% on the day following the election in 2008. Was that market reaction a symptom of an inexperienced President taking office? Perhaps one might think so when looking at the result in isolation. However, when we compare it with Obama’s reelection bid in 2012, we see a very similar market reaction, at least in terms of direction, with the S&P 500 ending down 2.4% the day after the election’s conclusion. All of this despite the fact that Obama had now gained experience in the four years prior.

For those that believe performance may be linked to the victorious political party (Obama was a Democrat), again the data quickly disabuses us of that notion.

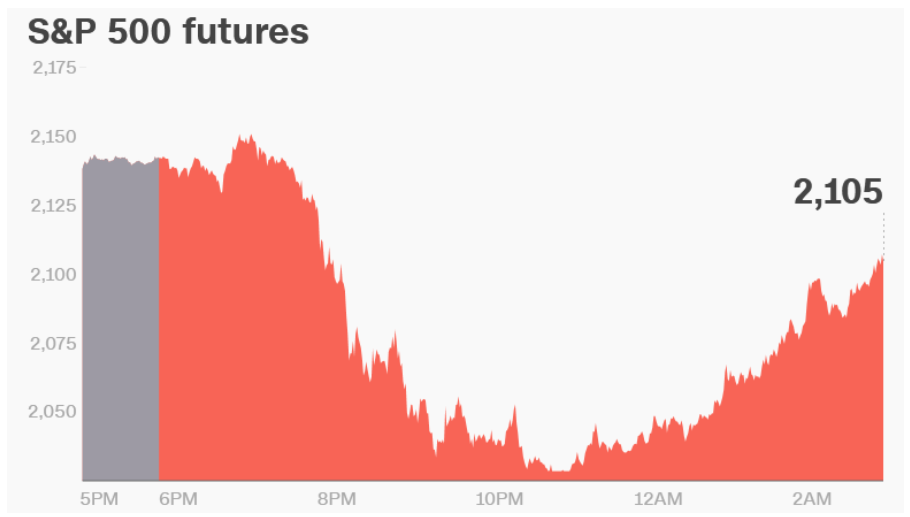

When Donald Trump (a Republican) defeated Hillary Clinton (a Democrat) in 2016, the S&P again tumbled in response to the undoubtedly surprising result. In fact, after futures markets realized that Trump would emerge victoriously, they fell to what in market parlance is known as limit down, the maximum allowed by exchanges before they intervene to keep the market’s orderly. The chart below shows the trajectory of futures once traders figured out that Trump would be elected.

And correlations between S&P performance over the 12 months following an election are extremely low at 0.09, meaning that virtually no discernable relationship exists between S&P performance and the political party elected.

Donald Trump has undoubtedly been good for markets, with the market rising more than 50% since the day he was elected. However, this impressive four-year stock market return has been eclipsed three times before under three different administrations. Dwight Eisenhower’s first term saw stocks rocket higher by 82%, Franklin Roosevelt’s first term saw markets zoom ahead by 98% and most recently, Bill Clinton saw stocks jump ahead 99% during his second term.

This shows why it is so important to maintain a longer-term view when it comes to markets regardless of what political or non-political events may be unleashing volatility at any given time.

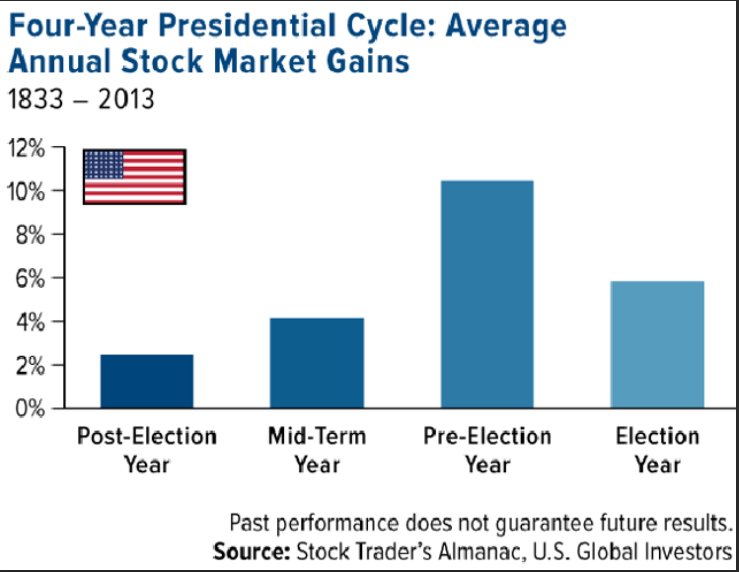

While initial sell-offs were scary at the time, pullbacks on the heels of elections have usually presented an opportunity. We already know that since Obama was elected to his first term stocks have moved higher, as the market value of the stock market has grown by a stunning $28 trillion. In fact, from 1833 until 2013, average annual stock market gains were positive in post-election years and have tended to improve through the pre-election year before falling back (albeit remaining positive) in the election year. This statistic is certainly promising for stocks.

However, what the data implies is that portfolio positioning can influence portfolio performance as assets have historically had different return profiles during election cycles. As the table below shows, some assets have turned in negative returns, on average, during certain portions of the election cycle while others have turned in positive performance on average during those same parts of the election cycle.

These factors support diversification across asset classes and the importance of the overall asset allocation to portfolio performance over both short- and long- time frames.

Weekly Global Asset Class Performance

[/toggle]

2020 M&A Insight – Upcoming Event

What to Expect in the Year Ahead

February 26, 2020 | Vic & Anthony’s Steakhouse

Click Here to Register

Financial Planning Goals for 2020

Written by Scott Bishop, MBA, CPA/PFS, CFP® and Carter Blackburn

The beginning of each year presents a unique opportunity to self-reflect about whether your Financial Plan is on track. Many of us set “New Years Resolutions” with no true actionable goal or follow-through. Remember a goal without a plan is just a wish!

With that in mind, especially given recent tax law changes and the passage of the retirement SECURE Act, now is an excellent time to review your plan to see if you are on track to meet your short and long-term goals. Below are some important areas which you should contemplate and plan before we get too far into the year.

Read Full Article Here

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*