Published on: 09/03/2021 • 8 min read

Avidian Report – Three Possible Portfolio Solutions to Deal with a Low Yield Environment

INSIDE THIS EDITION:

As we have discussed on multiple occasions over the last year, a low yield environment has diminished the benefit of holding bonds in a portfolio. However, that does not mean that they have no place in a well-diversified portfolio. Instead, investors must understand and accept the reality of the current fixed income landscape and determine whether any adjustments need to be made to meet their long-term financial goals and objectives. This week’s report discusses the current fixed income landscape, the role of fixed income within a portfolio, some considerations, and, most importantly, some possible options for addressing the challenges of a low yield environment.

Today’s Fixed Income Landscape

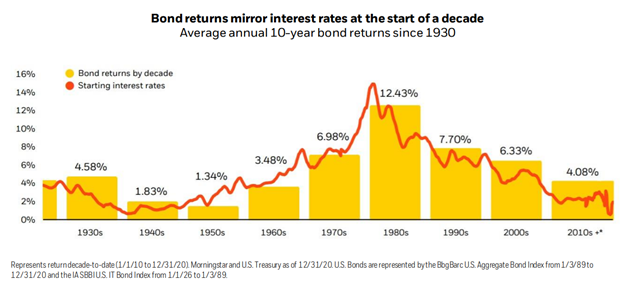

Looking ahead, we see low bond returns for the foreseeable future, especially compared to their historical performance.

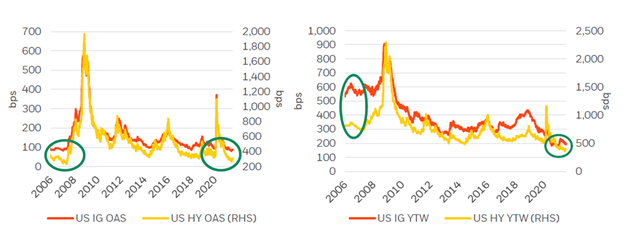

It will not surprise us if we see negative real yields in most fixed income asset classes, particularly as duration risk remains elevated and credit spreads are incredibly tight. As the chart that follows illustrates, the spread between US Investment Grade and High Yield Bonds shows that investors aren’t being compensated in many cases for taking on additional credit risk.

This has driven investors toward riskier assets. However, investors must realize that low interest rates will also drag down the expected returns of all asset classes, not just fixed income. Investors must then accept that despite the diminishing diversification benefits of fixed income, core bonds are still one of the most reliable sources of portfolio insurance and sources of liquidity when equity markets sell off. It just isn’t what it has been in the past.

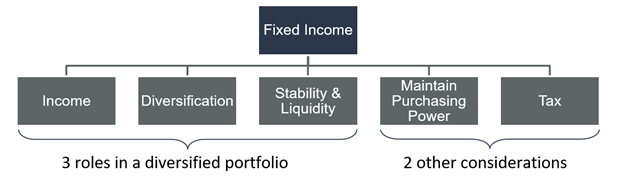

Traditionally, investors have looked to fixed income to play three significant roles in a diversified portfolio: an income producer, a diversifier, and a provider of portfolio stability and liquidity. And while fixed income’s ability to deliver on each of these concurrently is perhaps at its lowest point in history, there are no perfect replacements for bonds within a portfolio.

However, there are cases where incorporating some adjustments to fixed income allocations could make sense and help bolster either income, diversification, or liquidity in a portfolio, though improvement across all three dimensions is unlikely.

What are the possible options?

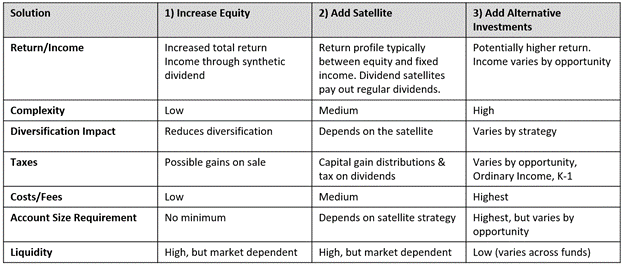

There are several possible options for dealing with today’s low-yield environment. However, we will focus on three specific solutions that might fit an investor’s situation:

- increasing exposure to equities by changing the asset class mix

- adding income-oriented satellites, and, lastly

- adding exposure to alternative investments

What follows will be some considerations that an investor must make when deciding on these three possibilities.

Changing the equity to fixed income ratio in a portfolio

As many investors know, higher returns are typically associated with greater risks. That means more volatility. For that reason, before changing the mix of equities versus fixed income in a portfolio, an investor must assess their investment time horizon. A shorter horizon could make this solution sub-optimal as downside volatility on equities could coincide with liquidity needs. A portfolio’s exact risk and volatility tolerance should also be determined precisely based on investment objectives. Additionally, shifting to more equity exposure versus fixed income will leave the investor with lower explicit dividend payments. Instead, as equities appreciate, they must be sold down to create synthetic dividends and naturally force an investor to take a total return approach to their portfolio. Lastly, we cannot forget about fees associated with making a shift here. While selling out of individual bonds may have limited tax implications, taxes are possible, there can be added trading fees and implicit costs from wide bid/ask spreads. These are all things an investor making this adjustment must consider.

