Published on: 10/30/2020 • 9 min read

Avidian Report – The Week In Review and What It Means For Investors

INSIDE THIS EDITION:

The Week In Review and What It Means For Investors

Year-End Tax Planning Checklist 2020

Coronavirus / COVID-19 Resource Center

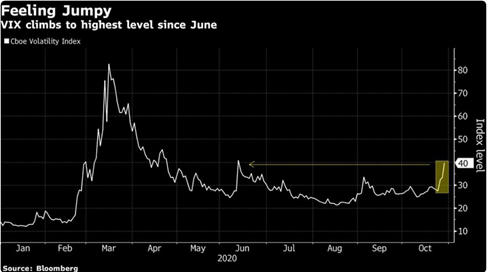

As we have said on numerous occasions over the last few weeks, equity market volatility was likely to increase heading into the US election as elections tend to provide markets and investors with considerable uncertainty.

As the chart below shows, we have indeed gotten the volatility that we have been expecting.

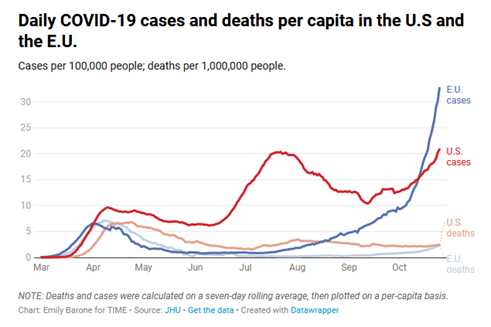

However, the increase in equity market volatility has not been solely because of election uncertainty. Instead, it has been a combination of election uncertainty and renewed concern about COVID-19 as global case counts moved higher and countries like Germany and France announced fresh lockdowns. The fear for investors of course is that lockdowns will spread and reinfect the global economy with a sharp decline of activity that could set the stage for a double-dip recession. Despite the steps taken in Europe to squash the spread of COVID-19 with the new lockdowns, from where we sit, we think widespread global lockdowns remain unlikely. The following chart might help explain why.

What we see in the chart is that while cases in October have gone parabolic in the EU, the case count in the US has risen at a much slower pace. Further, and probably more important, is that the number of deaths attributed to COVID-19 has remained relatively flat in the US and have only ticked slightly higher in the EU. We can all speculate why case counts of exploded higher and deaths have not kept pace – more testing, new preventive measures, better treatment, and infections jumping in a much younger cohort are all potential reasons.

But the bottom line is that the domestic economy continues to gradually reopen. Things are progressively getting back to normal and in our view, the wheels of the economy should continue turning toward a post-COVID-19 recovery. Although, it might take a relatively long time to get back to where we were before the pandemic.

The GDP report on Thursday lent support to this thesis as it showed that the US economy is reversing some of the COVID-19 effects from earlier in the year. In fact, the GDP report for the 3rd quarter showed the largest quarterly increase ever to the tune of 33.1% of real GDP (annualized quarter over quarter). This put the GDP number slightly ahead of consensus estimates and made up a lot of ground in terms of a GDP recovery, but still does not represent a full recovery to pre-pandemic levels.

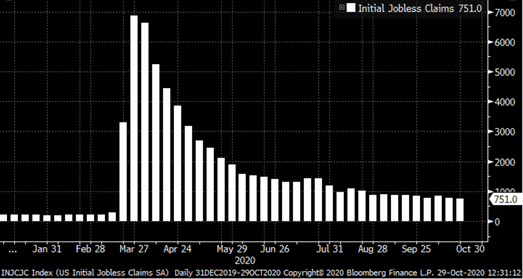

This data aligns with the improvement we saw last week in the US jobless claims number, which declined more than expected and is an encouraging sign that Americans are getting back to work. It also runs parallel to the drop below 8 million people counted in the continuing jobless claims number. But just like with the GDP data – both of these data points are still not back to pre-COVID levels and raise some concern to us that some of the jobs lost as a result of COVID-19 may turn out to be structural job losses which will be permanently lost.

Outside of the US, the picture is a bit less rosy, especially in Europe where we have seen the economy struggle and some countries face a fresh wave of lockdowns. This is something to watch as visits to both retail and recreation locations are down in some cases nearly 40%, a huge improvement over the March lows, but more lockdowns could drive traffic in these areas down yet again.

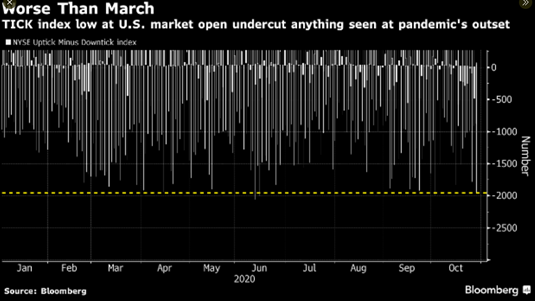

Investors, as a result, have responded by selling down equities on a broad basis as of late, giving up some of the gains for the year. What is interesting is that the selling has at times been broader than it has been at any other time this year, including during February and March which saw a violent drawdown. On the New York Stock Exchange, for example, we had stocks sell-off on October 28th to start the trading day more broadly than they had at any other time this year. That is what the TICK index below shows us.

In fact, even US technology stocks appear to be fading as of late with investors pulling money out of technology-focused ETF’s this month at a pace not seen since May 2019. These money flows tell us that investors may be getting a bit nervous about not only the upcoming election and potential regulatory changes that could impact the tech sector, but also that investors are getting worried that technology shares have maybe run ahead of their fundamentals, despite some of the COVID-19 tailwinds that made them attractive to investors earlier than the year.

To us, this is not terribly surprising. However, we do believe that there are still some long-term tailwinds still favoring some of these high growth sectors moving forward. As a result, we think investors should view drawdowns as potential buying opportunities but urge selectivity because as COVID-19 and the equity market has shown us many times this year, anything can happen.

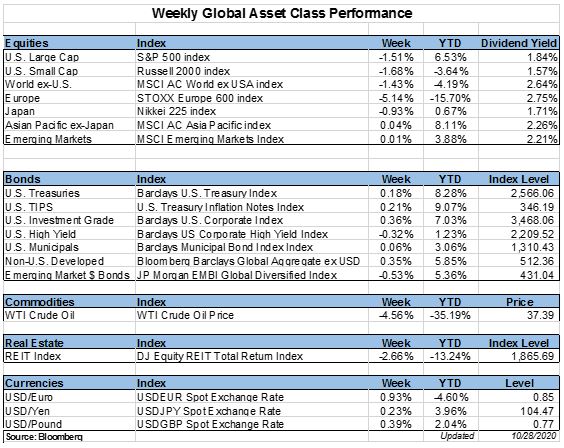

Weekly Global Asset Class Performance

What are the appropriate checklists for year-end tax planning?

Written by Scott A. Bishop, MBA, CPA/PFS, CFP® and Michael Churchill, CPA/MSPA, CFP®

From our experience, tax planners often develop checklists to guide taxpayers toward year-end strategies that might help reduce taxes. Throughout the year, we publish many timely tax-related articles (summarized here). In August this year, we also published our Top 10 Tax Planning Ideas for 2020. The tax filing season is now behind us. We have put together a year-end checklist of things that you should review. We have grouped the list into several different categories, such as “Filing Status” or “Employee Matters,” for ease of reading. As year-end approaches review each category that applies to your situation and consult with your tax advisor. Also, as this is an election year, we created a pice to compare the Trump vs. Biden Tax Policies.

Click Here To Read The Full Article

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*