The investor must also consider the advantages of making a shift to more equities. There are three significant advantages to using this solution. First, for investors concerned about inflation, equities tend to provide a better long-term inflation hedge relative to fixed income even with the massive amounts of money printing over the last ten years. Second, having risk assets does increase the potential future returns that the portfolio can generate. Lastly, making this change is the most straightforward among the solutions discussed today. It is a matter of deciding to shift the allocation toward more equities and then executing a portfolio rebalance.

Of course, there are some disadvantages to reducing fixed income exposure, but none is more significant than an investor accepting reduced asset class diversification, which can make it challenging to weather an equity market sell-off.

Add income-oriented satellite strategies to a portfolio

Satellite strategies are additions to a core allocation that provide an overall portfolio with increased income, lower volatility, or better diversification. As a result, investors might also use such a strategy to address the issues in the fixed income market related to low yields.

However, as an investor decides to add a dividend-focused satellite strategy to their overall allocation, they must first consider their risk tolerance. Many of the available dividend satellites might have an equity focus, making it comparable to dialing up overall equity exposure. This is very similar to what we discussed in solution one above. However, the difference is that often in a dividend-focused satellite strategy, income will come in periodic distributions, which means the investor may not have to synthetically create dividends by reducing exposure positions and potentially generating capital gains taxes. Second, like in any strategy that increases exposure to equities, one must consider the time horizon. This is especially true for dividend strategies as long holding periods are preferable as they help capture the totality of annual distributions.

Despite these considerations, there are some great benefits to using satellites: explicit dividend income, increase total return potential due to increased equity exposure, and the amount of choice and customization options satellites can provide an investor. This last point bears some emphasis. Satellite strategies can be incorporated in different proportions relative to a core allocation, which means that an investor can construct a bespoke solution to provide the type of income profile they seek within the constraints placed on the strategy by the market. However, this allows for better matching with client needs in the context of an overall financial plan.

Of course, the downside to this approach is that a transition might require selling down equities and/or fixed income securities and generating capital gains, though the impact from the fixed income allocation might be limited. Also, if the satellite utilizes actively managed funds, there can be trading fees and higher fund expense ratios to pay. If tax concerns are top of mind, many of those same actively managed funds can pay out capital gains distributions from time to time that may increase an investor’s tax liability, which is another potential con to using the dividend-focused satellite but will vary based on how the strategy is constructed and managed. Lastly, utilizing a satellite can make identifying the trust asset class mix in a portfolio challenging. So for this, an investor may have to find a software solution to determine the mix or work with an advisor like Avidian Wealth Solutions to help determine what is appropriate for their goals and objectives.

Add alternative investments to a portfolio

The final possible solution we will discuss is the addition of alternative investments to a portfolio. This is an area that is growing in both importance and investor attention. However, this is the most complex of all the solutions presented here because the convenience of access varies across fund sponsors and has quite a few constraints.

More specifically, an investor must meet the minimum investment requirements and investor qualifications of a particular fund or opportunity. These will vary depending on the investment, but the complexity does result in complicated paperwork and taxes. Additionally, many of these investments come with capacity constraints and limited liquidity. The trade-off is that potential returns can be higher due to the illiquidity premium that can be earned, and often, distributions are also quite meaningful. However, distributions can be lumpy and less predictable regarding size and timing, which makes planning their use potentially more complex.

Despite these drawbacks, alternatives are an increasingly important part of portfolios for qualified investors. Depending on the opportunity, they can help improve diversification, improve portfolio returns, and provide a more robust income profile than what might be found in public markets.

Solution Comparison

Finally, we want to stress how important it is to consider the appropriateness of any changes you make to your portfolio. Whether an investor uses one or more of the solutions above to deal with the low yield environment we are in today, or if they intend to incorporate any changes to their portfolio that have the potential to increase risk, change objective, or increase fees, it is imperative to assess the impacts before implementing the change. We always encourage investors to discuss with your advisor to ensure that any change doesn’t take you off track from your financial plan.

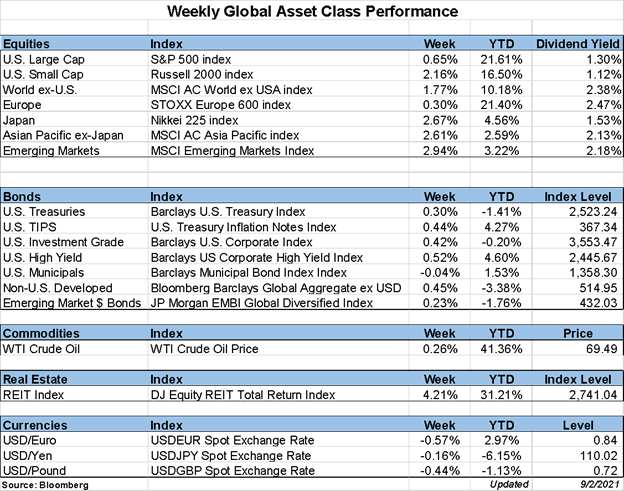

Weekly Global Asset Class Performance

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*